Alphabet (GOOGL) is presenting an interesting technical setup that has me watching closely. There are bullish elements developing on the chart, but several factors still give me pause before committing capital to the long side. The Bullish Case: Support and Pattern Development The stock has found support at previous lows, which is encouraging. When price

Traders often struggle to separate their feelings about a company from the reality of its stock price. It is easy to look at SoFi Technologies (SOFI) and see a disruptive fintech story. You might love the app or use the services and assume that means the stock should go up. But as swing traders, we

If you have been watching Nvidia lately, you have probably noticed the excitement has cooled off. The stock that led the market higher has gone nowhere for months. It has churned sideways, frustrating traders who are used to parabolic upside. Now the chart is showing something more ominous than boredom. A large head and shoulders

There are days in the market that test your resolve, and today is one of them. If you have been watching silver, you know exactly what I mean. We are seeing an aggressive move lower that is triggering panic selling. Fortunes are being won and lost on this kind of volatility. It is ugly out

Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization. Inflation remains somewhat elevated. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic

Every swing trader knows the feeling. It is right before the opening bell, coffee in hand, when you check your portfolio and see one of your positions has gapped up. It is an adrenaline rush. But there is also the flip side, that sinking feeling when a stock gaps down against you, wiping out weeks

SBUX Stock Analysis: Why Starbucks Keeps Failing Breakouts When you look at a brand as ubiquitous as Starbucks (SBUX), it is easy to assume the stock must be a perennial winner. We see packed cafes and long drive-thru lines, and as traders, our instinct is to want a piece of that action. It feels

Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up through September. More recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated. The Committee seeks to achieve maximum

Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated.

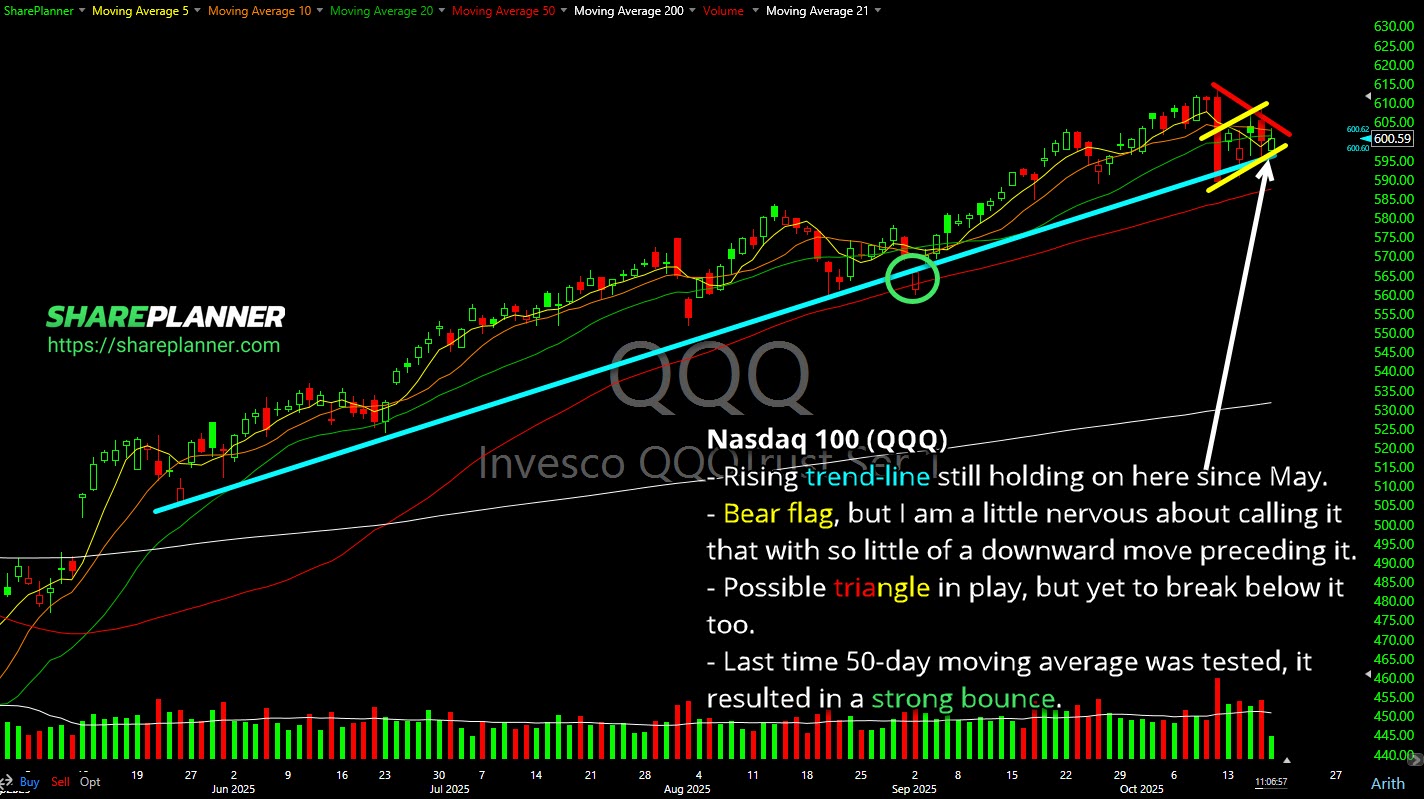

The Nasdaq 100 (QQQ) is still hanging tough despite some recent volatility. That rising trend line that’s been in place since May is continuing to hold up, and so far, buyers have stepped in every time it’s been tested. Now, there’s a bit of a debate here on what this current pattern really is. It