Forget the notion that the markets might be calm this week Or the idea that the markets might be engage in some friendly window dressing to close out the first half of the year. Because it has been anything but that. In fact, I would go on to say that it has been the most

I barely remember the sell-off that ‘alledgedly’ happened yesterday. People say that there was one, but I can’t take their word for certain. The buy-the-dip crowd would never allow such a thing. Don’t believe me? Take a look at the charts below – nothing ever happened yesterday. S&P 500 (SPY) Dip Buy Nasdaq (QQQ) Dip Buy

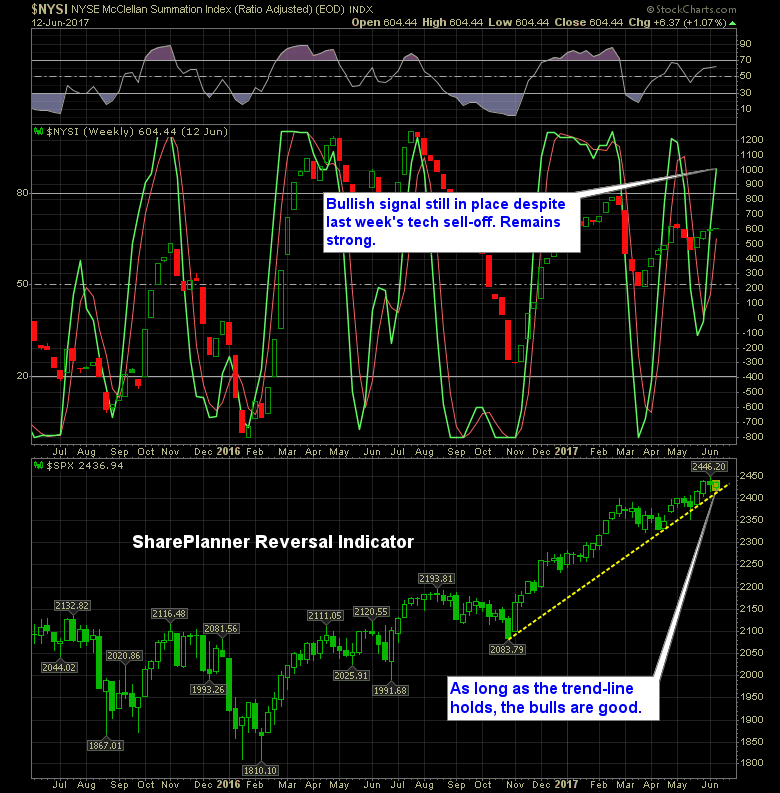

Is it time to reverse for the market or will we keep trucking higher? I came into today knowing that the bulls had to hold the 20-day moving average. That has been a level of support for them of late, and if they blew through it, that things could certainly get dicey.

Information received since the Federal Open Market Committee met in May indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have moderated but have been solid, on average, since the beginning of the year, and the unemployment rate has declined. Household

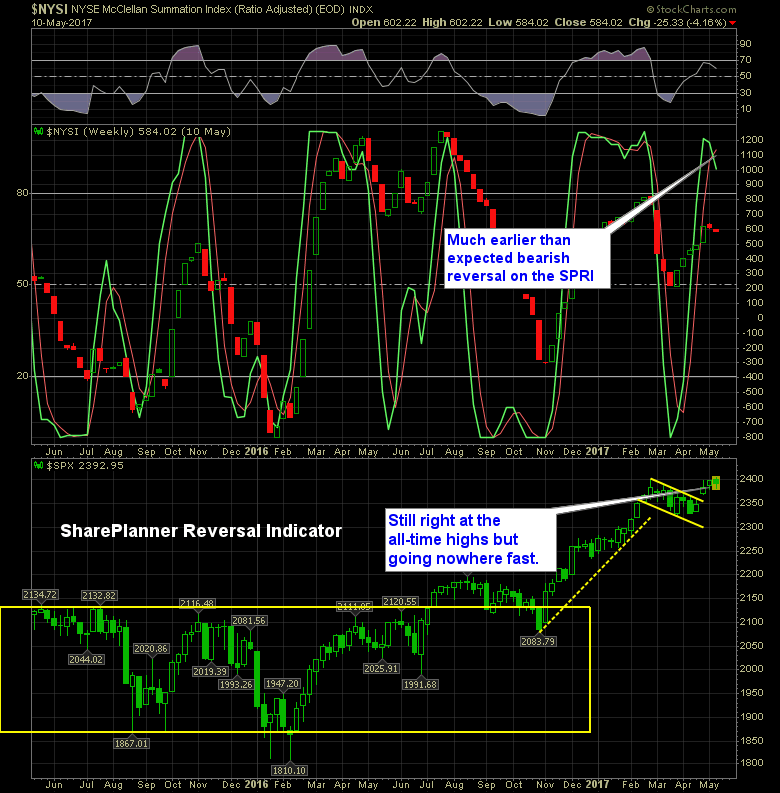

The recent sell-off in technology could be a signal that equities are in a bull trap. The market wants you to feel good here, it wants you to buy the dip just you like you have the last 458 times since 2009 when the stock market sold off. But with the FOMC Statement coming out

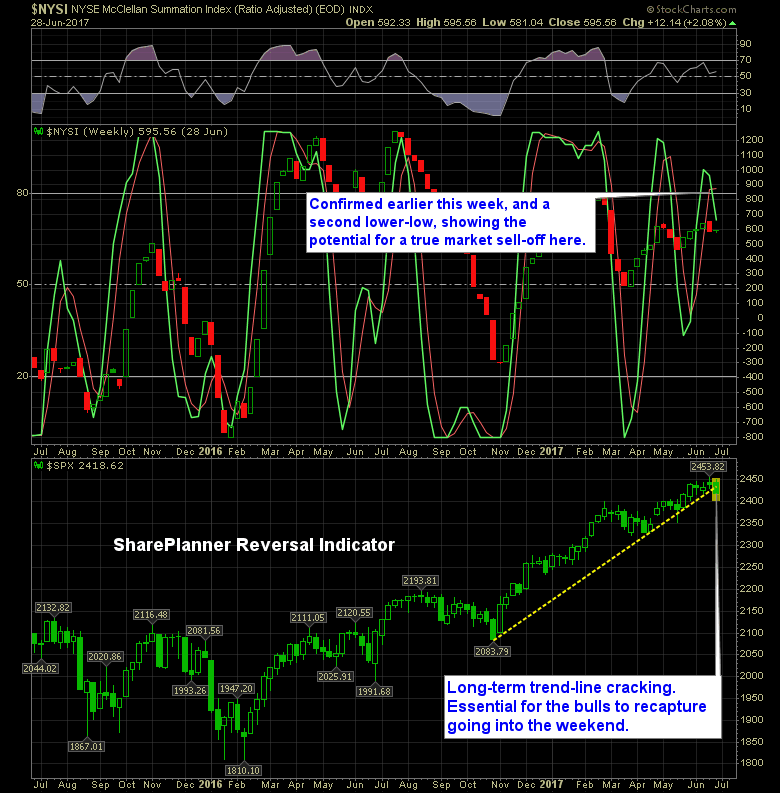

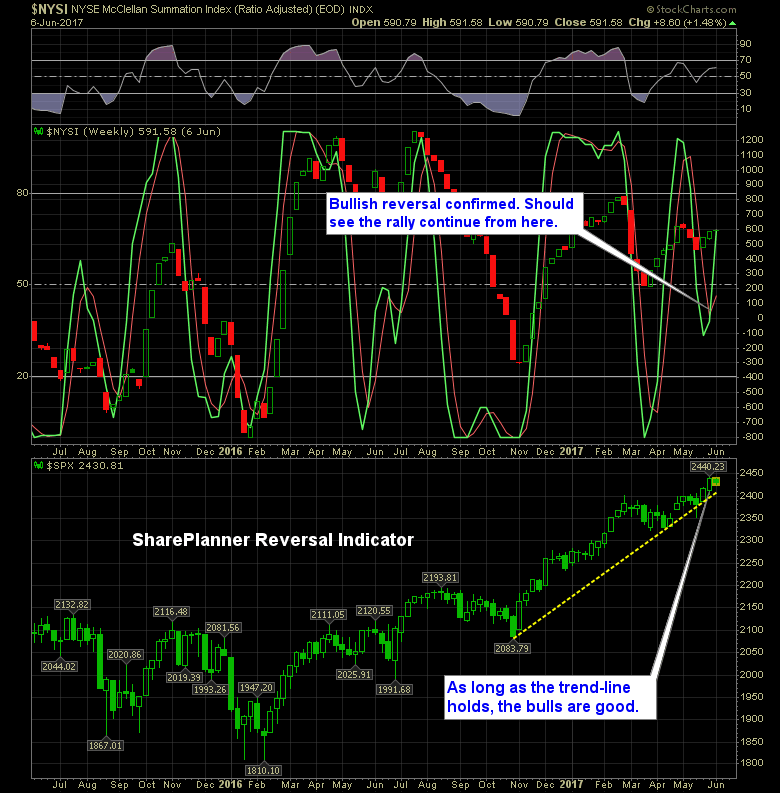

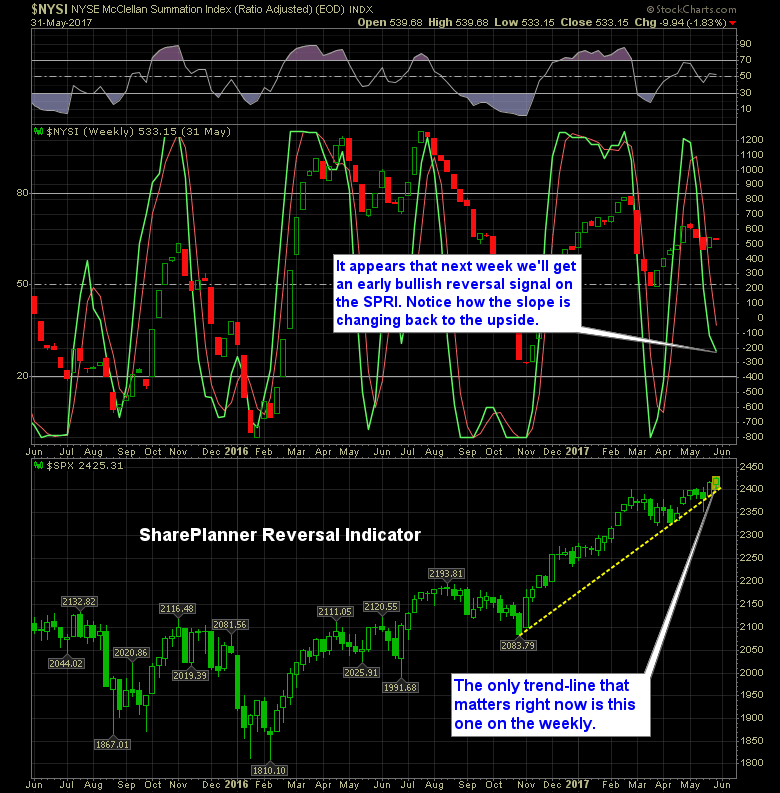

The bulls have a change in the reversal indicator Up until this week, the SharePlanner Reversal Indicator, had been pointing lower, but if you remember last week, I mentioned that we would probably get a bullish signal on the reversal indicator.

SharePlanner Reversal Indicator is wanting to reverse for the betterment of bulls. It is the rally that won’t quit, but don’t mistake that for believing that it is somehow “different this time” – because it is not.

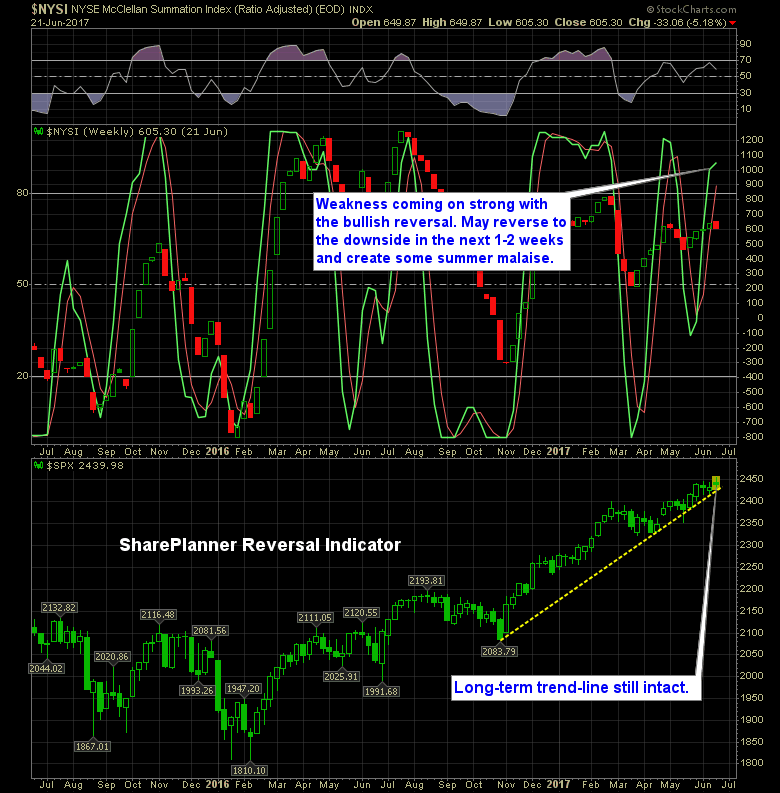

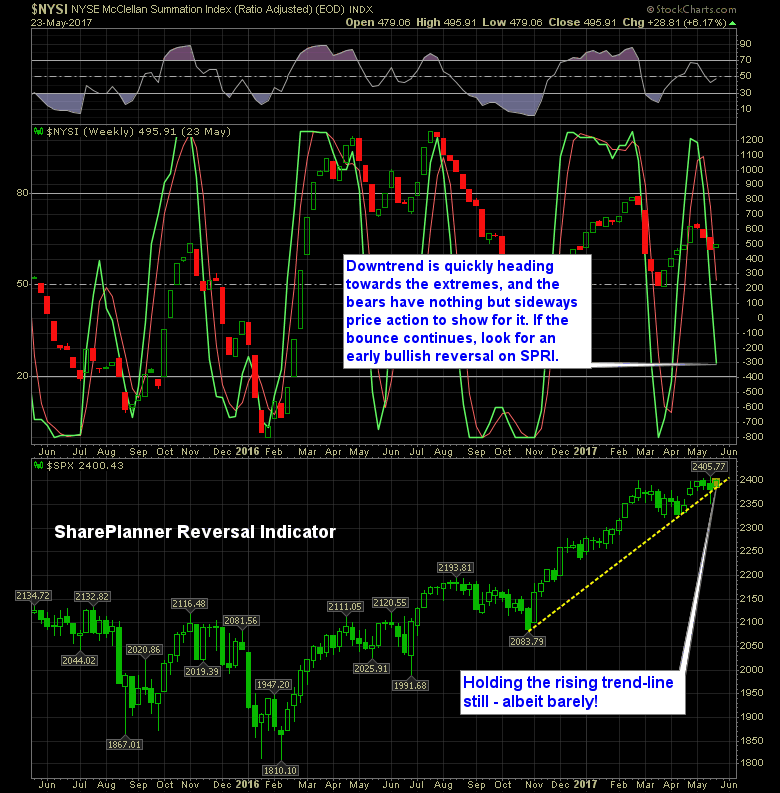

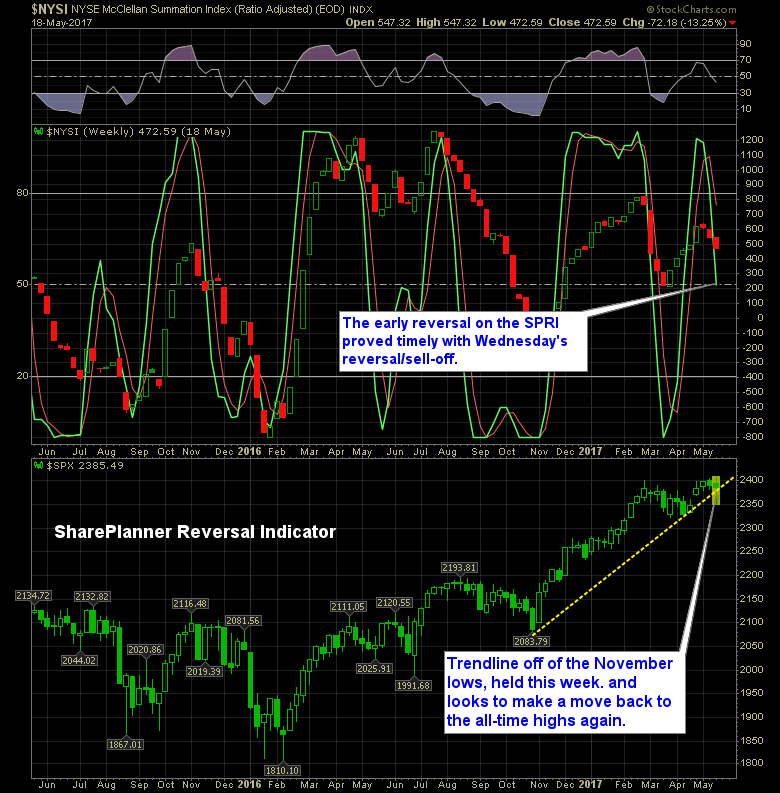

Time corrections in price often lead to a quiet market If you remember back to last week’s edition of the SharePlanner Reversal Indicator, I suggested that with the immediate bounce back the market was seeing, that it is likely we head right back up to the all-time highs and consolidate yet again in the price

The Sell-Off That Almost Was….Here’s some of my market musings I guess Wednesday will simply go down as a “scare” for the market and nothing more because right now the market is acting like nothing ever happened. Instead it is desperate to get back to the consolidation area just below all-time highs so it can

I feel like, honestly, the expression “Going nowhere fast” is creeping into every one of my posts these days. In reality, that is the state of the market. Market sells off hard and fast this morning, but by afternoon, it has managed to rally back to near break even. Prior to today, SPX had