One thing I don't like about this cup and handle pattern on Microsoft (MSFT) is the resistance overhead from an old trend-line.

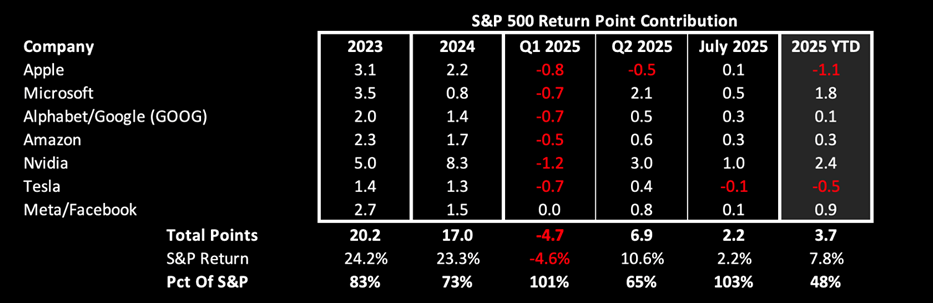

July would have finished in the red for the S&P 500 (SPY) if it weren't for the Mag 7 stocks. In 2025, they are responsible for 48% of the market's returns!

The Monday Short Squeeze For a couple of months now, Monday’s on have represented bloodshed on Wall Street. But today, you have the bulls taking off, and squeezing the shorts in the process. For now, I consider this a dead cat bounce, but a dead cat bounce that could squeeze the shorts for days.

Market Rotation Into Small caps is unfolding. IWM ETF appears to be set to make another rally here to the upside as the market rotation into small caps continues. Russell 2000 (IWM) pulled back late last week and is now bouncing off of the Fibonacci retracement levels and sets up for a potential rally

The indices are making new all-time highs on a regular basis, following NVDA, MSFT and AAPL - but is it time for the "everything else rally"? But what about all the other stocks that have been lagging behind? In this video, I'll explore whether these overlooked stocks are poised to play catch-up and join the

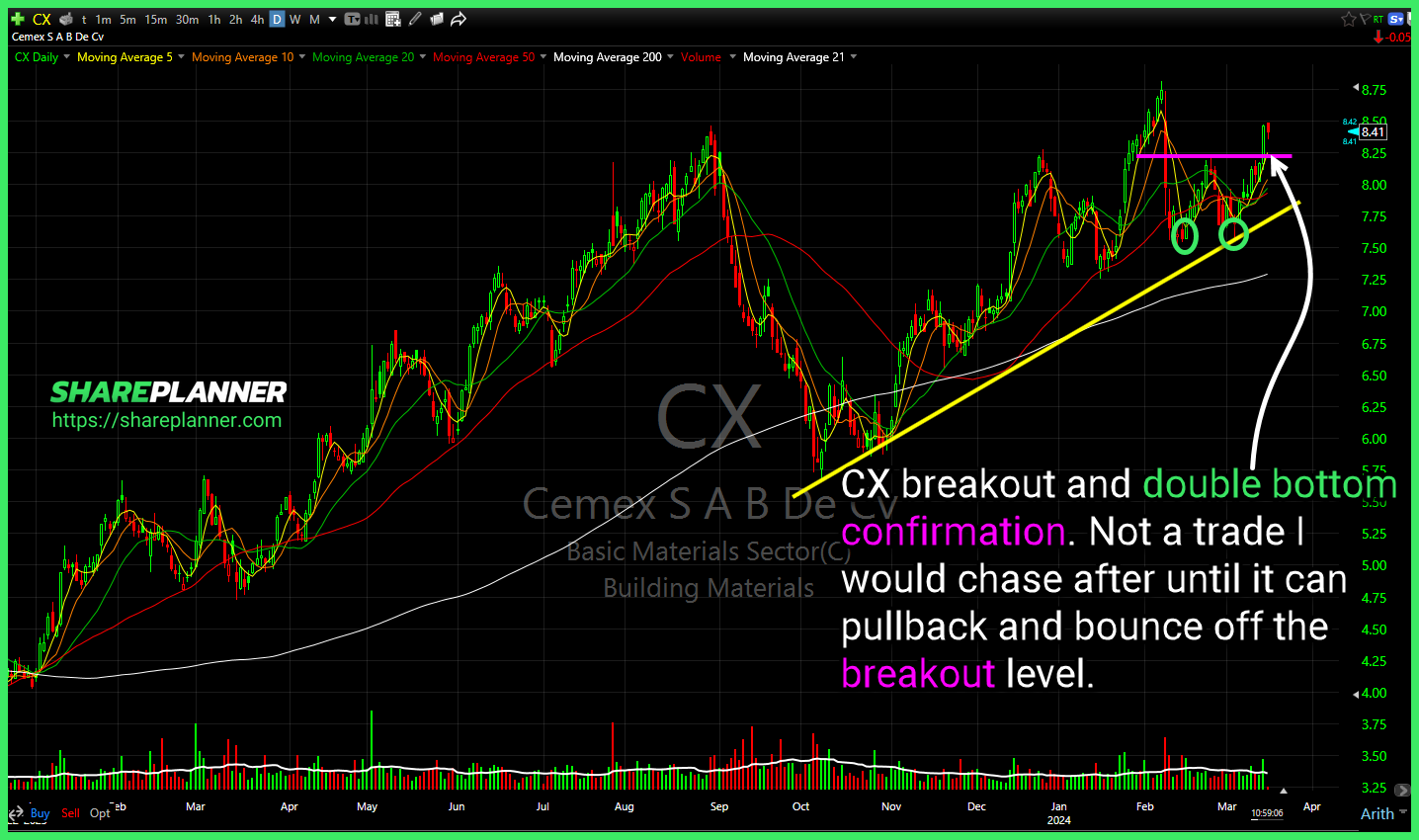

Don't Chase Stocks Gapping Up! When swing trading, it's crucial to be aware of the potential pitfalls that can derail your strategy. One common mistake many swing traders make is chasing stocks gapping up significantly higher at the open. While it may be tempting to jump on board, hoping to catch a ride on the

Cemex (CX) breakout and double bottom confirmation. Not a trade I would chase after until it can pullback and bounce off the breakout level. Microsoft (MSFT) with a pullback to the breakout level. Extreme volume at the open though is concerning that it will be able to hold. Could see a pullback to the rising

Microsoft (MSFT) holding the rising trend-line here, but not quite getting much in the way of a bounce so far. Semiconductor ETF (SMH) attempting to find some support here on this pullback. Boeing (BA) breaking below the lower channel band that goes back to October '22