Better to wait for Tesla (TSLA) to pullback to some support here.

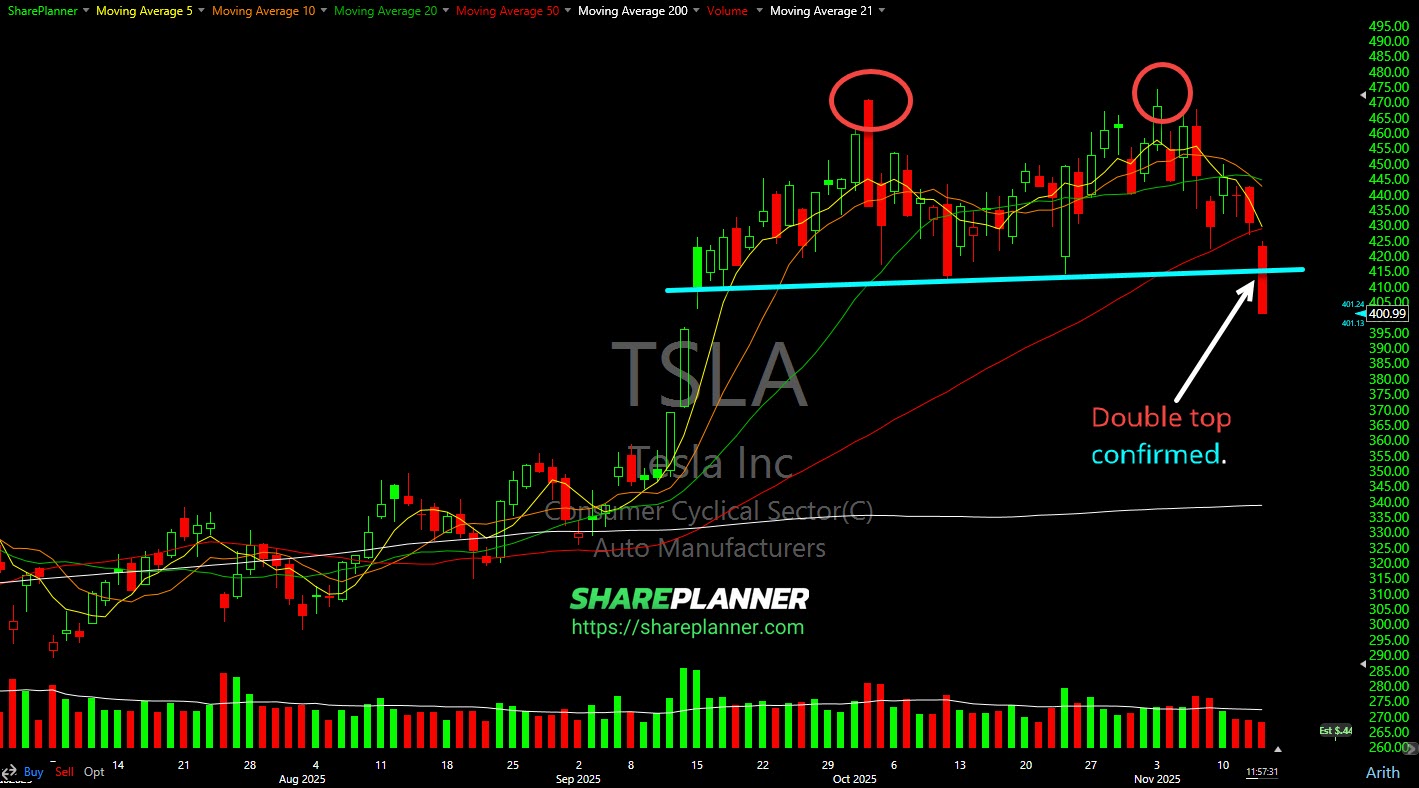

Tesla (TSLA) has been a battleground stock for what feels like forever, but since September, it’s been stuck in a choppy, sideways pattern. For traders like me, this kind of price action is a clear signal to pay close attention for a potential trend reversal as distribution played out over a two-plus month period.

Ugly sight for Tesla (TSLA) as it just confirmed its double top pattern today.

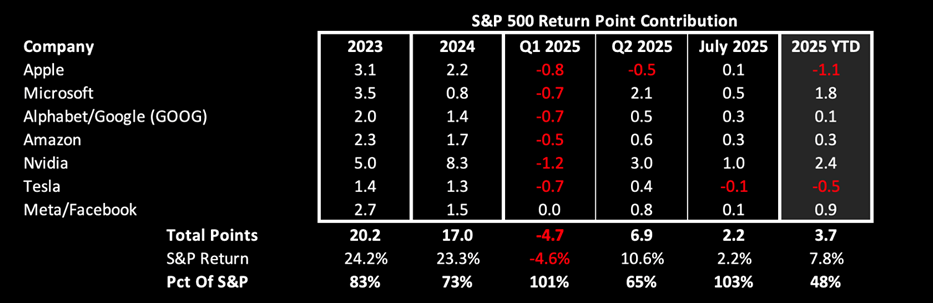

July would have finished in the red for the S&P 500 (SPY) if it weren't for the Mag 7 stocks. In 2025, they are responsible for 48% of the market's returns!

TSLA seeing another huge sell-off. Tesla (TSLA) has seen some sharp moves recently, and the chart is now testing some key technical signals. In this video, I break down the price action, highlight major support and resistance levels, and walk through what the TSLA chart is telling us right now, from both a swing trading

Tesla (TSLA) breaking out of the continuation triangle on robotaxi news.

Watch Tesla (TSLA) on this continuation triangle pattern here. If it can break through, could have a really nice.

TSLA misses, the stock still rallies. Tesla (TSLA) reported Q1 2025 earnings that missed expectations, with revenue at $19.34 billion and earnings per share at $0.27. Despite the miss, TSLA shares experienced a notable post-market reaction. In this video, I analyze the earnings reaction, provide technical analysis for TSLA, and discuss the key price levels

Massive upside move for TSLA after rumors he plans to return to Tesla.

TSLA Up +20% off its recent lows. TSLA short squeeze is fully underway as traders find themselves way offsides on the stock last week with insane amounts of puts being purchased. Now the stock has rallied over 20% off its lows and sets up for further upside still. In this video, I dissect the TSLA