The overall market continues to frustrate traders with choppy, directionless price action. All three major index ETFs - SPY, QQQ, and IWM - remain range-bound, making it difficult to capture momentum or follow-through in either direction. In today’s video, I dive into each chart and examine: Where major support and resistance levels are forming How

After opening deep in the red, the market saw a sharp rebound across all major indices, with S&P 500 (SPY), Nasdaq 100 (QQQ), and Russell 2000 (IWM) all bouncing off the lows, though not recovering all the losses. We've seen a number of these huge sell-offs of late lead to massive rebounds in the days

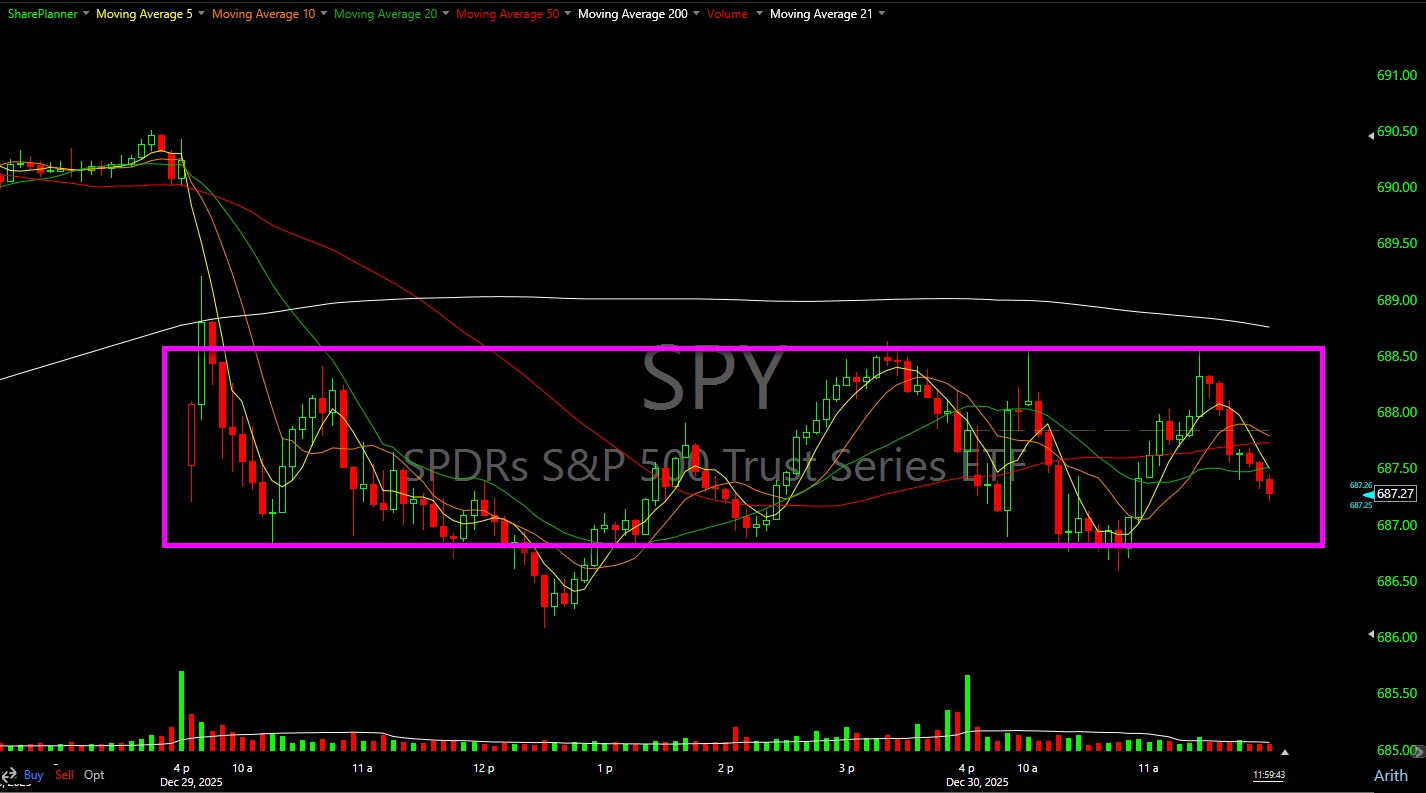

This resistance on SPY that goes back to November continues to bludgeon traders who want to get long anything not semiconductor related.

SPY continues to lull traders to sleep. The price action is expected, yet still mind-numbing.

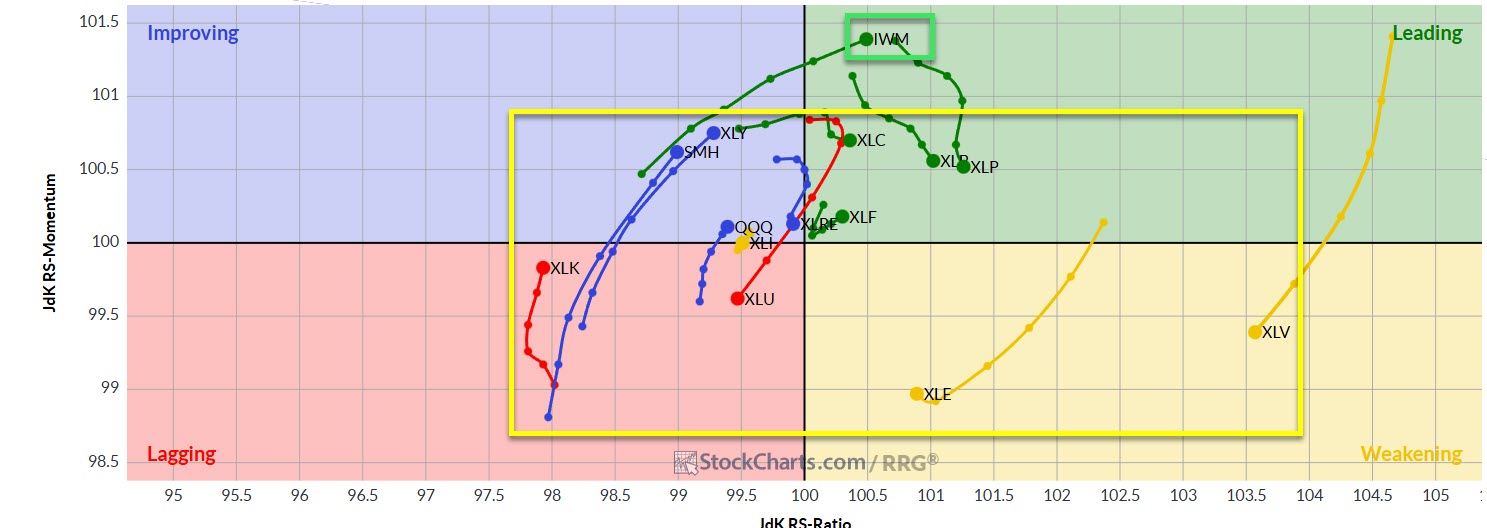

Only Russell 2000 (IWM) is showing any real leadership under current market conditions. Everything else is simply circling the S&P 500 (SPY).

This fade on SPY is not a good look technically.

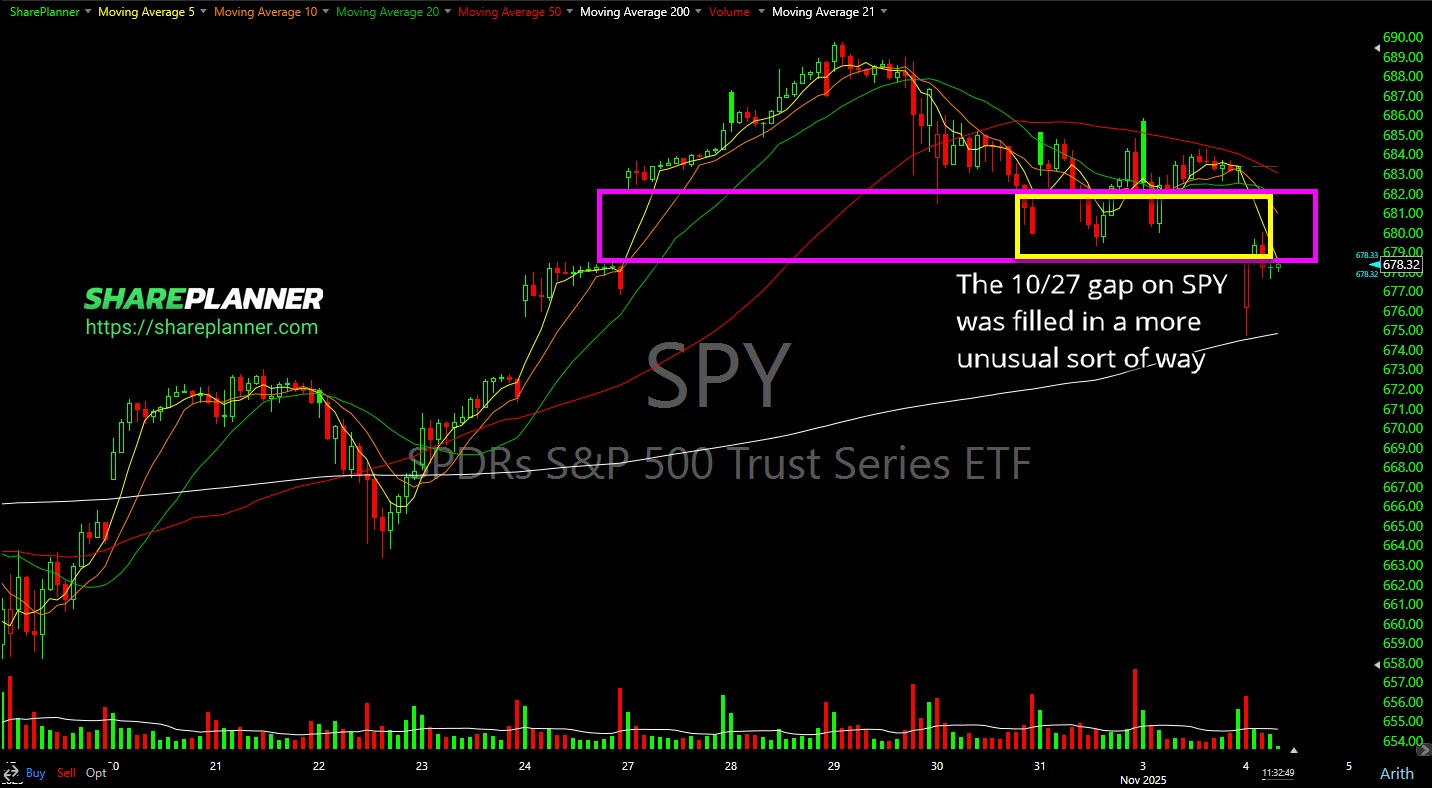

SPY filled the gap in a most unusual sort of way.

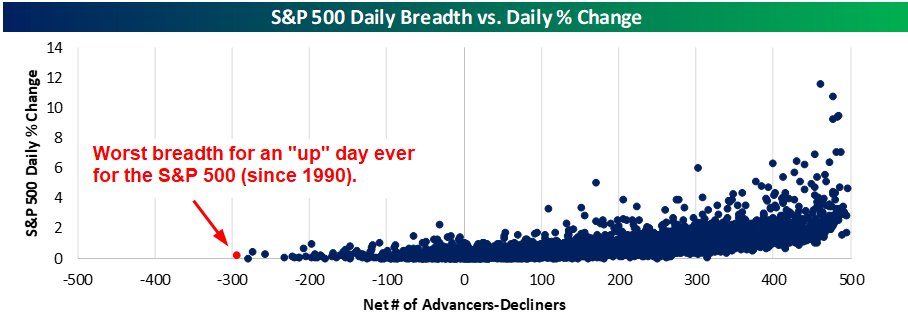

Never before have we see this many stocks go down when the S&P 500 traded higher. It's the NVDA effect.

This stock market bounce hasn't shown incredible follow through And the fact everyone is expecting a bounce in the stock market just after a two-day sell-off in the S&P 500 (SPY) goes to show just how ridiculous the expectations have become for this stock market. Sure, it was a huge sell-off on Friday,