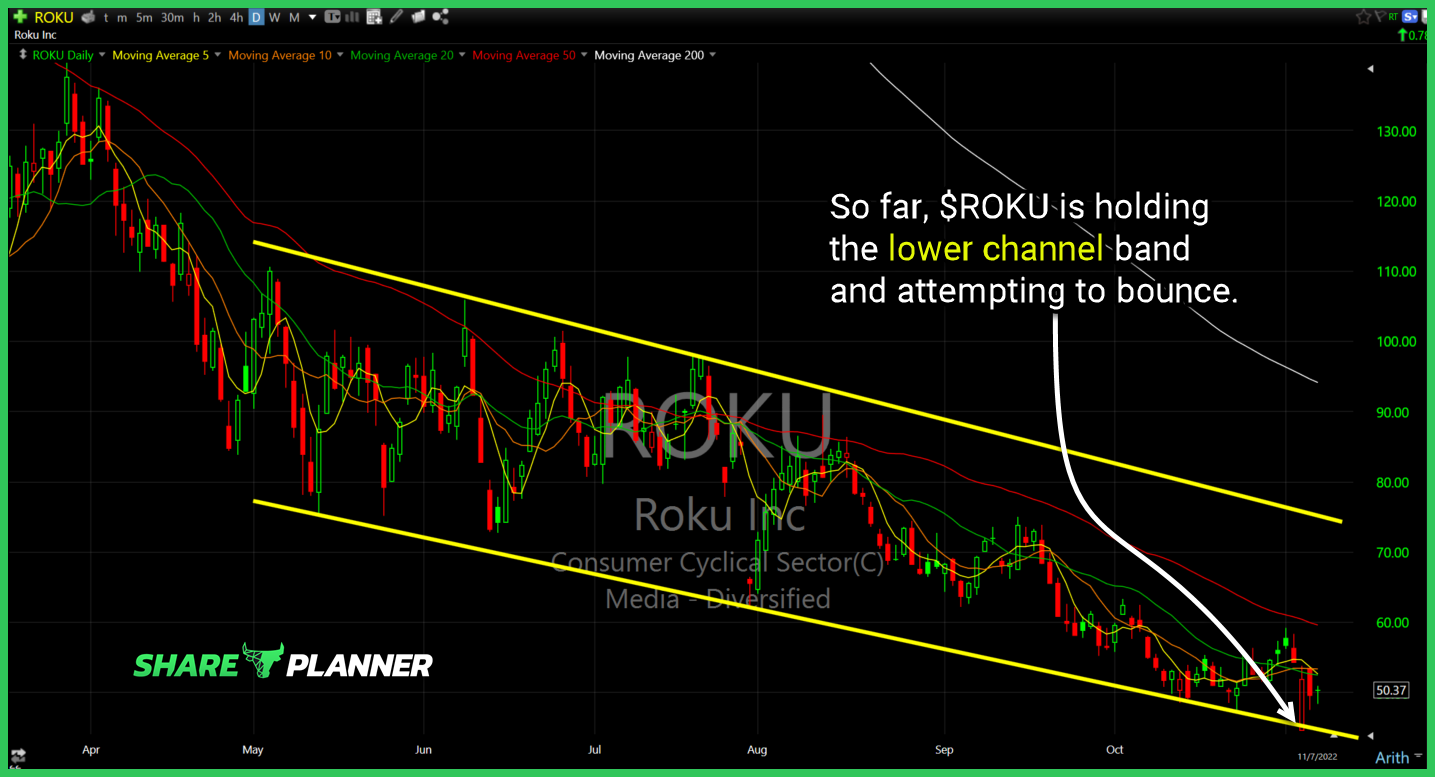

Roku (ROKU) pulling back to its breakout level today - watch to see if it can bounce off of it here.

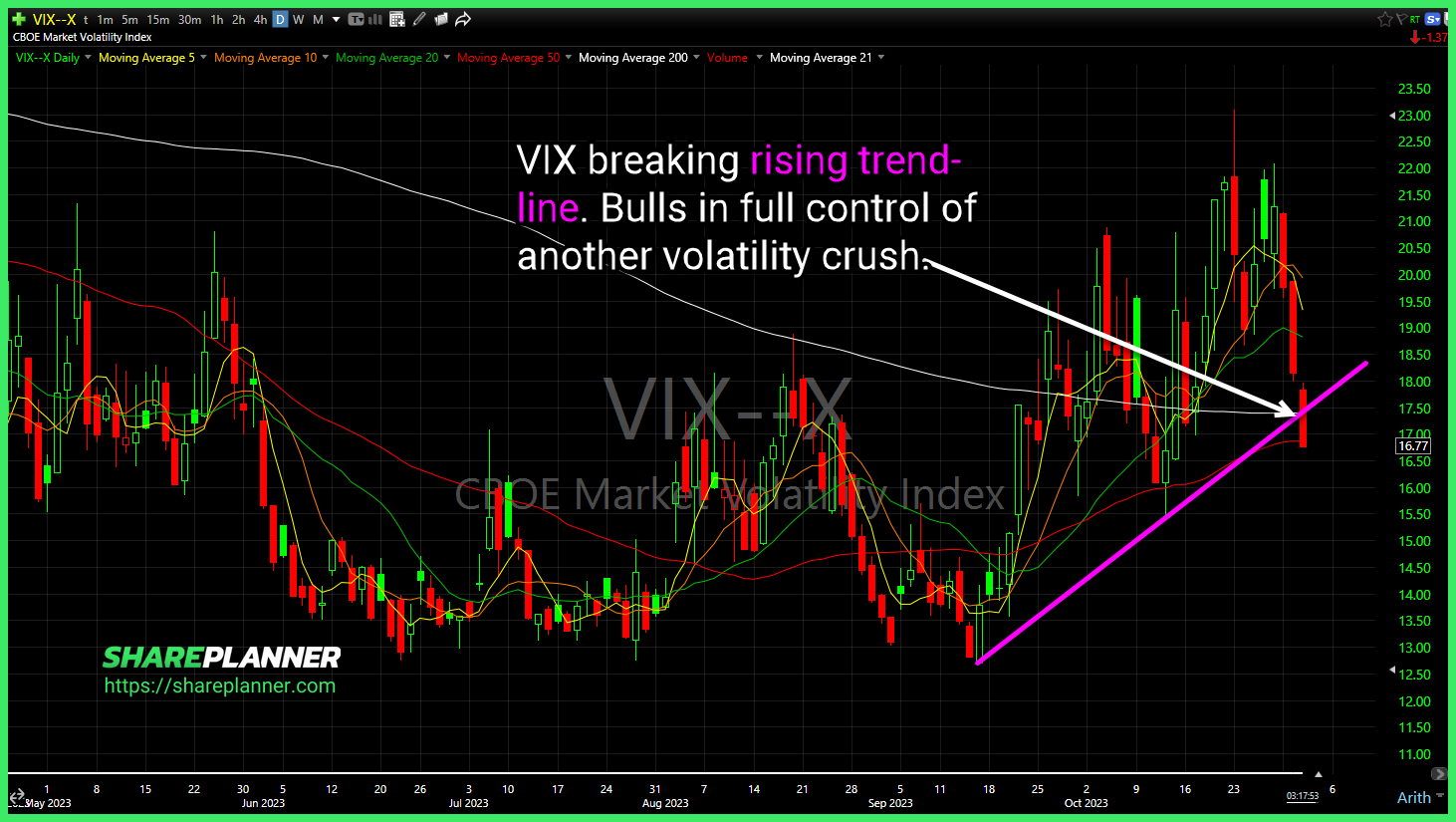

CBOE Market Volatility Index (VIX) breaking rising trend-line. Bears in full control of another volatility crush. Declining resistance on Boeing (BA) broken today. Declining channel in Advanced Micro Devices (AMD). Room to run, but watch for a potential reversal around the 106-107 area. Roku (ROKU) with a bullish wedge. Watch for the potential

$ROKU bull flag right around the breakout level. I prefer waiting until after earnings, before making a move this stock due to the heightened risk. $DWAC pumps have historically been short lived and I expect nothing different here. $DKNG bull flag worth watching. May see a breakout here $QQQ can stabilize and bounce. Bullish wedge

$DPZ breaking declining resistance with double bottom in play. $RMBS nice bull flag breakout & retest of declining support. Needs to hold this bounce in order for the trade to remain intact. $PERI nearing a double bottom breakout but may be a little overstretched in the short-term. Some consolidation before the breakout would be ideal.

So far, $ROKU is holding the lower channel band and attempting to bounce.

Roku (ROKU) declining channel remains firmly intact despite today's gains. Wait for a breakout of the channel before considering a long position. Despite solid gains for SoFi Technologies (SOFI) today, there is no clear direction going forward, until this sideways channel gets a breakout/down. Adobe Systems (ADBE) Reason 4,520,369 why I don't hold a stock

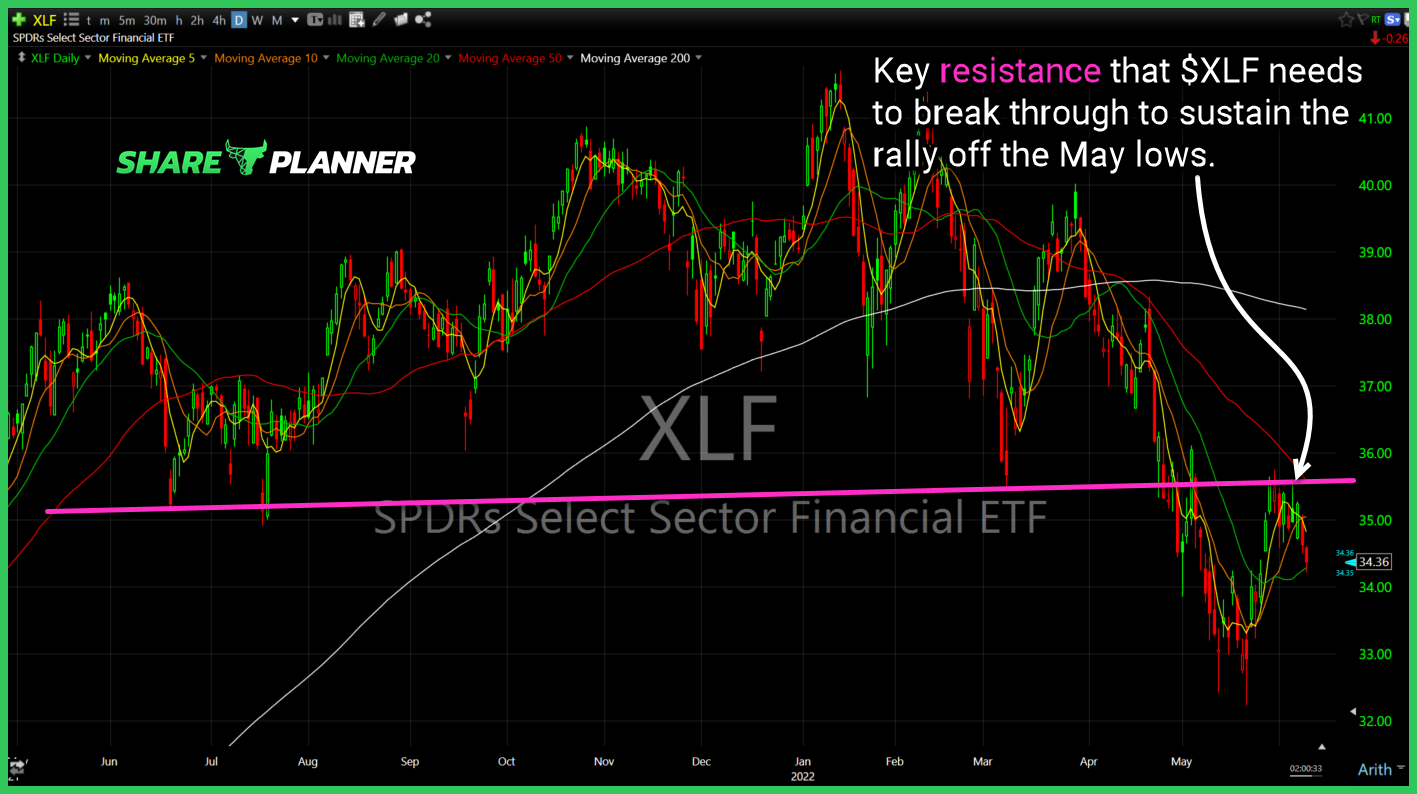

$XLF needs to make another run towards resistance and break that resistance, if the bounce off the May lows is going to stick.

$ROKU resistance break through today.

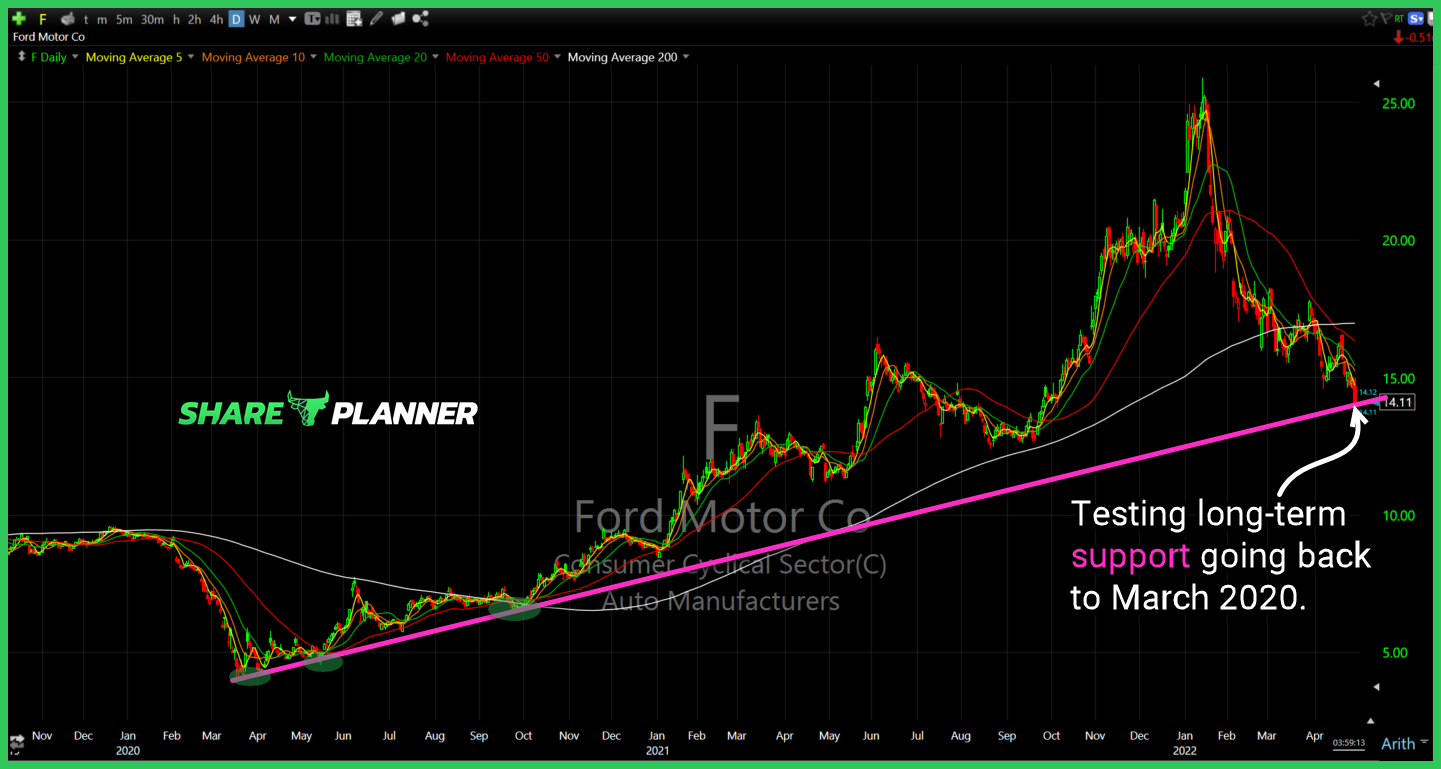

$F testing its long-term trend-line here.

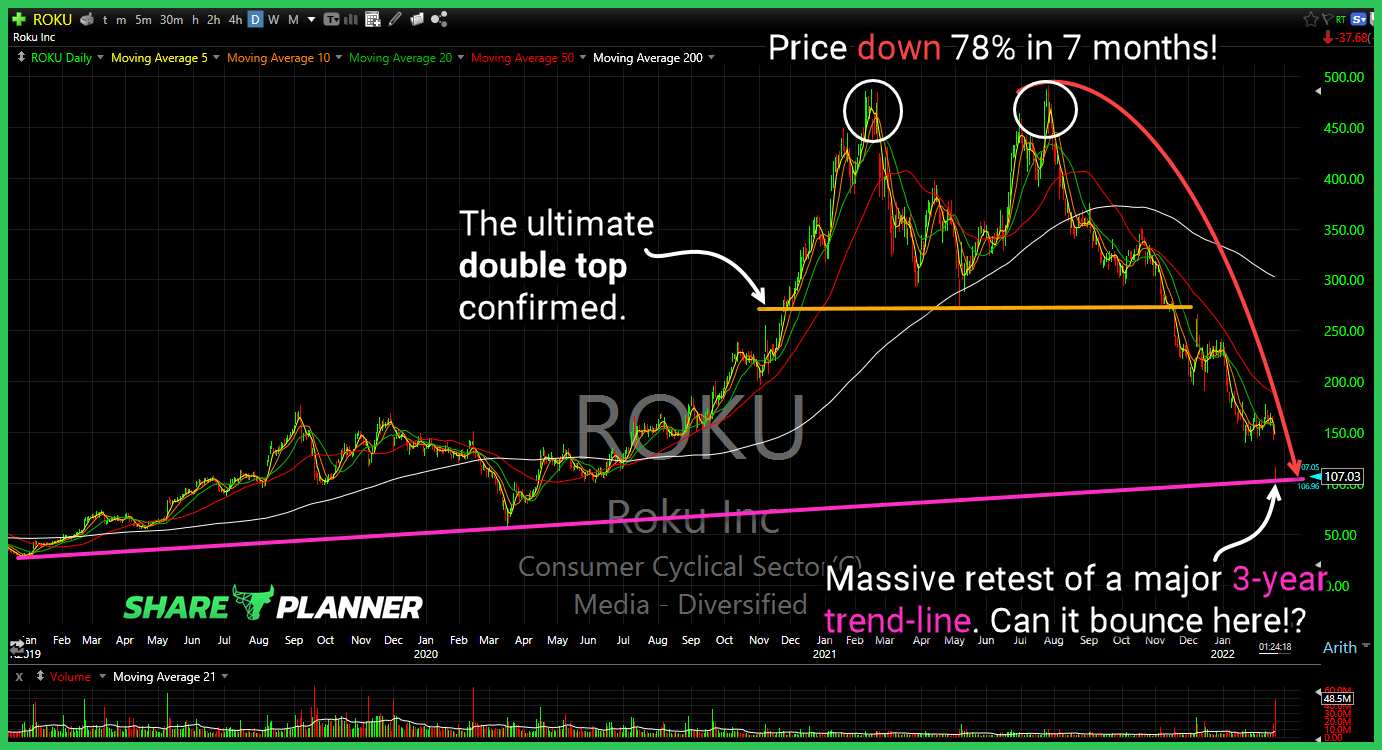

$ROKU has pulled back to a major trend-line from 3 years ago. Not worth catching the falling knife right now, but if it can start to form a base around support, it could provide a opportunity to get long in the next few weeks.