Episode Overview Have you ever wondered what it takes to know when you are on the cusp of a long-term bull market? Ryan, in this podcast episode, talks about the signs that he looks for as well as his go-to indicator for spotting long-term trends in the stock market. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

Episode Overview In this podcast episode Ryan covers the basics of building a swing trading watchlist for beginning traders. Also covered are the key elements that are necessary to ensuring that the watchlist is functional and capable of providing quality results for one's swing trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps

Navigating the Storm: Cash Strategies for a Market Correction During a stock market correction, it is natural to feel anxious and wonder if going cash in one’s portfolio is the best course of action. As a seasoned trader, I’m here to tell you that going to cash during a correction is not a rookie move

Swing Trading Strategy: How am I now 100% cash!?! My two remaining long positions were stopped out – that stunk. Both were contained with AbbieVie (ABBV) being the worst at -6% and the other, Northrop Grumman losing -3%. But Short positions were straight fire – I covered United Parcel Service (UPS) for +10%, Caterpillar

Swing Trading Strategy: Holy cow what a crazy, freakin’ day! Granted, a 100 point sell-off on SPX is nothing like a 100 point sell-off back in January of 2018 when it was trading 500 points lower. However the impact that it has on the portfolio is still incredible. Most of my long positions over the

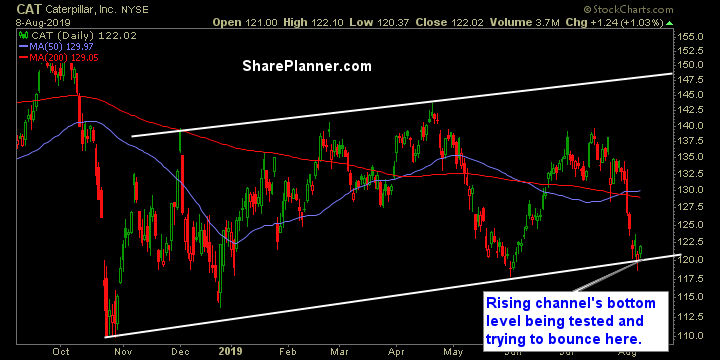

Friday’s Swing-Trades: $CAT $LRCX $RCL Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Caterpillar (CAT)

My Swing Trading Approach I took profits in Caterpillar (CAT) for a +1.9% profit yesterday, while getting stopped out at the open in ROKU and PYPL. Currently I am short, and will gauge the market today for a potential bounce and quickly close my short position if need be. Either way, I

Tuesday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and start making some profits for yourself! Long Caterpillar (CAT)

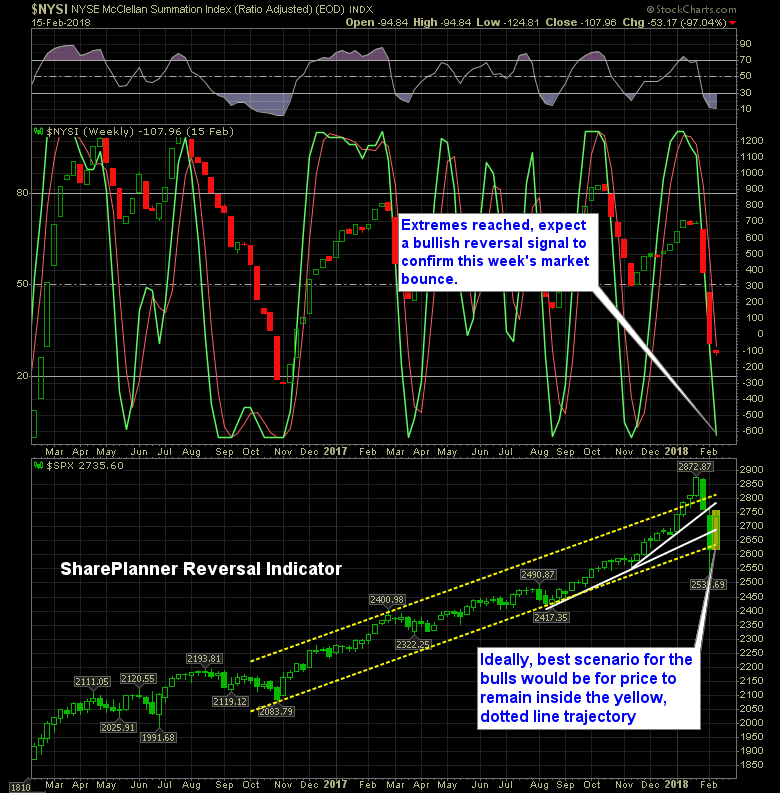

Last week’s sell-off hit extreme reading on the SharePlanner Reversal Indicator. Following the bounce off of the 200-day moving average on the S&P 500, it is no surprise, that we saw one of the best one-week rallies in years. However, with a three-day weekend ahead of us, next week represents another chapter in what has

Wednesday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Caterpillar (CAT)