MU Breakout needs to first push through the 200-day moving average. Micron (MU) just reported earnings and saw an initial large rally in the stock after hours, followed by a sharp pullback. However, MU on the daily chart looks really good and using technical analysis, I am able to identify a potential breakout area for

Episode Overview In uncertain times for the stock market, is going all cash as a flight to safety a poor decision? Or should one toughen up and trade through those periods of difficulty? In this podcast episode, Ryan will address the merits of going cash and making sure your long exposure is reflected in the

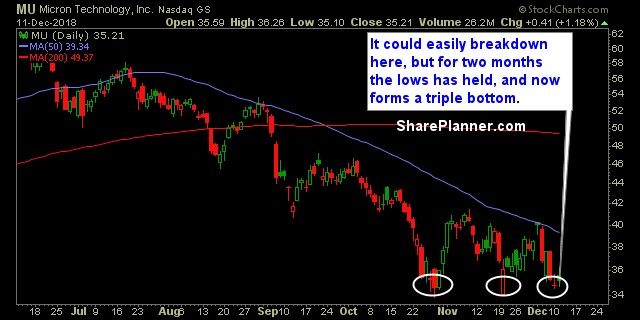

National Health Investors (NHI) a bit choppy of late, but has some potential above $61.81 Pfizer (PFE) stuck in sideways price action. Better to wait for a breakout instead of getting caught in the chop. Micron (MU) trying to turn the tide and put in a double bottom - but definitely not worth considering until

The stock market saw a signifcant sell-off from fears of a new variant called Omicron, which rattled financial markets across the world. The S&P 500 ($SPY), Nasdaq 100 ($QQQ) and Russell 2000 ($IWM) all saw heavy selling. Is the stock market going to crash like it did in 2020, or will investors buy the dip

Stocks Today are at all time highs. Should you buy stocks at all time highs, or should you wait for a stock market correction to make stocks more affordable? Should you be long or will the stock market crash yet again? In this video, provide the technical analysis and chart analysis for swing trading in

Micron Technologies (MU) has become one of my favorite trades of the past few months. I originally spotted this beauty of a chart based off of triangle breakout back on October 29th. I provided my trade setup to members of the Trading Block. As MU pulled back and held the breakout level, it absolutely soared

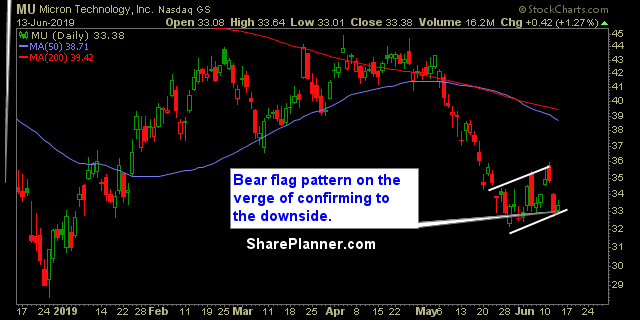

Swing Trade Approach: Took some small gains off the table of trades Amgen (AMGN) and Starbucks (SBUX) that simply wasn’t providing enough return for the risk I was taking. Got knocked out of my Micron (MU) short trade at the open, following that damn upgrade they received this morning. Overall, I was fine with the returns

Friday’s Swing-Trades: $PYPL $TTWO $MU Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: PayPal (PYPL)

Wednesday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Micron Technology (MU)

My Swing Trading Approach I closed my trades in Micron (MU) for a +0.2% profit and Johnson & Johnson (JNJ) for a +0.1% profit – meager profits to say the least, but the in the case of MU, I avoided a lot of downside as a result. The afternoon fading that is taking