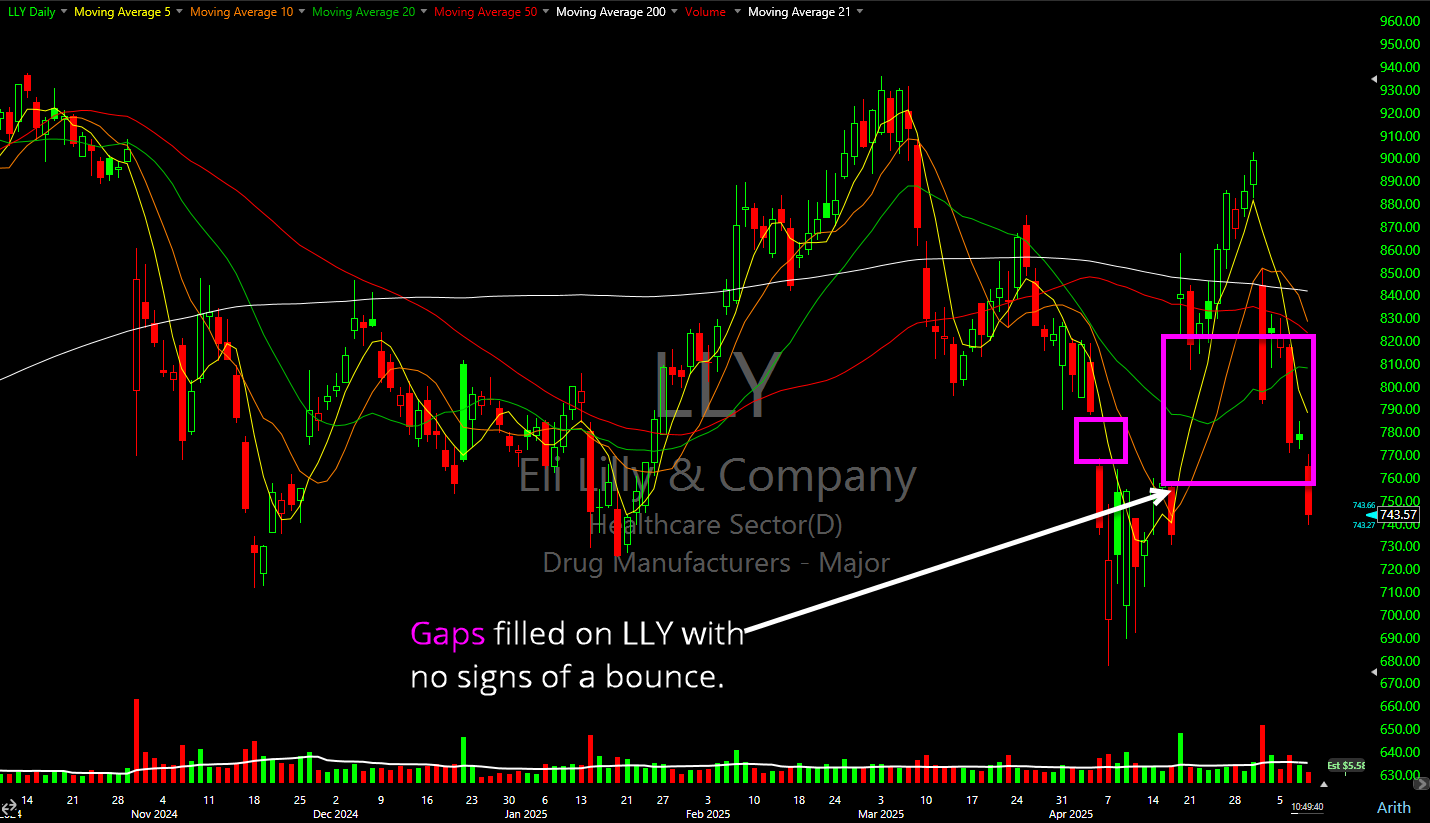

LLY filling two major gaps yesterday and today. No signs of a bounce though.

TSLA clean break of declining resistance with old-trend-line resistance now looming, has previously struggled to push through in the past. Triangle pattern starting to break here, but just underneath it is testing the rising trend-line off of the March lows. Make or break moment for LLY. RIVN keep an eye this morning on a test

MO getting steamrolled post earnings, but may find some support here off of long-term rising trend-line at $36. A lot of chasing taking place in SAVA over the last two days, but you'll want to be mindful, if long, that there is some heavy resistance looming above. LLY looks like it is on a crash

AMZN with an ugly break of long-term support. SOFI price action unable to sustain the move above resistance. Watch for it to close the gap. The SNAP pop isn't worth trusting as long as it remains below declining resistance just overhead. LLY rising trend-line off of September lows could be tested here really soon.

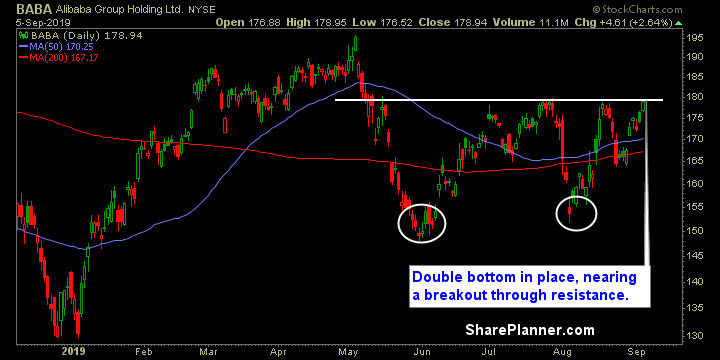

Friday’s Swing-Trades: BABA, LLY, and ILMN Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Alibaba Group (BABA)

My Swing Trading Approach I closed Square (SQ) yesterday for a +3.1% profit. I also added one additional play from the energy sector. I will consider one additional long position today, but the sketchy price action of late, may have me on the sidelines today. Indicators Volatility Index (VIX) – Intrday price action on

Friday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Michaels Companies (MIK)

Monday’s Swing-Trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Eli Lilly (LLY)

Technical Analysis: Two major milestones achieved yesterday, with the Dow Jones Industrial Average (DJIA) reaching 19,000 and S&P 500 (SPX) passing 2,200 for the first time. The market has continued along the lines of Thanksgiving being a reliable ‘bullish’ week for the market. The Wednesday before Thanksgiving has a history of being reliably and consistently bullish as well. Since