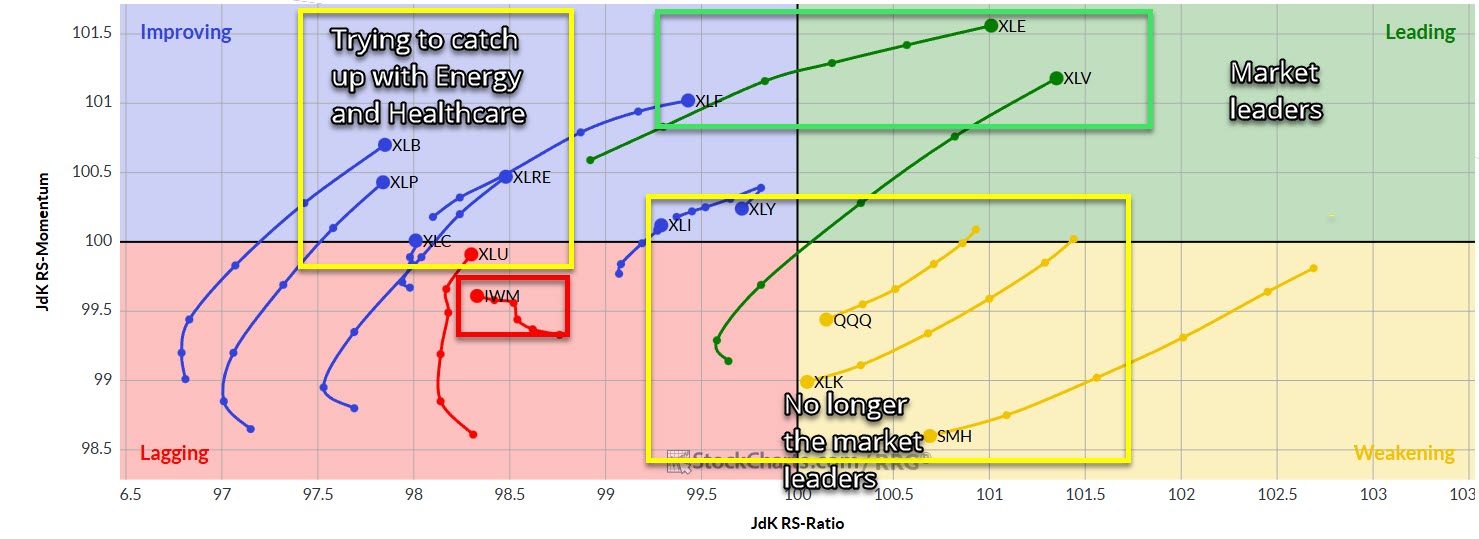

Semis and tech losing the leadership mantle and handing it over to Energy and Healthcare.

The Nasdaq 100 (QQQ) is still hanging tough despite some recent volatility. That rising trend line that’s been in place since May is continuing to hold up, and so far, buyers have stepped in every time it’s been tested. Now, there’s a bit of a debate here on what this current pattern really is. It

Nasdaq 100 (QQQ) setting up for a pullback to key support.

Crazy divergence between the net longs on the Nasdaq 100 (QQQ) and the Russell 2000 (IWM).

Nasdaq 100 (QQQ) pushing below its lower channel band. At six days in a row lower, setting up for a bounce here.

Nasdaq 100 (QQQ) has established itself a new rising channel.

If this market is going to pullback here, there is a ways to go before 38.2% retracement level is reached.

Nasdaq 100 wasted no time in going from oversold extremes to overbought extremes

Massive Gap Higher on QQQ The Nasdaq 100 (QQQ) had a huge rally, closing up 4% following the announcement of a 90-day tariff truce between the U.S. and China, reducing tariffs from 145% to 30% on Chinese goods, and from 125% to 10% on U.S. goods. The agreement has boosted investor confidence, particularly in tech

HIMS Update & Chart Analysis Hims & Hers (HIMS) surged over 23% after announcing a partnership with Novo Nordisk (NVO) to offer the weight-loss drug Wegovy through its telehealth platform. In this video, I analyze the breakout of the stock and explore what this means for HIMS stock moving forward. Become part of