Multiple support levels to watch following the hard fade in AdvisorShares Pure US Cannabis ETF (MSOS). Notable support at $6.75, followed by $6.20. Johnson & Johnson (JNJ) testing the rising trend-line and attempting to bounce intraday. If broken, and moves below $157, I want nothing to do with it. Bear flag in AMC Entertainment (AMC)

$TNX pushing above October '22 highs and breaking through some heavy resistance. $AMC rejection at resistance was the clue to get out. Now it is breaking major support going back to '22. Retested it on Friday and failed. For those that think $AMC is rigged, then why are you even trading it? Simple logic -

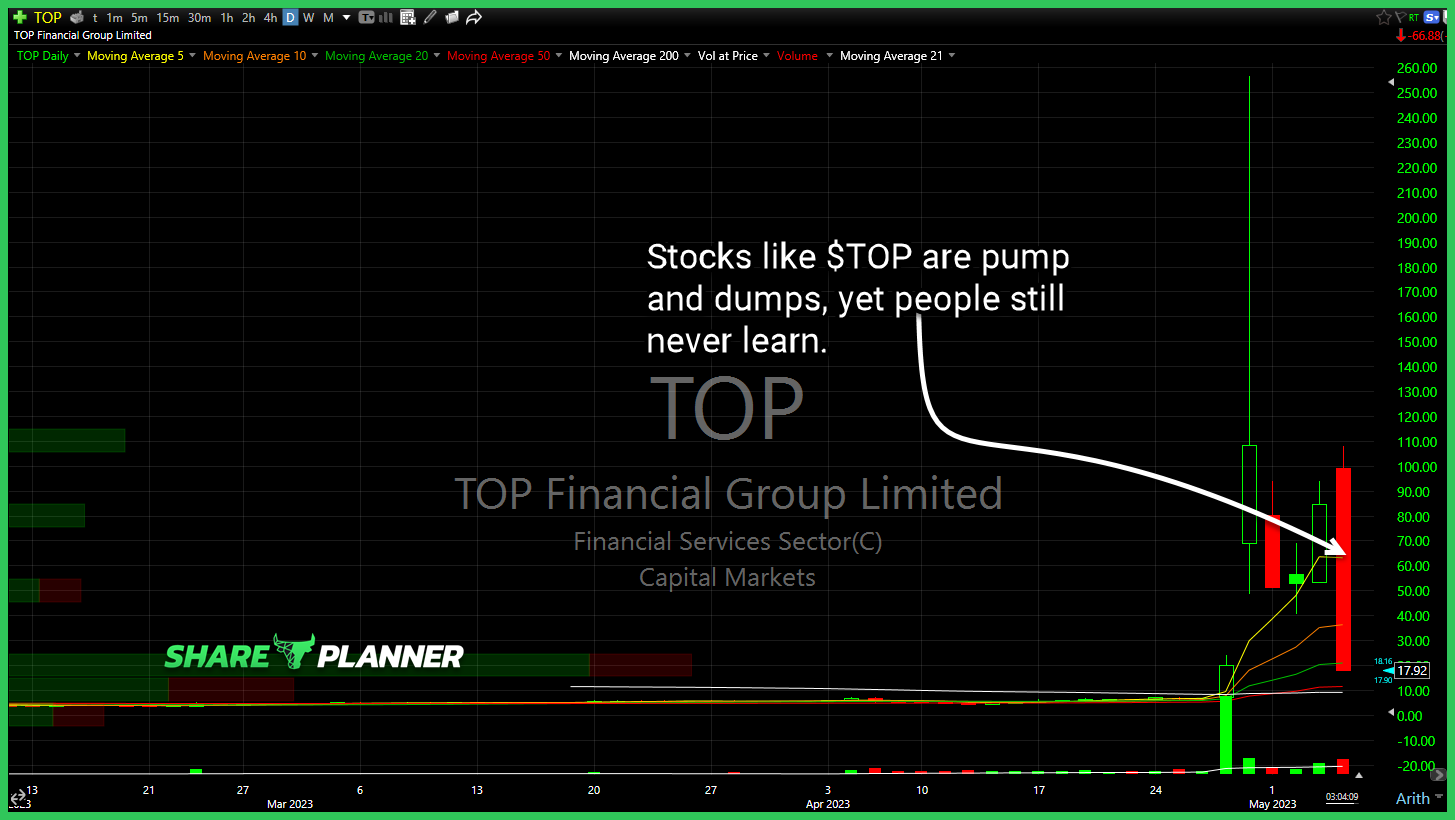

Stocks like TOP Financial Group (TOP) are pump and dumps, yet people still never learn. They still have to chase and then blame the boogeyman when it doesn't work out. Bearish Big move out of Advanced Micro Devices (AMD) on Microsoft (MSFT) news, but still within the short-term declining channel. Considering there hasn't been a

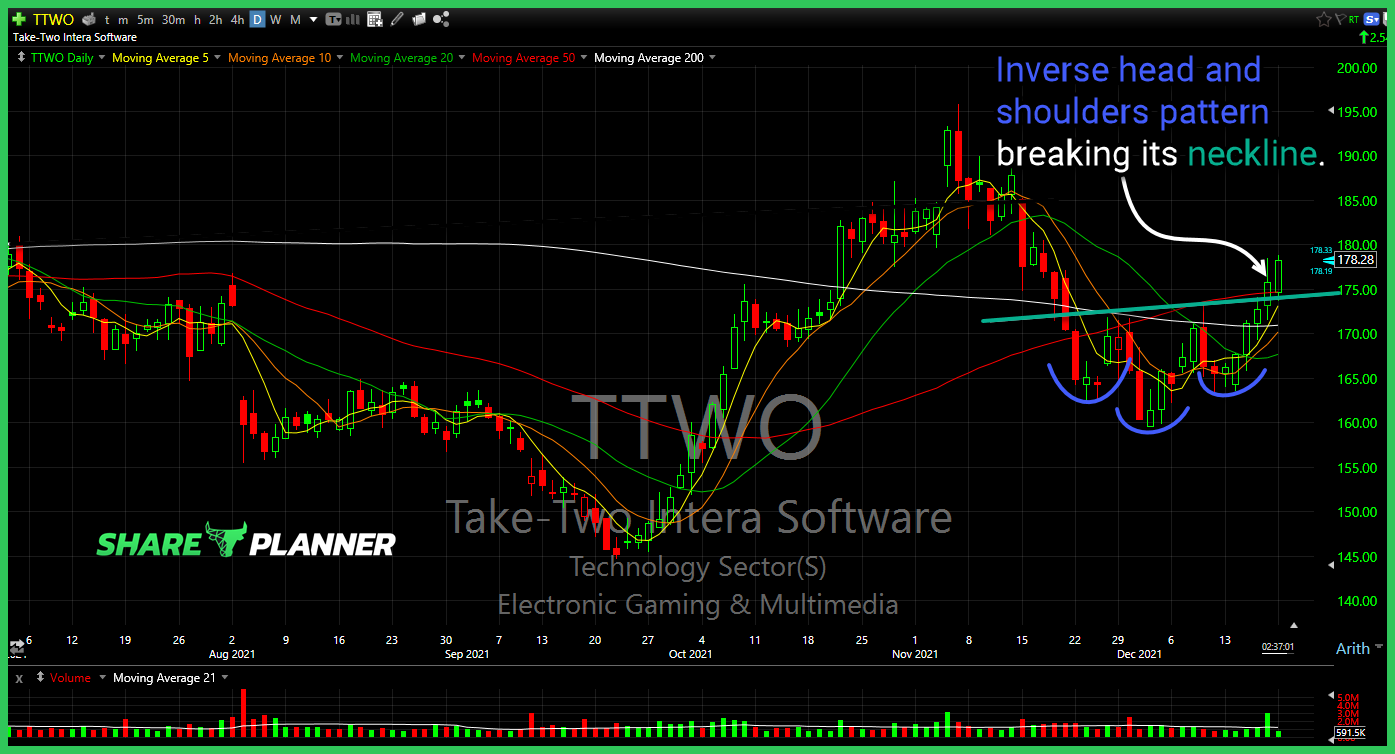

$TTWO very impressive and continues to march to the beat of its own drummer.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

My Swing Trading Approach I closed my trades in Micron (MU) for a +0.2% profit and Johnson & Johnson (JNJ) for a +0.1% profit – meager profits to say the least, but the in the case of MU, I avoided a lot of downside as a result. The afternoon fading that is taking

Technical Outlook: SPX gave up all of its morning gains and dropped further into the red throughout the morning. But, you guessed it, the bulls rallied the market hard in the afternoon to close the market at break even. For the purposes of staging entries into new positions in either direction, it becomes fairly

Technical Outlook: Major reversal to the downside following Tuesday’s rally. But now today, SPX looking at gapping higher and challenging Tuesday’s highs once again. Back in play is the head and shoulders pattern, particularly if today’s strength and gap up cannot hold. Just a reminder, the market has not played well with gaps of late.

Technical Outlook: Massive rally yesterday – the largest one since March 11th. SPX reclaimed the middle band (20-day moving average). Also recaptured the 10-day moving average. Despite a hard rally yesterday, the sell-off was still below recent averages. SPX, since bouncing off of the lows Friday (and off of the 50-day moving average) price