My Swing Trading Approach

I took profits in Caterpillar (CAT) for a +1.9% profit yesterday, while getting stopped out at the open in ROKU and PYPL. Currently I am short, and will gauge the market today for a potential bounce and quickly close my short position if need be. Either way, I expect to be very cautious in my trading approach in the market today.

Indicators

- Volatility Index (VIX) – VIX popped 21% yesterday but still gave up some of its gains from yesterday following an end of day rally to recover some of the market losses. Still managed to breakout of its recent consolidation.

- T2108 (% of stocks trading above their 40-day moving average): Dropped 12.4% yesterday down to 34%. The breadth in the overall market continues to weaken more and more.

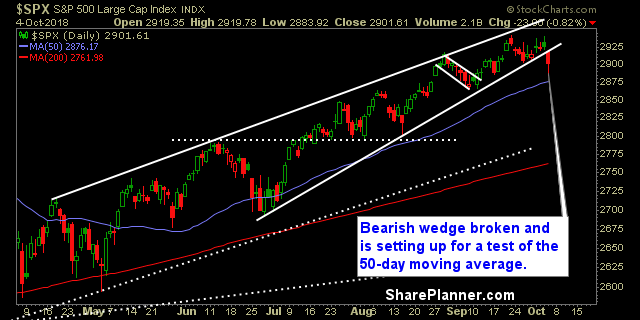

- Moving averages (SPX): The 5, 10 and 20-day moving averages were broken, while the 50-day moving average could be tested today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities were flat today, which isn’t unexpected considering the weakness in the overall market. Financials continues to struggle to provide any real direction going forward. Has been sideways since March. Telecom continues to trade well in a rising channel with support at the 50-day moving average. Staples had a major breakdown yesterday and confirmed a head and shoulders pattern too. Discretionary in a full-fledged breakdown and testing the 200-day moving average. Very bearish. Technology also breaking down, taking out its September lows.

My Market Sentiment

Bearish wedge chart pattern confirmed to the downside. Close to testing the 50-day moving average. SPX gave up its gains from September. Jobs number is weighing on the market today and could create further volatility as the day unfolds.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Short Position

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.