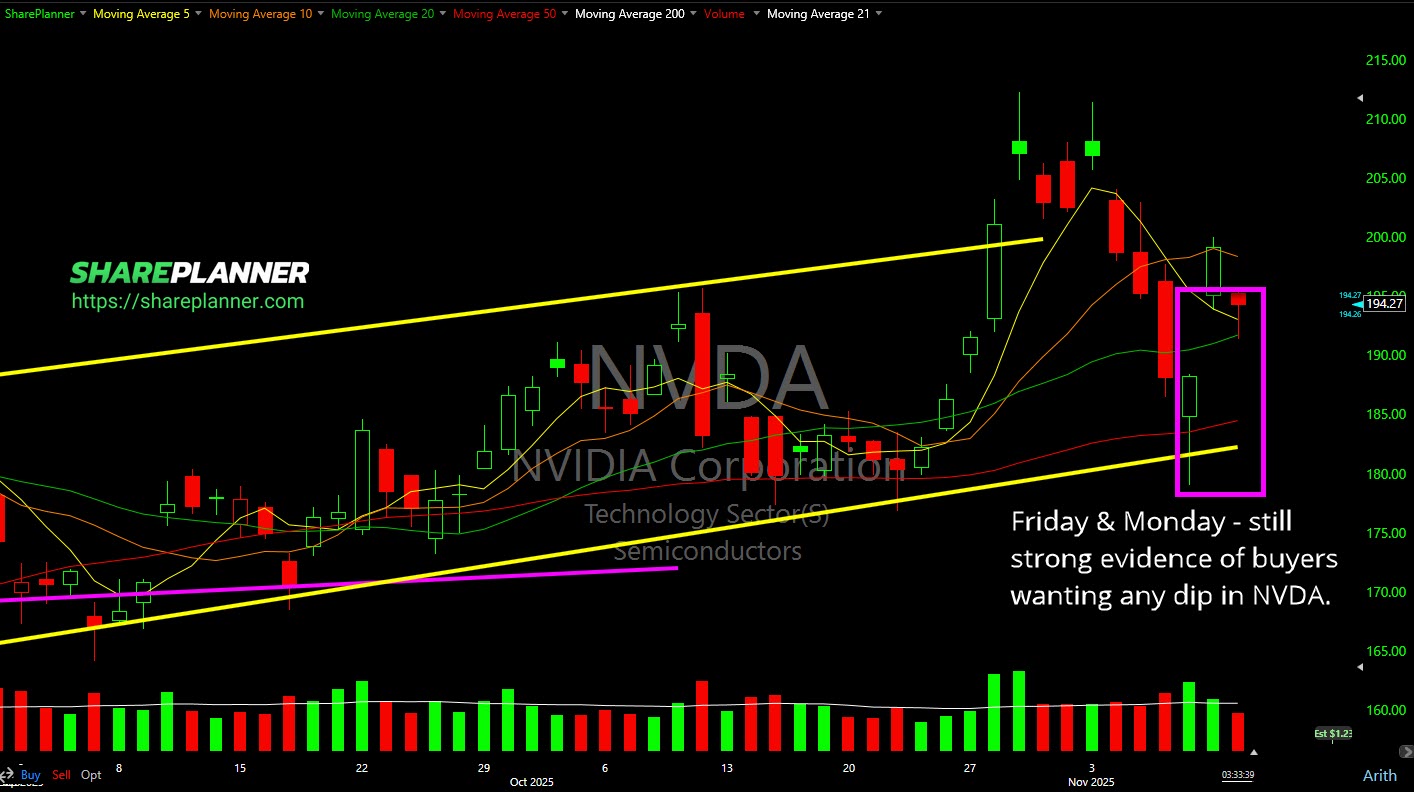

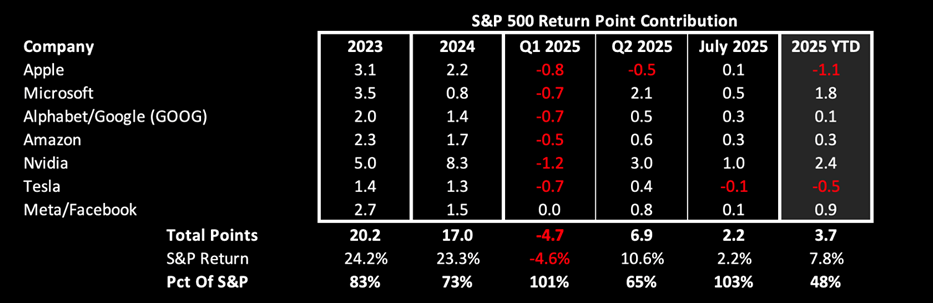

Investors still dog piling into NVDA at every turn. However, I think they are simply helping Wall Street de-leverage.

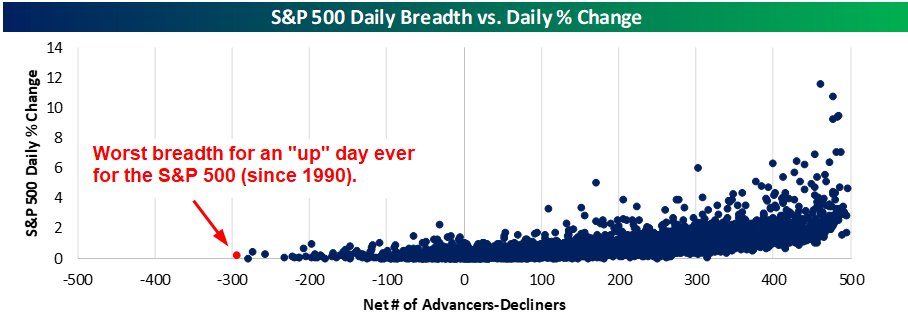

Never before have we see this many stocks go down when the S&P 500 traded higher. It's the NVDA effect.

NVDA Stock – Rally, Risks and Strategy Nvidia (NVDA) captured the spotlight today with an explosive move upward—and you may be wondering: Did I miss the boat? Should I hop in? Or is it time to consider selling? In today’s video, I walk you through: The technical pattern behind the rally and key levels now

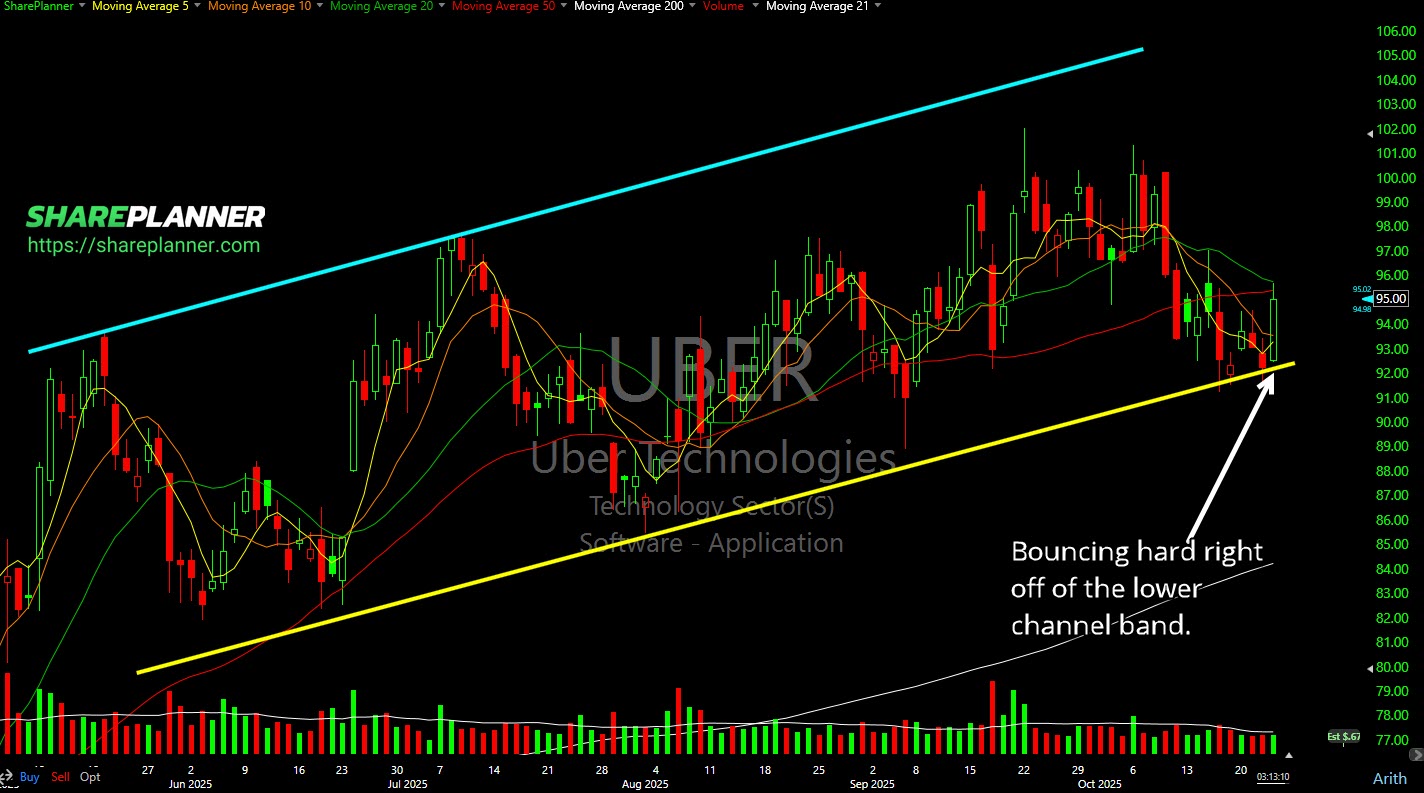

Uber Technologies (UBER) getting the love after Nvidia (NVDA) said they were working with them on autonomous vehicle development. I'm not buying it.

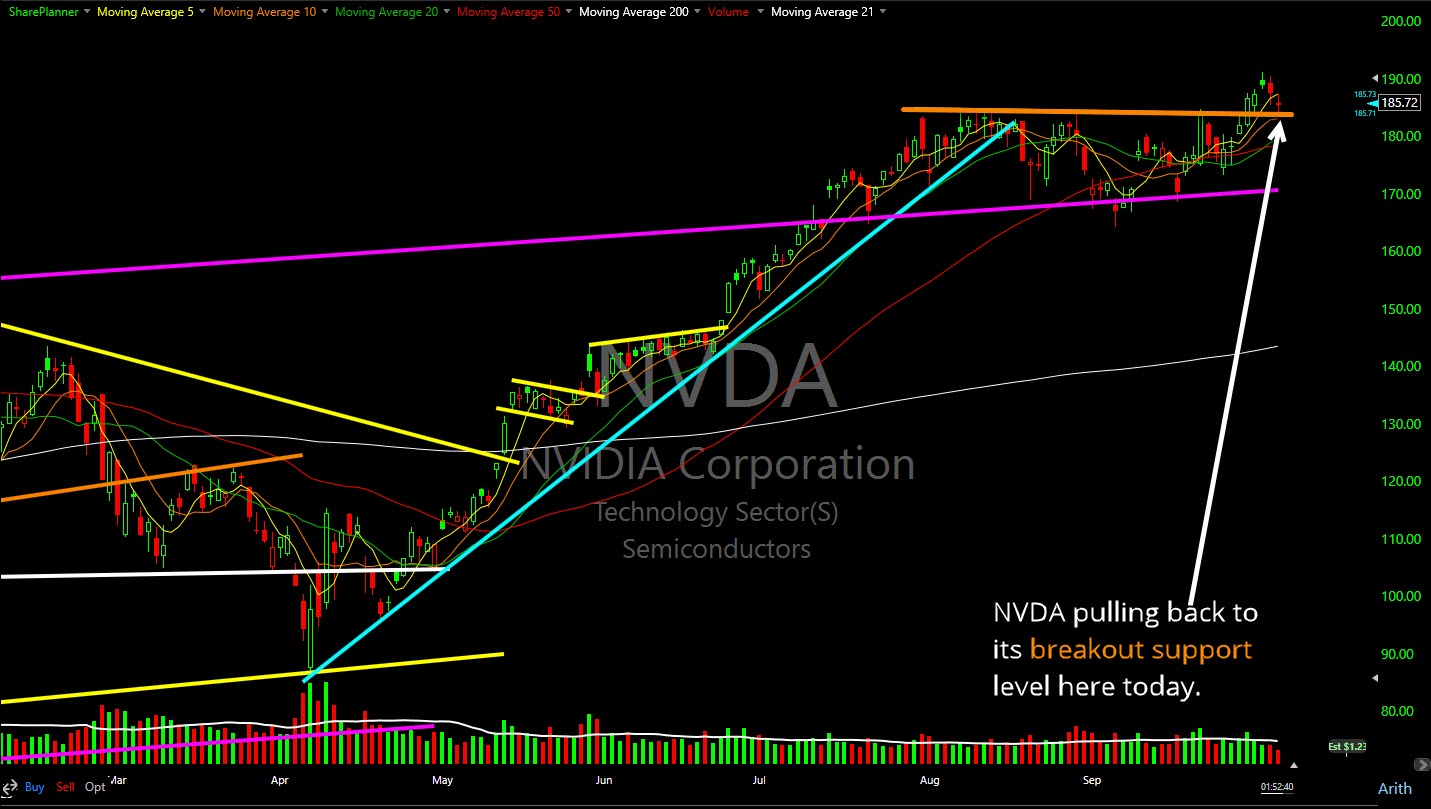

With news from Advanced Micro Devices (AMD) up over 25% today, Nvidia (NVDA) is pulling back to is breakout support level.

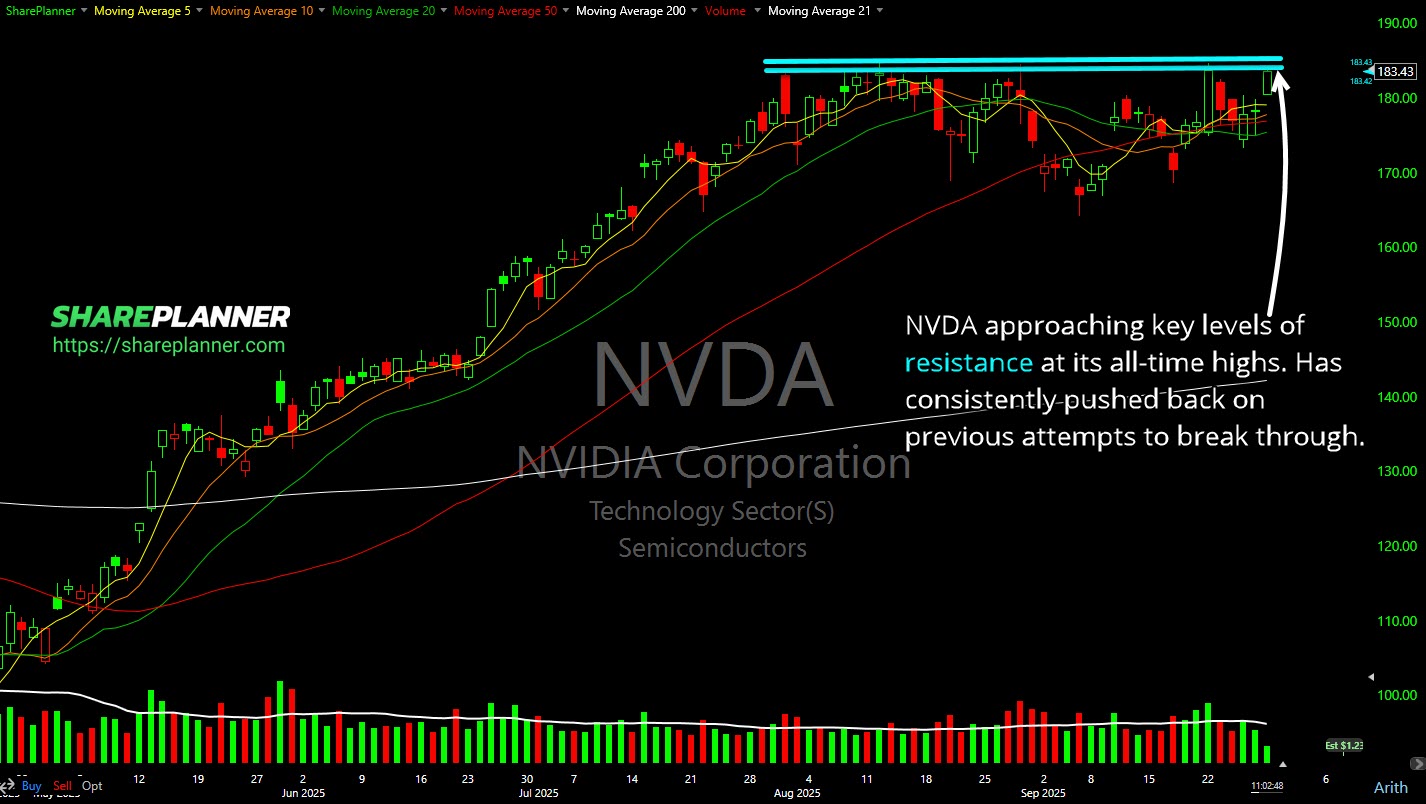

This level at all-time highs continues to push back as resistance on Nvidia (NVDA).

Nvidia (NVDA) breaking below support is not a good look here for it or the overall market.

Nvidia (NVDA) currently on a key support level that previously acted as resistance. Major inflection point for this stock.

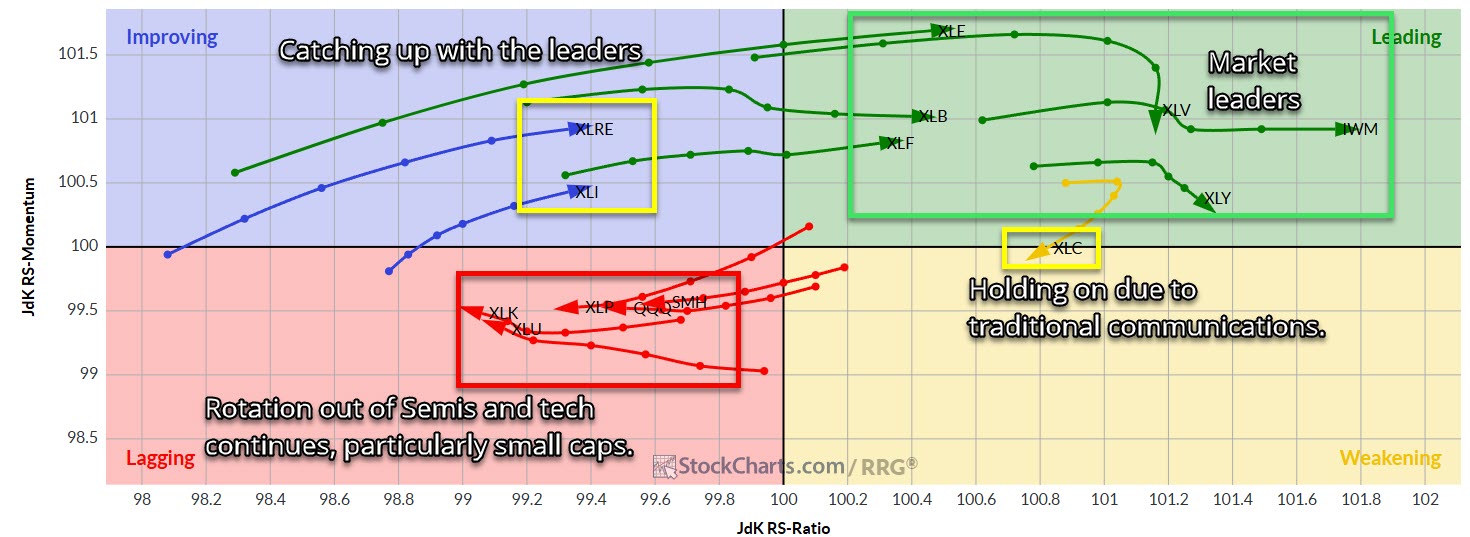

Technology sector is taking heavy losses this week, with Nvidia (NVDA) looking at a third straight week of losses. Meanwhile Russell 2000 (IWM) looking to rally for a fourth straight week.

July would have finished in the red for the S&P 500 (SPY) if it weren't for the Mag 7 stocks. In 2025, they are responsible for 48% of the market's returns!