My Swing Trading Approach I used yesterday to take advantage of the strength in Square (SQ) and book profits for a +4.5 profit. I also added another trade to the portfolio yesterday, and will look to do the same, as long as the market can hold up today. But any additional trades at this

My Swing Trading Approach Yesterday was a damn good day with a +13.1% profit in my ROKU swing-trade. The trade was placed last Wednesday and closed out yesterday following an amazing run. I still hold two additional long positions, and held off adding anything new yesterday to the portfolio. Indicators Volatility Index (VIX) – VIX

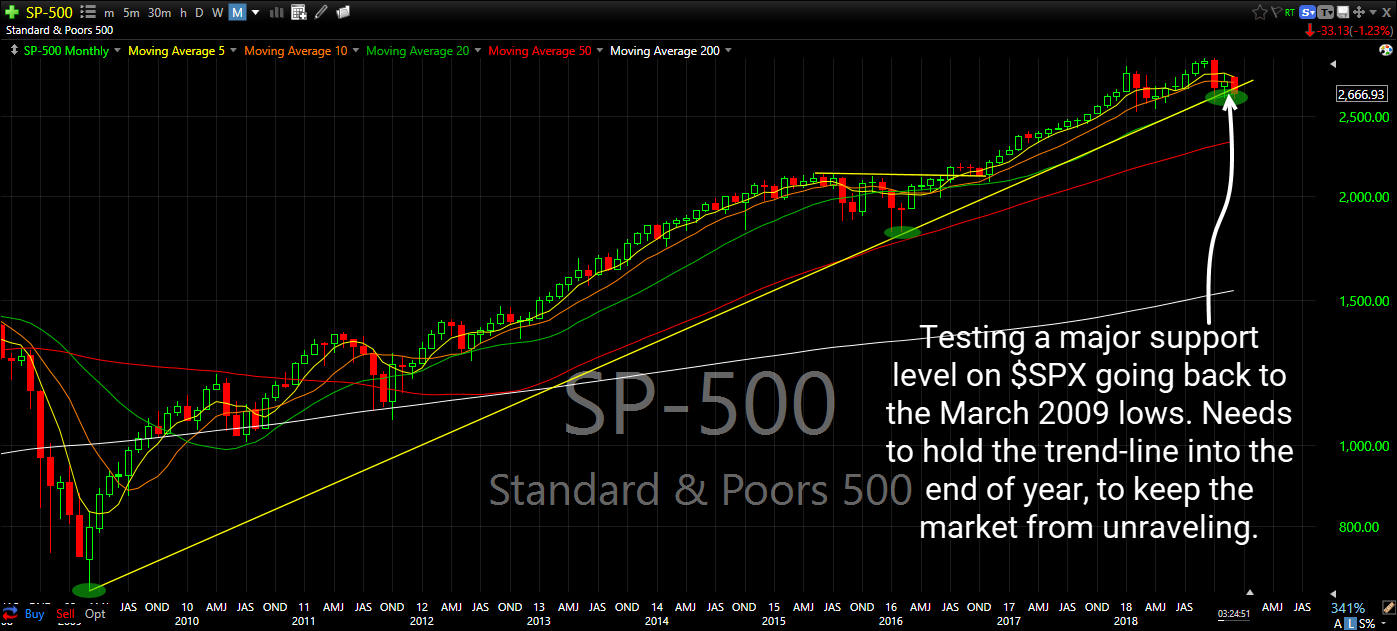

My Swing Trading Approach Stopped out of one position but added another on Friday. Holding respectable gains in two of my positions, but likely to stay put as the market remains on uncertain footing at recent highs. The market continues to have issues over the past week with fading morning gains, throughout the afternoon. I

My Swing Trading Approach I added one additional long position to the portfolio yesterday. I may add another today, but the market will have to show me it is intent on rallying again and none of this meandering like we saw following yesterday’s gap higher. Indicators Volatility Index (VIX) – Closed right on the 200-day moving

My post frequency has been on the light side of things over the past few weeks, mainly because of the amount of concentration it took to trade this volatile market, and also with the Christmas Season, I wanted to take some time off from the normal, rigorous schedule that I held for all of 2018.

My Swing Trading Approach I’m 100% cash coming into the day, and was not affected by the monstrous sell-off yesterday. I took a small loss in Apple (AAPL) yesterday, but that was the only position I had to deal with. Not bad! Now I will sit back and wait to play the bounce higher,

My Swing Trading Approach I booked my profits in NFLX at $354 for a +3.2% profit yesterday. I added one additional long position, but that is all I am working with in this market. I am not looking to get aggressively long, and may even flip to the short side, if the bulls lose

My Swing Trading Approach I’m coming into the day with one long position to see whether the bulls can follow through on yesterday’s bounce and hold of the 50-day moving average as well as the hammer candle it managed to form. If the market turns bullish today, I may consider adding one additional long position.