My Swing Trading Approach

I didn’t add any new positions to the portfolio yesterday, but did book profits in Netflix (NFLX) for a +2.2% profit. The market though continues to sell off in the afternoon rendering any morning strength meaningless, which is making it difficult for adding new positions to the portfolio. Until that changes, it makes it difficult to be aggressive in terms of adding significant exposure to the long side.

Indicators

- Volatility Index (VIX) – Another flat day for the index, unable to sustain a move in either direction, continues to trend sideways.

- T2108 (% of stocks trading above their 40-day moving average): No surprise here, as the indicator shows a continued weakening of stocks under the surface, with another 4.5% decline down to 37%, despite the Dow hitting new all-time highs yesterday.

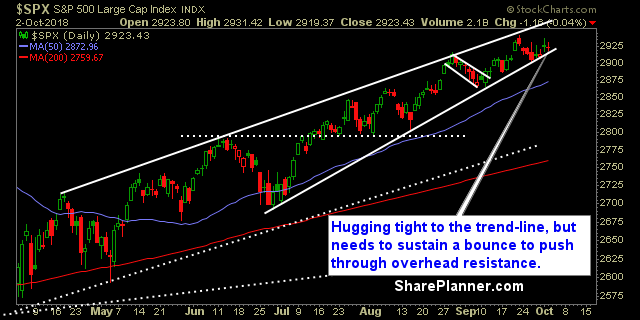

- Moving averages (SPX): Closed above all the major moving averages yesterday, held and tested the 5 and 10-day moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities continues to show strength, but not doing enough to change the sideways narrative of the sector. Financials down eight straight days – well overdue for a bounce here. Still waiting for that bounce out of Industrials. Profit taking in Healthcare the last two days on heavy volume – some concern there. Technology seeing notable weakness over the last two days, and looks to test its 50-day moving average. Discretionary in a complete breakdown the last two trading sessions.

My Market Sentiment

The trend-line is shockingly be maintained here, but the indifference and low volume that the market has exhibited of late, won’t be enough to do so going forward. A sustained bounce here is absolutely necessary to negate the bearish wedge on the daily chart.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan examines one swing trader's disaster of a trade in Robinhood (HOOD) and the problems that come with not managing the trade and managing the risk in every swing trade that one takes.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.