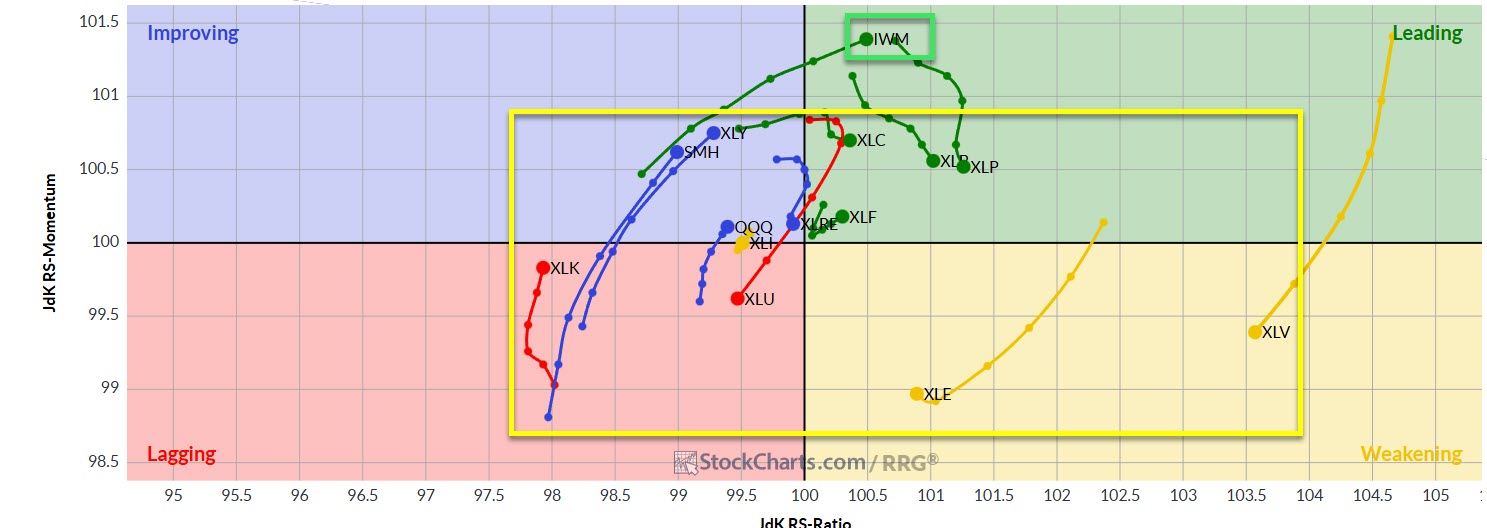

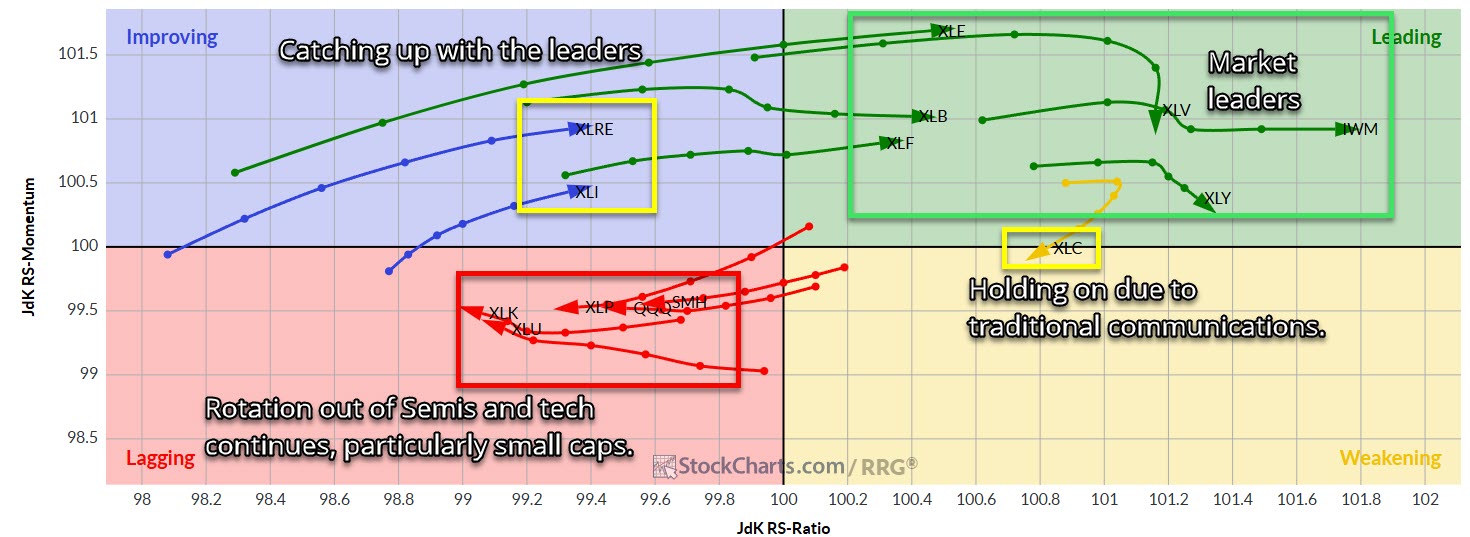

Only Russell 2000 (IWM) is showing any real leadership under current market conditions. Everything else is simply circling the S&P 500 (SPY).

Russell 2000 (IWM) faking out traders who played the breakout at all-time highs.

Technology sector is taking heavy losses this week, with Nvidia (NVDA) looking at a third straight week of losses. Meanwhile Russell 2000 (IWM) looking to rally for a fourth straight week.

Crazy divergence between the net longs on the Nasdaq 100 (QQQ) and the Russell 2000 (IWM).

Technology and Small Caps are the market leaders.

Russell 2000 ETF (IWM) struggling big time with declining resistance and looks set to test it again.

Heaviest short interest, by a long shot, in the last six years.

Crazy One-Day Sell-off for Stocks! The stock market just got rocked with SPY dropping almost 5%, and the Nasdaq plunging 5.4%. Is this the start of a bigger crash, or just a sharp correction? In this video, I break down the technical analysis behind today's sell-off, covering key support and resistance levels, and discuss what

Since 2/17 IWM has been trading sideways on the 30 minute chart, but getting closer to a breakout here.