Alphabet (GOOGL) has not confirmed, but remains holding on to the neckline for dear life.

Alphabet (GOOGL) is presenting an interesting technical setup that has me watching closely. There are bullish elements developing on the chart, but several factors still give me pause before committing capital to the long side. The Bullish Case: Support and Pattern Development The stock has found support at previous lows, which is encouraging. When price

has a pretty intriguing bounce play setup here with the wedge, but be wary of the broken trend-line resistance.

It seems Warren Buffett is making waves again. News recently broke that Berkshire Hathaway took a significant $4.9 billion stake in Alphabet (GOOGL). As you would expect, the stock rallied hard on the news. When the Oracle of Omaha makes a move, people pay attention. But should you follow him into this trade? I have

I would aim for the rising trend-line for key trade support on Alphabet (GOOG). Successfully pulled back and tested the bull flag today as well. Like seeing that.

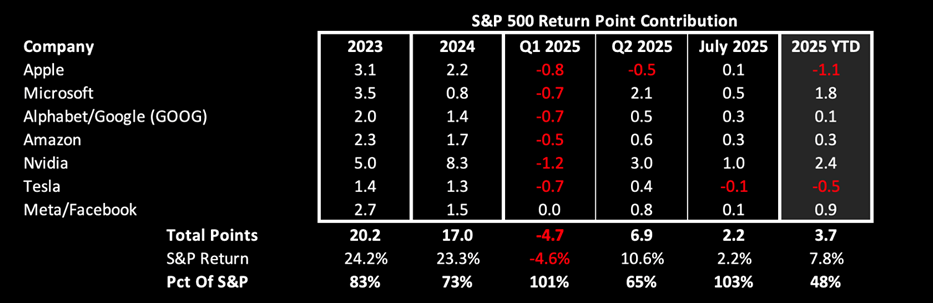

July would have finished in the red for the S&P 500 (SPY) if it weren't for the Mag 7 stocks. In 2025, they are responsible for 48% of the market's returns!

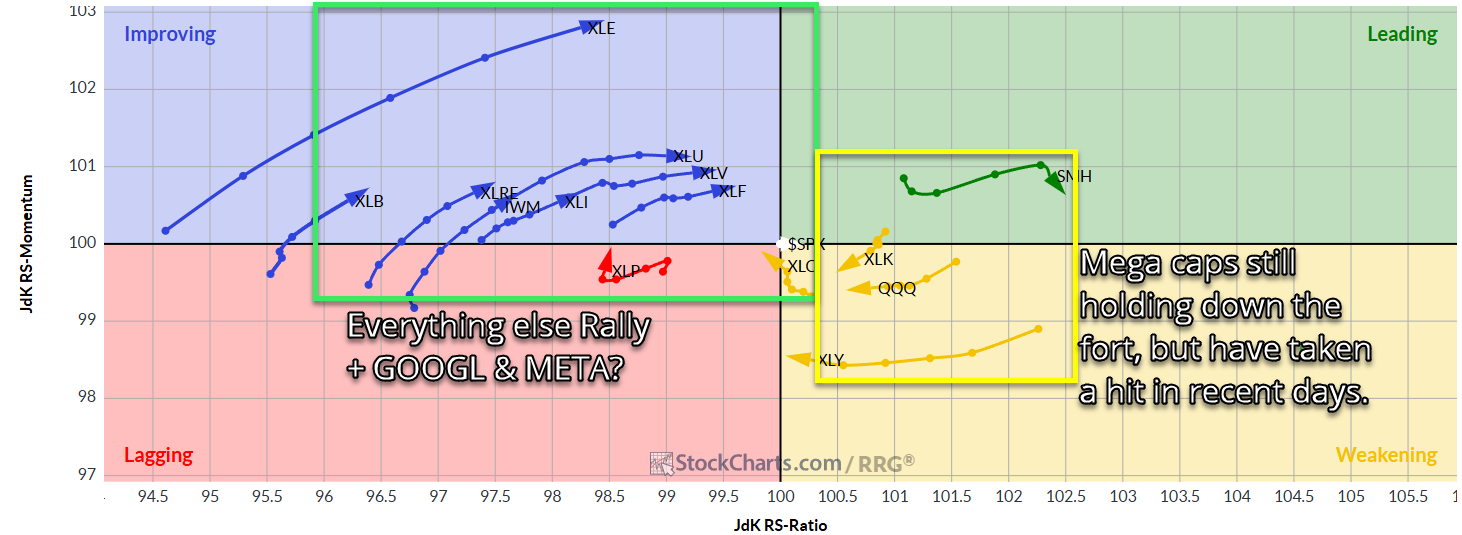

Is GOOGL Still a Buy? Alphabet (GOOGL) isn’t exactly moving in sync with the rest of the tech sector right now, and that has traders asking serious questions. While the Nasdaq 100 and key names like TSLA, NVDA, and META continue pushing higher, GOOGL looks stuck in the mud. So what’s really going on here?

Market Rotation Into Small caps is unfolding. IWM ETF appears to be set to make another rally here to the upside as the market rotation into small caps continues. Russell 2000 (IWM) pulled back late last week and is now bouncing off of the Fibonacci retracement levels and sets up for a potential rally

Don't Chase Stocks Gapping Up! When swing trading, it's crucial to be aware of the potential pitfalls that can derail your strategy. One common mistake many swing traders make is chasing stocks gapping up significantly higher at the open. While it may be tempting to jump on board, hoping to catch a ride on the