My Swing Trading Approach I came into Friday with one long position, which was an ETF that acts as a short position on the S&P 500. I closed out SPXU at $33.55 for a +4% profit. I am now 100% cash entering today, and looking to play a potential bounce if the market will allow

My Swing Trading Approach I took profits in Caterpillar (CAT) for a +1.9% profit yesterday, while getting stopped out at the open in ROKU and PYPL. Currently I am short, and will gauge the market today for a potential bounce and quickly close my short position if need be. Either way, I

My Swing Trading Approach I closed my trades in Micron (MU) for a +0.2% profit and Johnson & Johnson (JNJ) for a +0.1% profit – meager profits to say the least, but the in the case of MU, I avoided a lot of downside as a result. The afternoon fading that is taking

My Swing Trading Approach I didn’t add any new positions to the portfolio yesterday, but did book profits in Netflix (NFLX) for a +2.2% profit. The market though continues to sell off in the afternoon rendering any morning strength meaningless, which is making it difficult for adding new positions to the portfolio. Until that

My Swing Trading Approach My concern in the current market is the willingness of any strength being faded in afternoon trading, particularly as it pertains to morning gaps higher. The plan here, is to continue increasing stops, but unwilling to over commit to adding too many positions too quickly. Less is better, until the bulls

My Swing Trading Approach Strong momentum right out of the gate today and the potential this week for a move back to all-time highs, will have me looking for 1-2 new long setups today. Indicators

My Swing Trading Approach I held all my positions overnight, while adding one additional play to the portfolio. I will be raising my stops today, while also playing it cautious as today is the last day of the quarter. Indicators

My Swing Trading Approach I closed my swing-trades in JEC at $76.80 for a +3.8% profit and CRM at $158.60 for a +3.1% profit. I am open to adding another long position today should the market cooperate and allow for it. Yesterday’s sell-off creates some concern as to whether a rally can be sustained here.

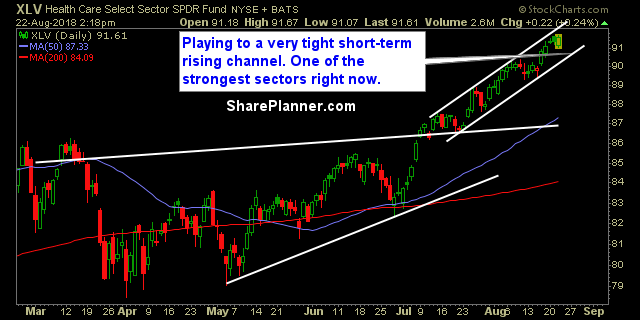

Sectors as a whole support the market’s move to new all-time highs. Outside of Energy and Materials, the sectors as a whole have shown some solid trend-lines and a willingness to push higher going forward.

My Swing Trading Approach At least standby for the first 30 minutes of trading this morning before making any decision on market direction. Volume picked up on the selling to the downside on Friday with an above average volume reading. I will not be making a ton of moves today as I remain nimble and