My Swing Trading Approach My portfolio is quite light going into the open. The bulls need to resume the uptrend here. If so, I’ll be a buyer, otherwise, I will flip to the short side. Indicators

My Swing Trading Approach I expect us to see a rally come forth at some point this week that will be hard and fast. However, while playing it is okay, committing too much capital to it is a bad thing. Be careful as it may not take place exactly when you expect. Stay nimble and

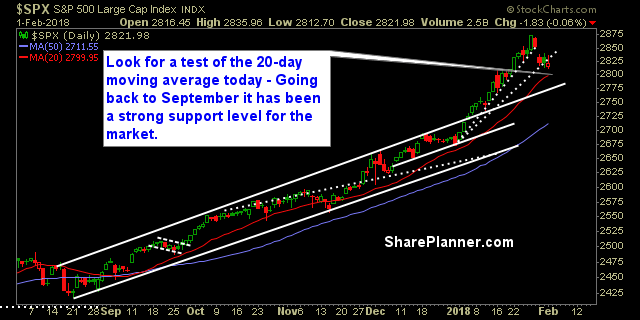

My Swing Trading Approach I will be watching to see how the 20-day moving average is holding up today. If it does hold, it will likely be a good opportunity to buy the dip. Otherwise, if it slices right through it, I will stand by. Ideal shorting opportunities going forward should come from a failed

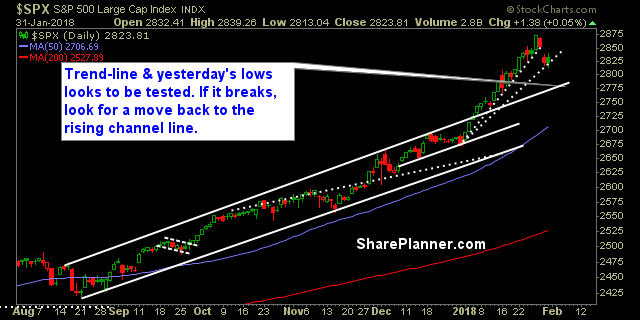

My Swing Trading Approach I didn’t buy any stocks yesterday. I stayed put, and may do the same thing again today. If the bulls can turn things around, I’ll consider adding some long exposure, but not ready to start aggressively short this market. I’ll see how the day unfolds. Indicators

My Swing Trading Approach I added some long exposure on the dip yesterday, I may add more depending on the price action today. My main focus will be to increase the stops on my existing trades. Indicators

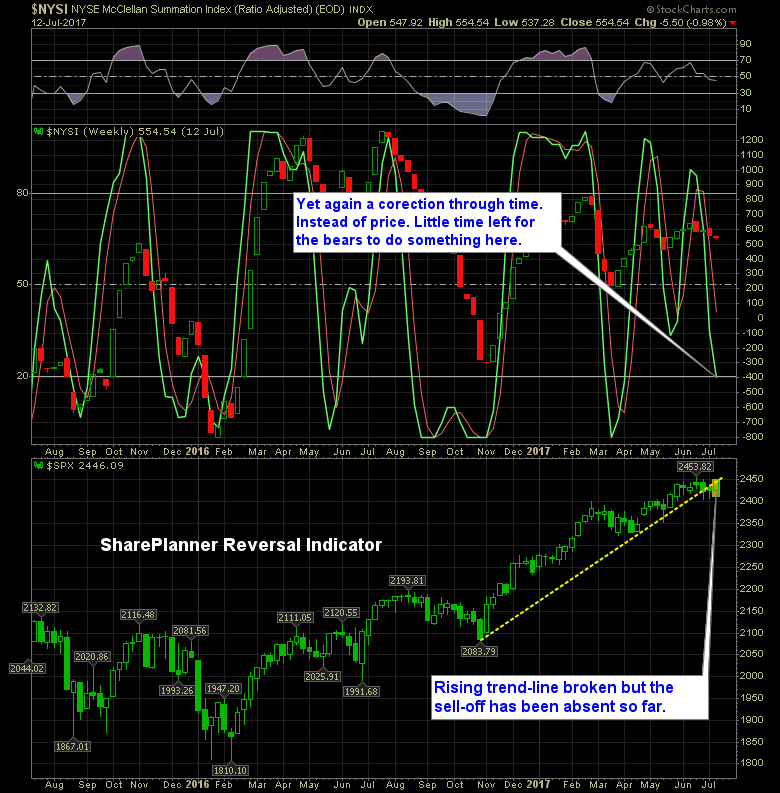

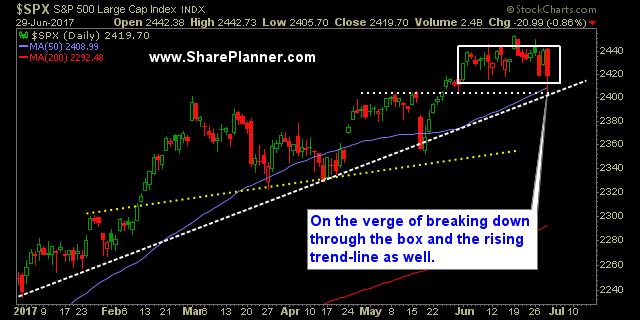

Stocks simply don’t want to give up this ride from the past 8 years. It can’t. IT WON’T! And that is because you have this massive long-term trend-line going back to February of last year that simply won’t break.

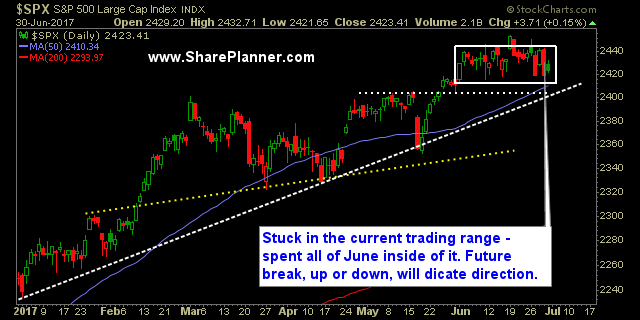

The market is gasping for air everytime it revisits the all-time highs that it made back in June. Yet the bears have yet to show up and relieve the market at current price levels that the bulls can’t seem to do anything with. As a result you have a stalemate. We got the bearish reversal

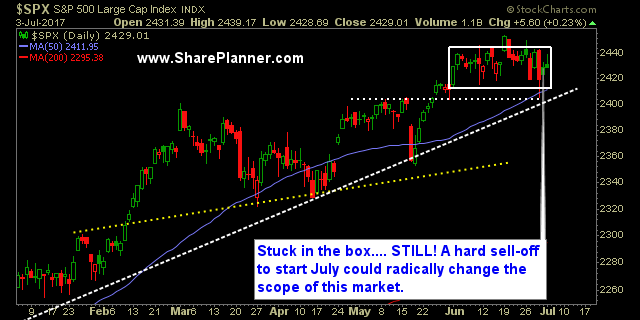

I suspect that the holiday volume will persist into the week. Anytime you have a week where there are only 3.5 trading sessions in total, you can expect that much of Wall Street will take the week off and enjoy an extended vacation.

Futures are surprisingly making a move in the premarket Whether it holds will be a whole other question. Gap highers tend to be shakey business of late. Even Friday, where the market was solid all day long, chose to sell off in the final 10 minutes of trading and wipe out about 80% of the

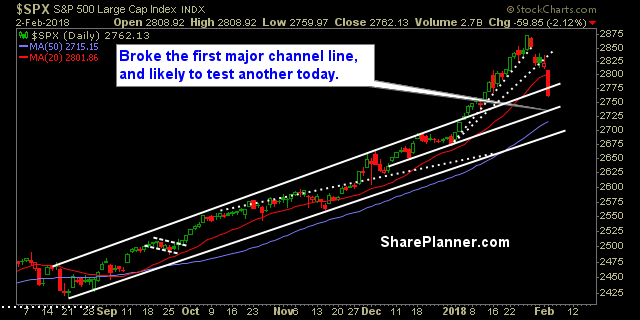

Stock market is on shaky ground That doesn't mean the market is simply going straight down from here - if it were only that easy. That's because, despite the sudden bearishness that has been prevalent throughout this week, there is still that pesky dip buying mentality of the stock market that won't let the 8