Nasdaq selling off again, SPX flat The technology purge looks to resume again this morning, while most of the overnight gains have been lost by the large caps. This market is becoming a bit less predictable in the latter half of this month. yesterday's bounce looked reminiscent of the bounce following the May 17th sell-off,

Buy Machines Continue to Bounce following One Day Sell-offs If the premarket is any sign of what looms for the market today, it will be yet another hard bounce following a one-day sell-off.

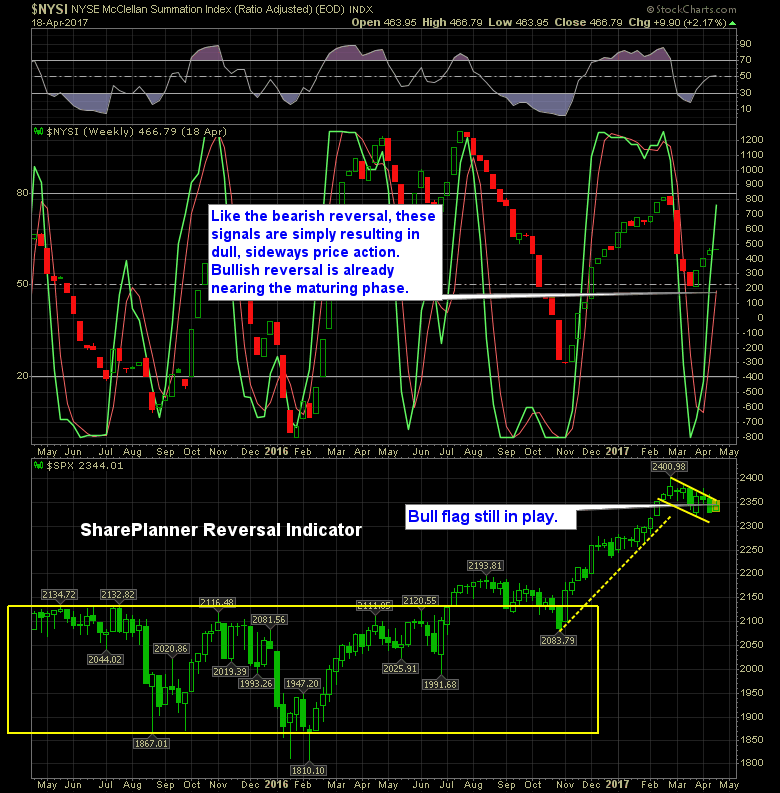

Stocks and Indices continue to trend sideways Outside the first trading day of the month, the market has absolutely gone nowhere. Stock trends in general have been totally sideways or in more technical terms, “consolidating”.

Is it time to reverse for the market or will we keep trucking higher? I came into today knowing that the bulls had to hold the 20-day moving average. That has been a level of support for them of late, and if they blew through it, that things could certainly get dicey.

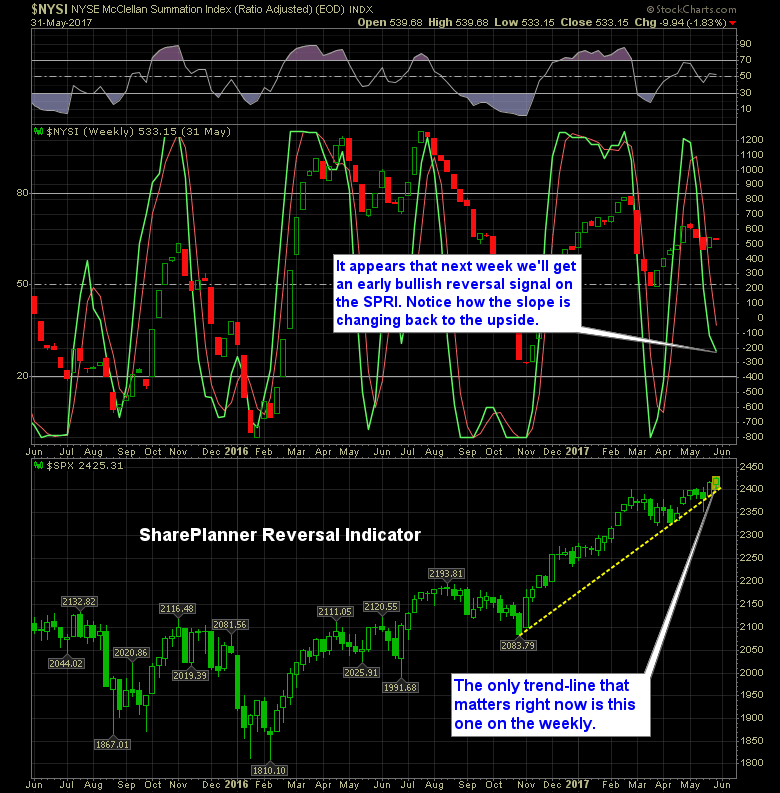

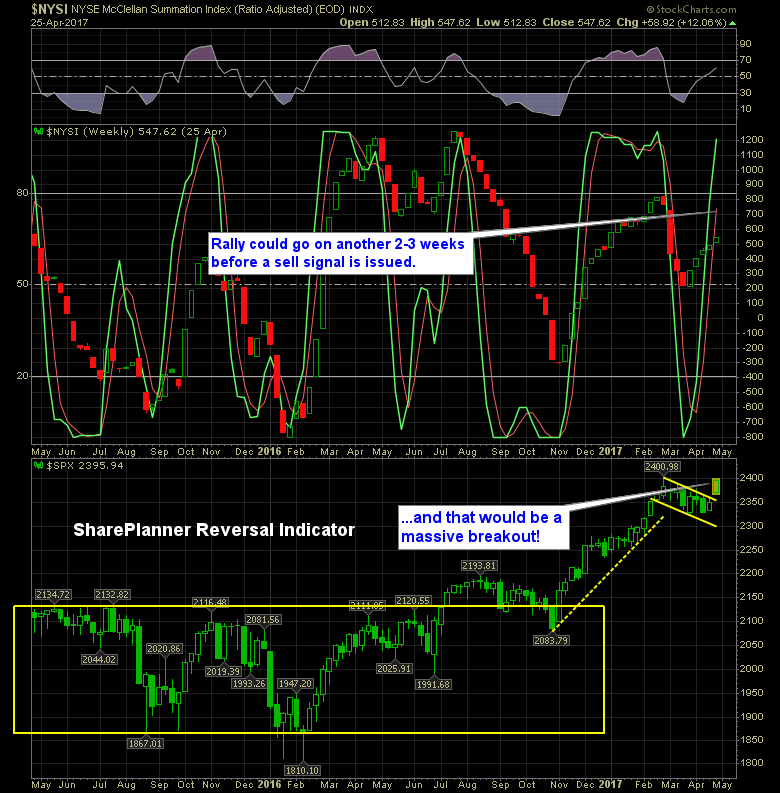

SharePlanner Reversal Indicator is wanting to reverse for the betterment of bulls. It is the rally that won’t quit, but don’t mistake that for believing that it is somehow “different this time” – because it is not.

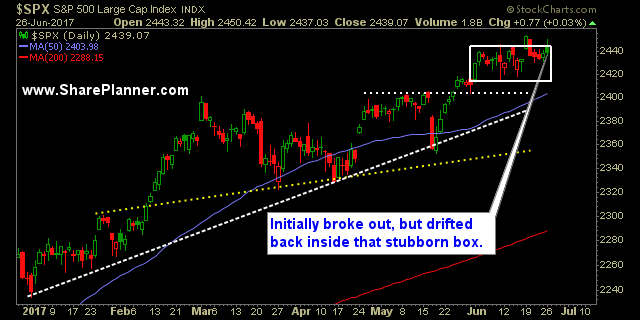

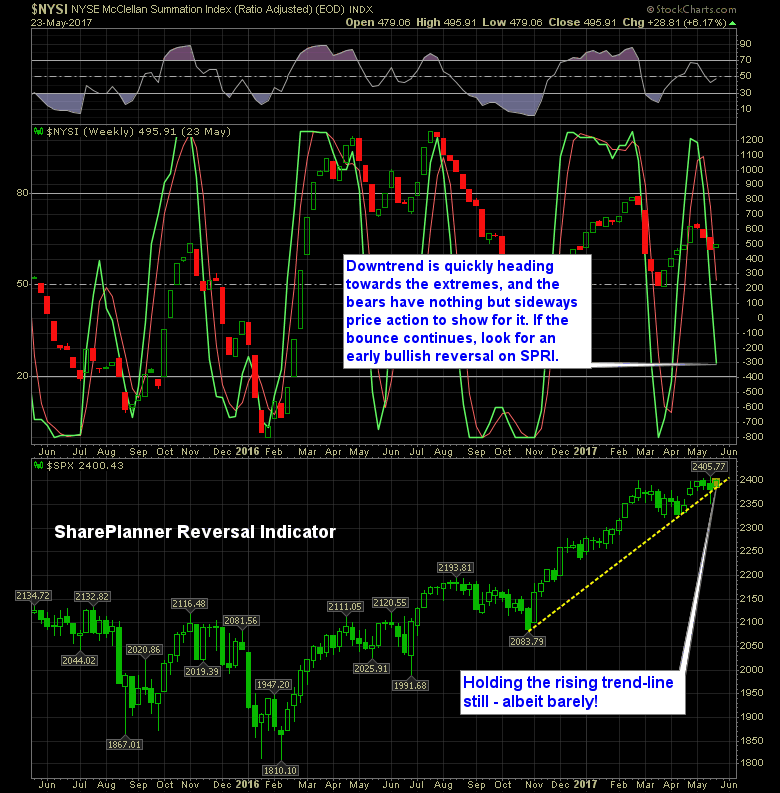

Time corrections in price often lead to a quiet market If you remember back to last week’s edition of the SharePlanner Reversal Indicator, I suggested that with the immediate bounce back the market was seeing, that it is likely we head right back up to the all-time highs and consolidate yet again in the price

I feel like, honestly, the expression “Going nowhere fast” is creeping into every one of my posts these days. In reality, that is the state of the market. Market sells off hard and fast this morning, but by afternoon, it has managed to rally back to near break even. Prior to today, SPX had

Currently Rally Losing Momentum More action off of the 10-day moving average today on SPX. It is holding strong once again today, with another solid bounce. You can make the case that the market is in a mind numbing bull flag pattern that has lasted longer than the rally itself that started back

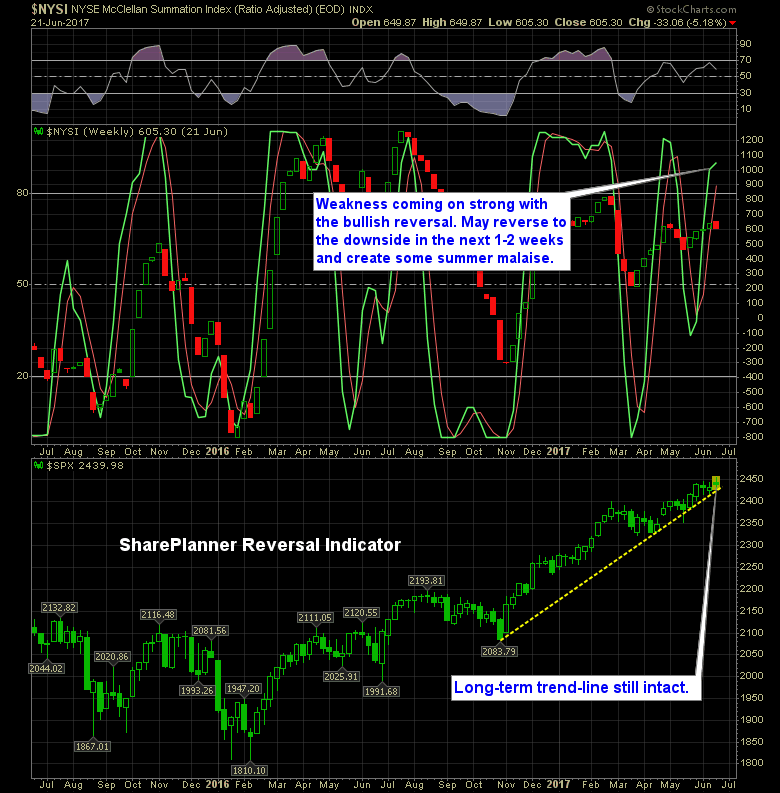

SharePlanner Reversal Indicator came through like a charm Last week I was stating that the SharePlanner Reversal Indicator was more than likely going to make a move to the upside and the SPRI was already forecasting the move. And that is exactly what it did. The proof was in the pudding when the bears had

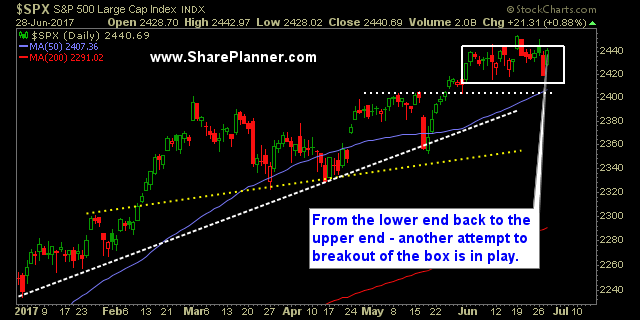

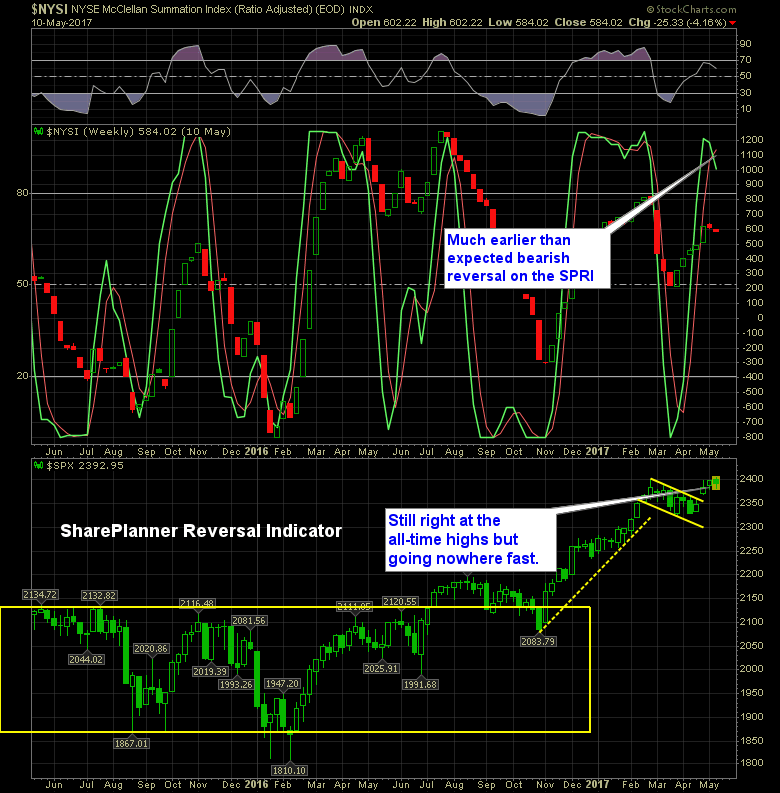

Market not trending the way reversal signal suggests it should The SharePlanner Reversal Indicator flashed a bullish reversal signal about a week and a half ago, but nothing has really materialized from it. Instead, every attempt at a rally quickly falls apart and closes at or below break even for the day. Despite the lack