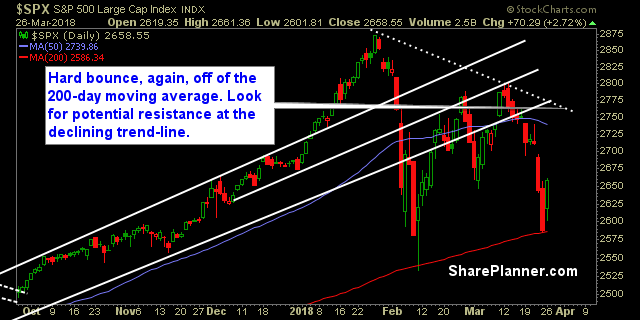

My Swing Trading Approach I held off adding any new long positions yesterday, while continuing to increase my stops on all my trades. I am doing the same again today. The possibility of getting short exists as well, as you have renewed trade war jitters which creates a headline-risk trading environment, allowing for renewed fear

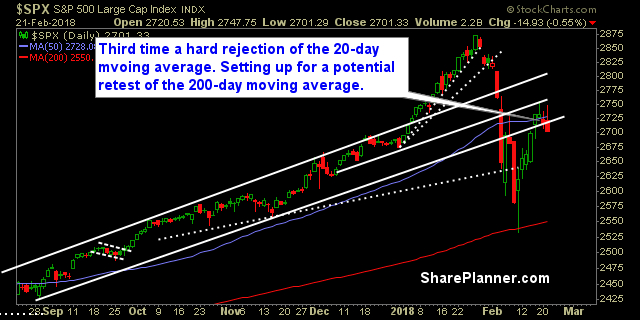

My Swing Trading Approach At this stage of the game, I am weary of how much more the bulls have left in the tank before we see some kind of pullback. More than likely, I will play it safe here, and let the existing positions do the work, while tightening my stops. Indicators

My Swing Trading Approach I’m not opposed to adding more long exposure, but may wait for some consolidation in price or a light volume pullback first. Indicators

My Swing Trading Approach I will look to add another 1-2 positions should the rally sustain itself today, along with increasing my stop-losses as well. Indicators

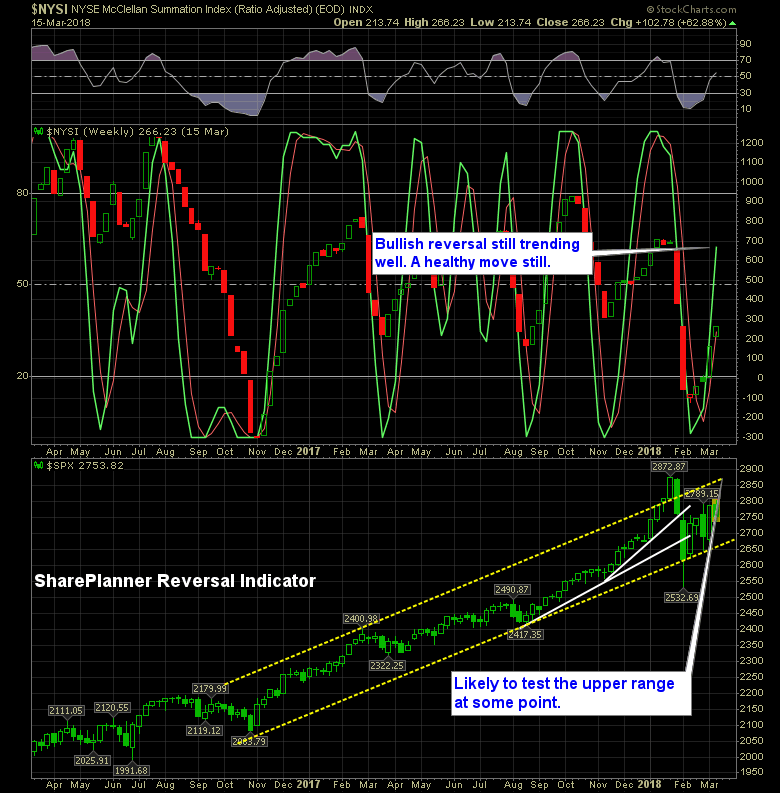

It has been a couple of weeks since we received the bullish reversal and it remains strong today. Price action this week has been less than desirable, to put it mildly, but that hasn’t affected the SharePlanner Reversal Indicator from trending bullish still.

Considering all the fireworks we have seen so far in 2018, this week here, has to be the most boring trading weeks so far. Fear not, the summer time is around the corner, and there will, no doubt be some mind numbing weeks there as well.

My Swing Trading Approach Today’s follow through will be important, following Friday’s big technical move. Should that happen, I’ll look to increase my long exposure. Indicators

My Swing Trading Approach I will look to earn 1-2 new positions to the portfolio today on market strength today. Indicators

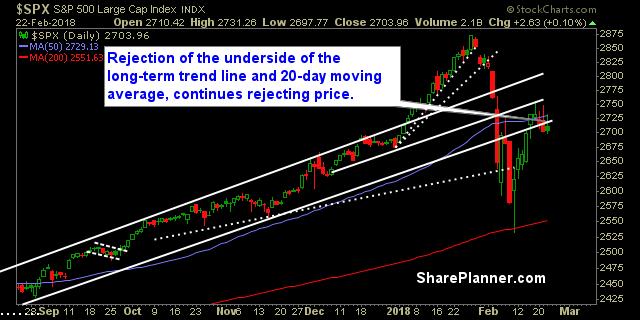

My Swing Trading Approach I still think this market could easily roll over at this point. That has yet to happen, but price action of late raises a lot of concerns. If the bulls can breakout here today, I will close the short position and keep the current long positions running. Indicators

My Swing Trading Approach I am positioned to take advantage of this market for whatever direction it decides to go today. Bulls are showing difficulty with maintaining intraday profits and very much susceptible to end of day sell-offs. Indicators