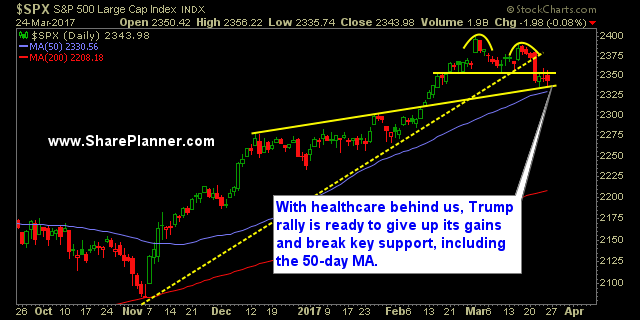

Missile Strikes, Employment and the Stock Market Yesterday SPX bounced off of that 50-day moving average but overnight you had some pretty intense news coming out of Washington that they launched missiles into Syria. You can find the details everywhere about the strike, but how that affects the market is that initially the market traded

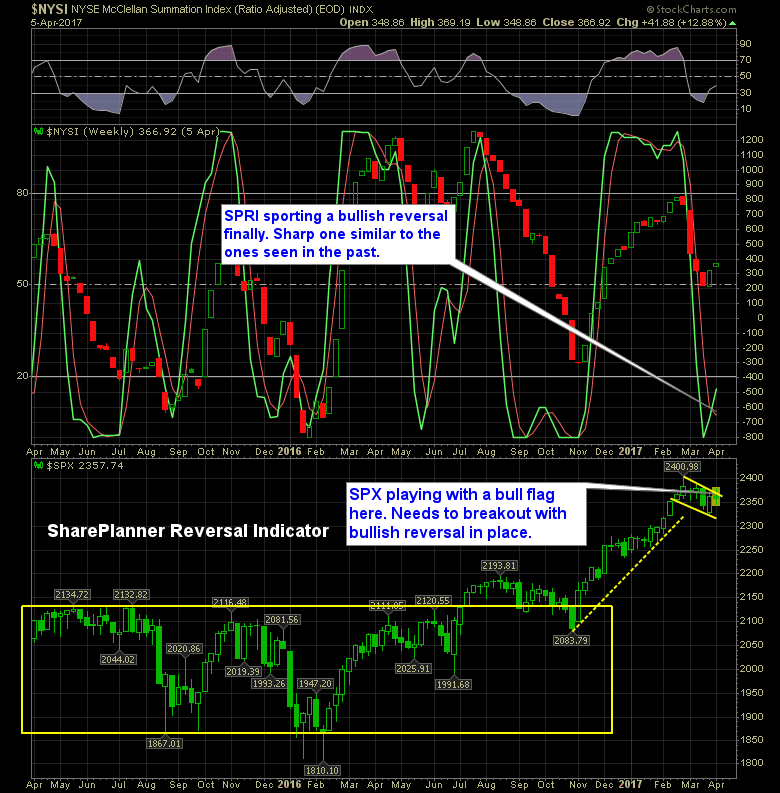

Bullish Trend Reversal Signaled In somewhat of a surprising development following yesterday's hard sell off from the day's highs, the bulls are managing to put together a bullish trend reversal on the SharePlanner Reversal Indicator. That's actually quite impressive considering where the market has been over the past few weeks. Needless to say, unless the

Fed offers up a stock market beatdown I don’t get all the annoyed by the stock market all that much. Sure it can do things that will make you scratch your head, but yesterday’s manufactured afternoon sell off coming from the Fed proclaiming that stock prices were a bit too high, was not something I

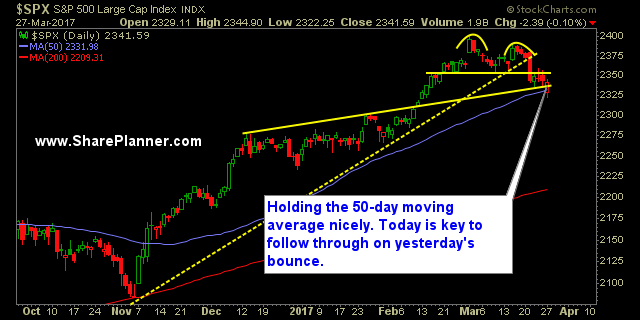

My stock market trading plan today Bears had the opportunity to really drive this market lower. It was right in their hands. The result? Same as 99% of the other instances. They get the charts to line up for them, make the market look top heavy and ready to rollover and then they disappear. The

My stock market trading plan today Another dose of “Buy the Dip”. At one point it was down as much as 18 points. I kid not, but once the afternoon rolled around, that 18 points shrank to just under 4 points by the close of business. In the meantime, that kind of price action leaves

April Stock Market If you believe in old stock market cliches, then you’ll know that April represents, in theory, the last good month of trading for the bulls before they “Sell in May and Go Away!”. But lets face, it, yes, the volume in the summer is lower, and sell-offs tend to happen more often

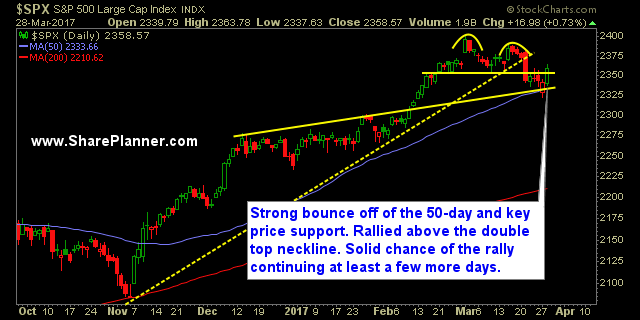

Solid bounce yesterday, but can the markets today follow through? For many years now, when we see the dead cat bounce come about, stocks overall will look to continue the bounce for several days going forward. For the markets today, will that ring true yet again? The futures are slightly down, but that has

Dow Jones Chart has not been down 9 straight days since 1978 That is quite a run, to not have a sell-off of nine straight days since Jimmy Carter was president. But the Dow Jones chart is finding some support at the 50-day moving average as is the S&P 500 chart. I suspect that we’ll

Not a stock market crash based on historical sell offs Obviously! But the sell-off that we are seeing this morning before the equity market has even opened, is far greater than what we have become used to seeing. One thing I will add here is that, based on my experience and years of observations, the

Facebook (FB), a stock that, back in 2012, was trading in the teens, now the FB stock is trading at $140+ per share. That is a massive run that it has experienced and made many people wealthy along the way. Now it is settling in and becoming more of a value play. Kind of like