Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up through September. More recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated. The Committee seeks to achieve maximum

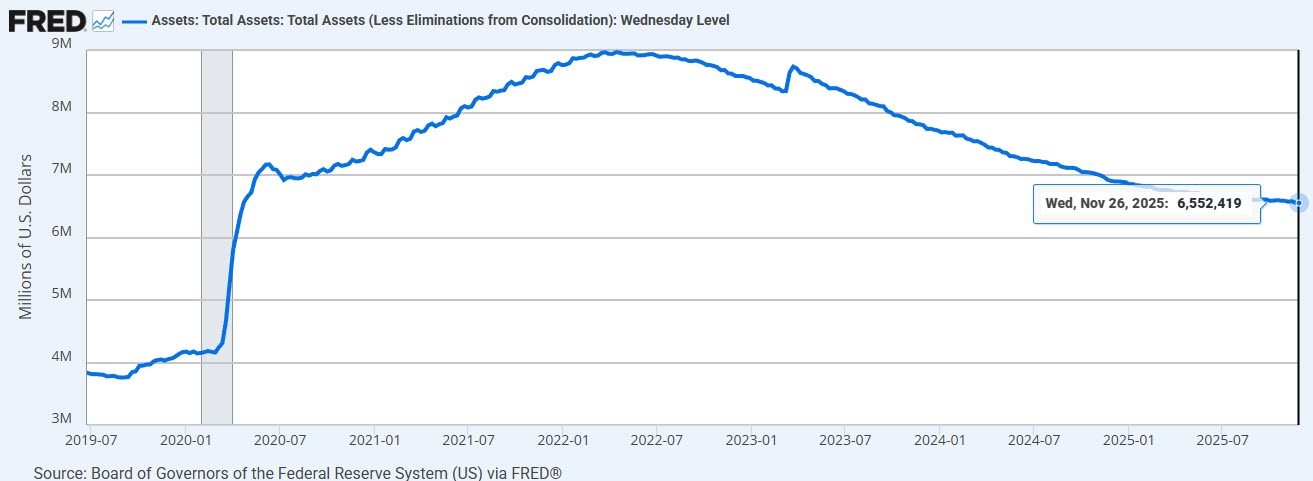

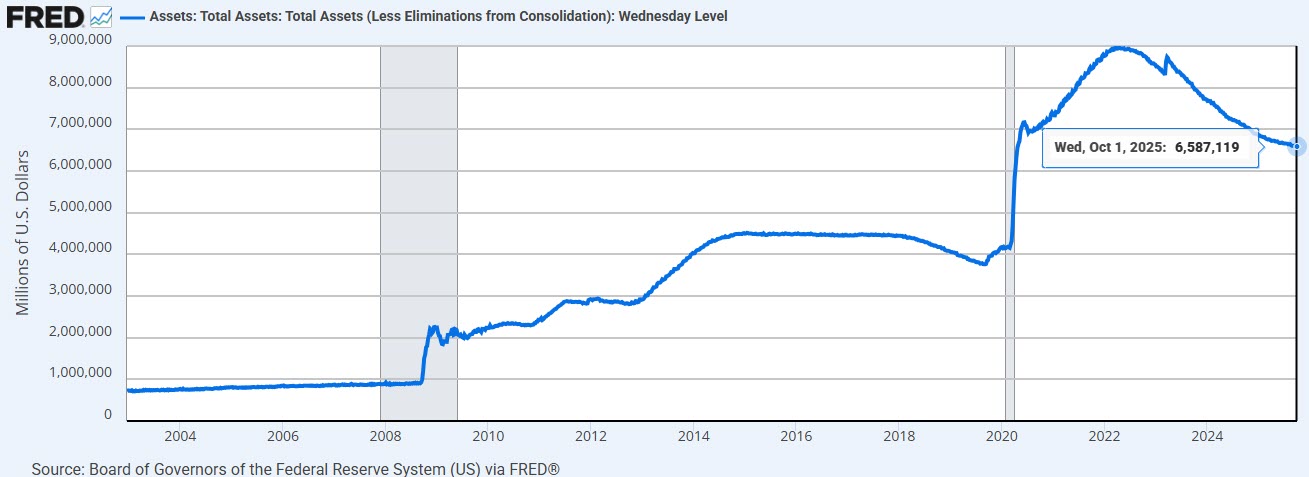

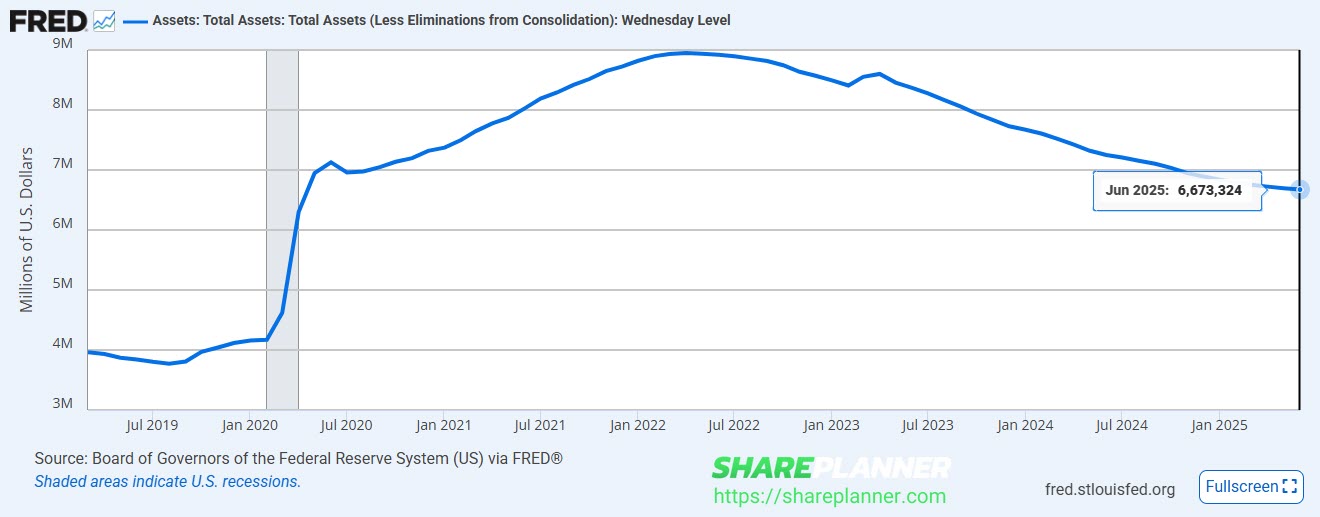

With quantitative tapering (QT) over, we managed to get $2.5T off of the balance sheet, but over $2.5T remains from the rapid increase brought about from Covid.

Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated.

The Fed is still very much uninterested in fighting inflation...If they were, their balance sheet wouldn't still be so astronomically high.

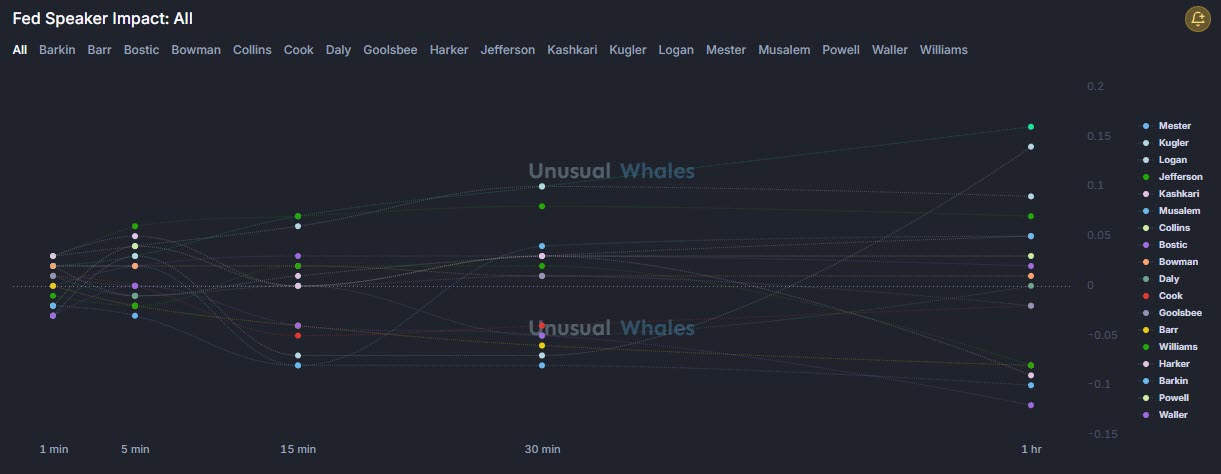

According to the facts here, Loretta Mester is the most bullish while Jerome Powell and Christopher Waller are the most bearish.

Recent indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.

According to the CME Group, odds for a rate cut over the last week has jump to 98% likelihood.

Fed allowed another $30B to run off its balance sheet this month.

Although swings in net exports continue to affect the data, recent indicators suggest that growth of economic activity moderated in the first half of the year. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Fed essentially let 0.4% ($27b) of the balance sheet run off last month. That's not going to make much of a dent.