Little in the way of support for Affirm (AFRM) on the weekly until it comes back down to where it originally broke out at (27.50), which is also in line with the 200-day MA on the daily. Compelling bounce play here in Apple (AAPL) if it weren't for the declining resistance just above. Better to

Episode Overview In this podcast episode Ryan provides some simple solutions to focusing in on what is moving in the stock market on a daily basis and debunking the claim that following sector movements is a method of trading that is behind the curve of trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

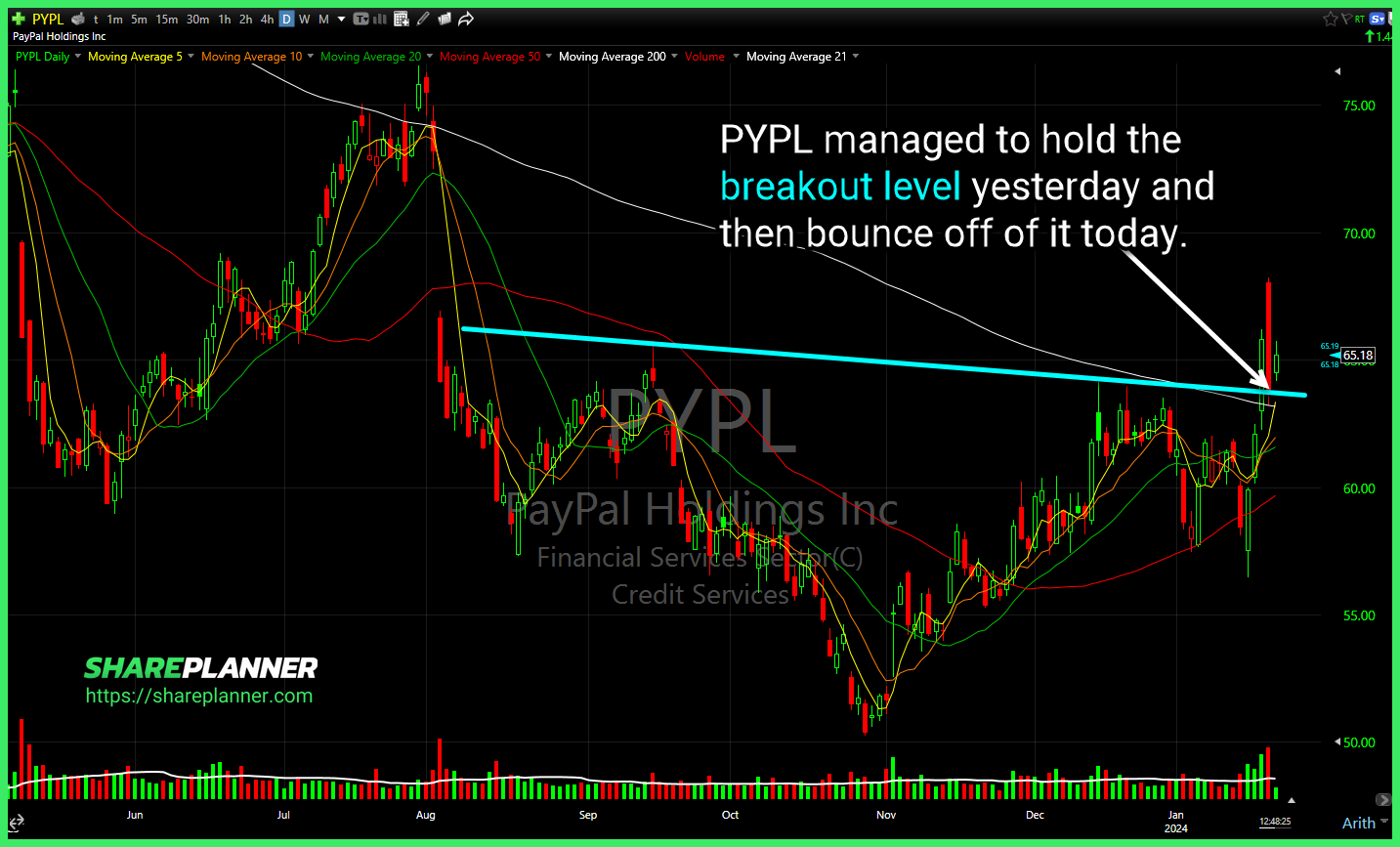

$PYPL managed to hold the breakout level yesterday and then bounce off of it today. . Earnings gave $UAL a boost right back through the resistance that was holding it back. $BTC.X 3 support levels to watch as bitcoin has broken short-term support levels and now in a free fall here.

United Airlines (UAL) couldn't push through resistance, and instead resumed its current downtrend. Sets up well for a retest of the lower $30's. Advanced Micro Devices (AMD) despite pulling back about 5% today, for me it's not worth playing until it retests its rising trend-line and holds. The ideal way for me to play PayPal

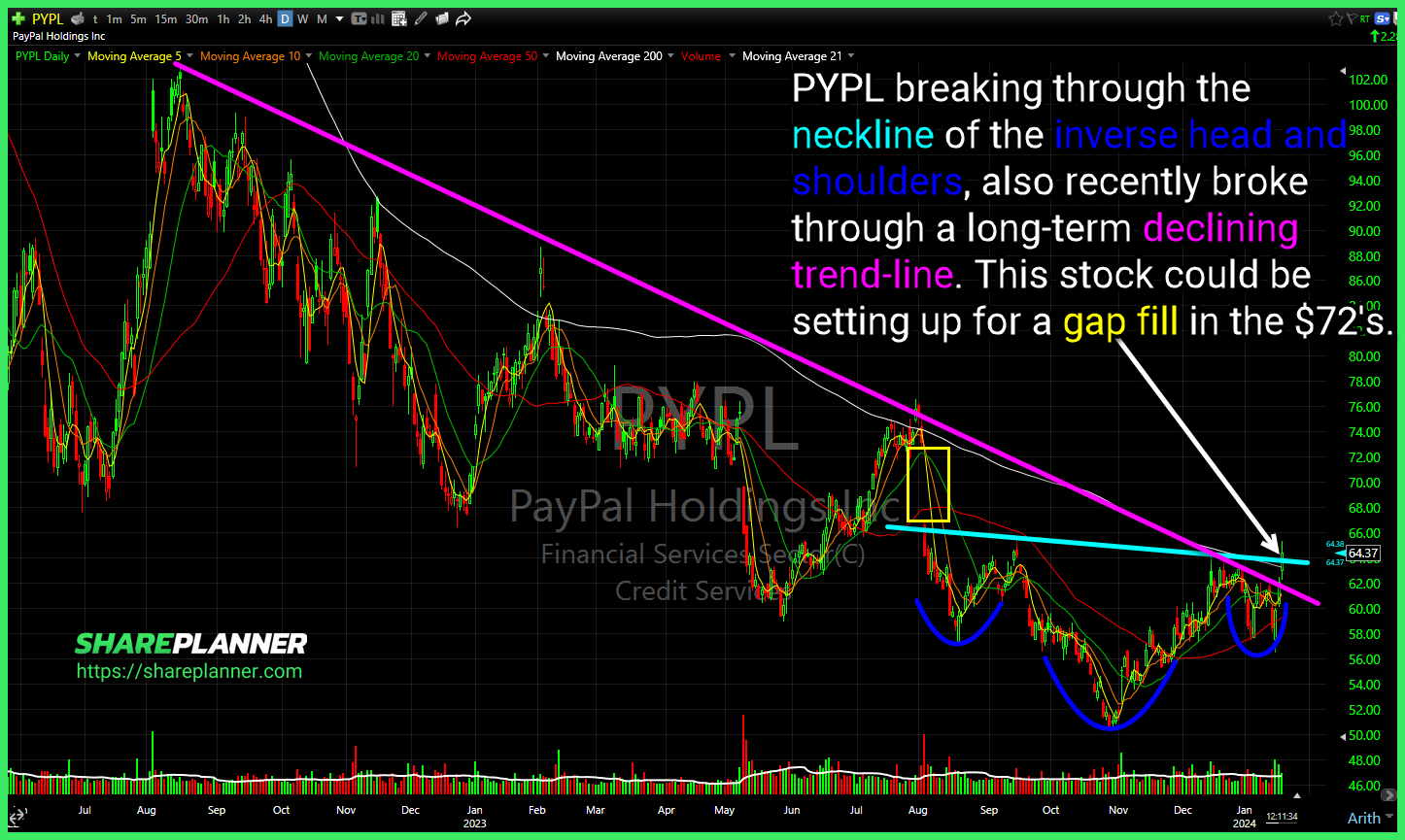

PayPal (PYPL) breaking through the neckline of the inverse head and shoulders, also recently broke through a long-term declining trend-line. This stock could be setting up for a gap fill in the $72's. Closed out this bounce play in Wayfair (W) today for a +12% profit. Nice to get some positive news that helps the

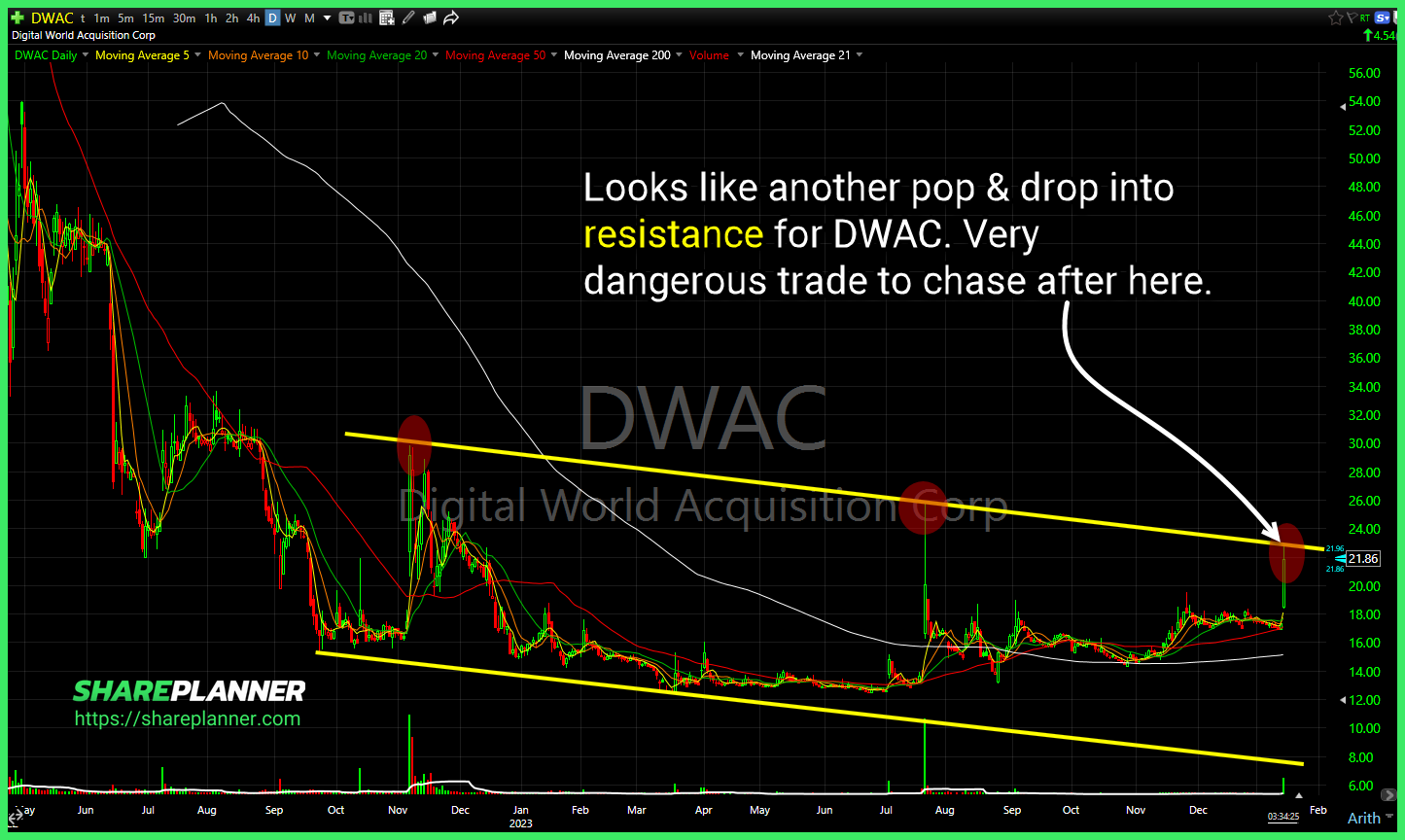

Looks like another pop & drop into resistance for $DWAC. Very dangerous trade to chase after here. $SPY bearish wedge trying to confirm. Essentially an inverse head and shoulders forming on $PYPL. Some potential support here today could come from the 50-day moving average as well.

10 year yield is now testing a major long-term rising trend-line, after selling off almost two months $TNX Similar pattern continues to emerge on $PYPL, and each time it has resolved itself to lower prices here. Huge red flag if that trend-line breaks down again

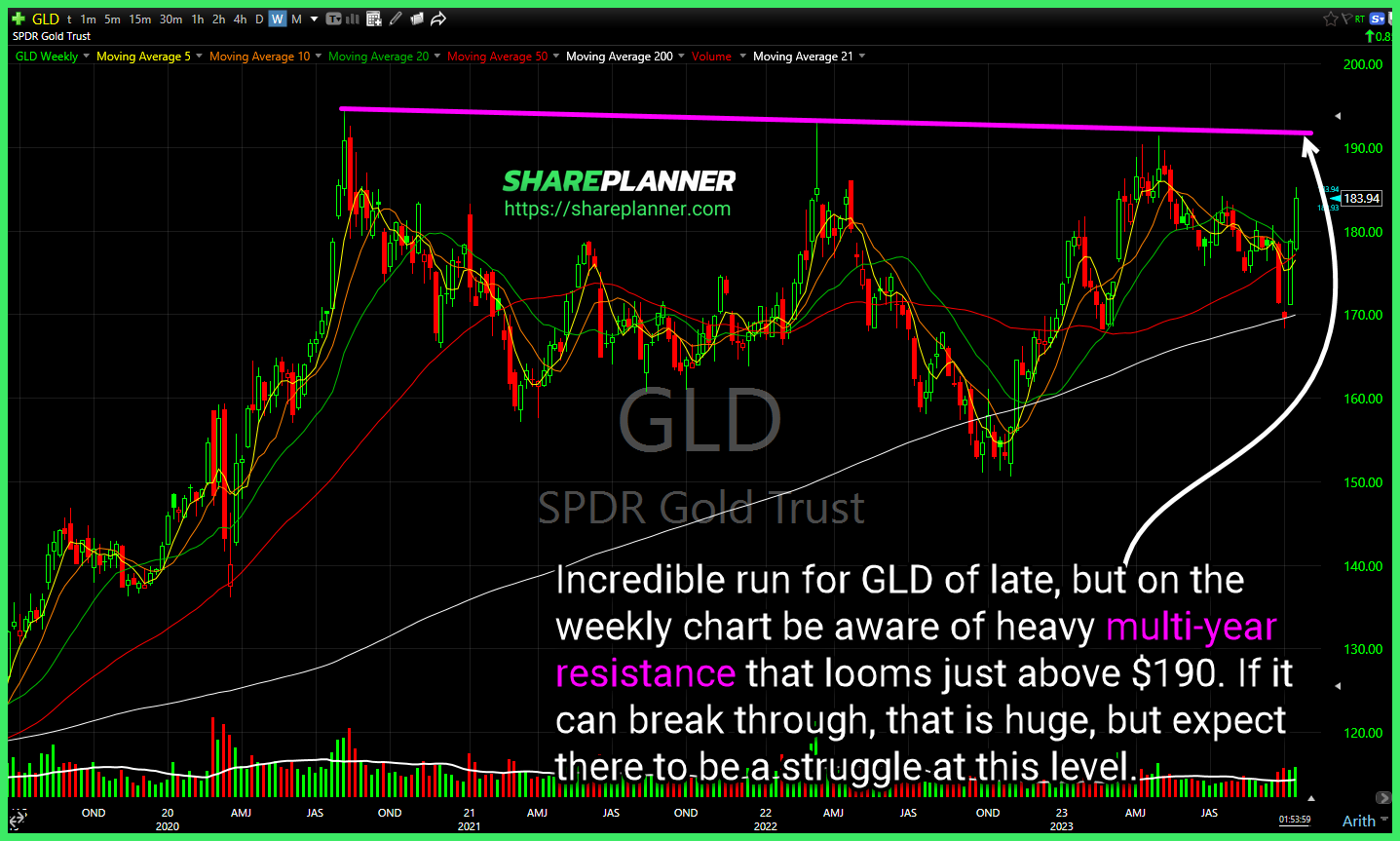

Incredible run for $GLD of late, but on the weekly chart be aware of heavy multi-year resistance that looms just above $190. If it can break through, that is huge, but expect there to be a struggle at this level. Just when you think $PYPL can't go any lower, it breaks another important support level,

$WING testing key support, and on the verge of a breakdown that has the potential for a move to the $130's. $VIX back to testing a major support level. Break it and the 11-12's are within reach. $EOG triangle forming - worth waiting for the breakout to help determine future direction for the stock. $PYPL

Another day of selling in $SHOP could create a really good bounce opportunity off of the rising trend-line. Bull flag in $GS looks sharp, but a very problematic declining trend-line just above the breakout level. Bull flag developing in $ABBV - resistance overhead currently sitting at $161. Nice trade setup here. $PYPL Currently sitting at