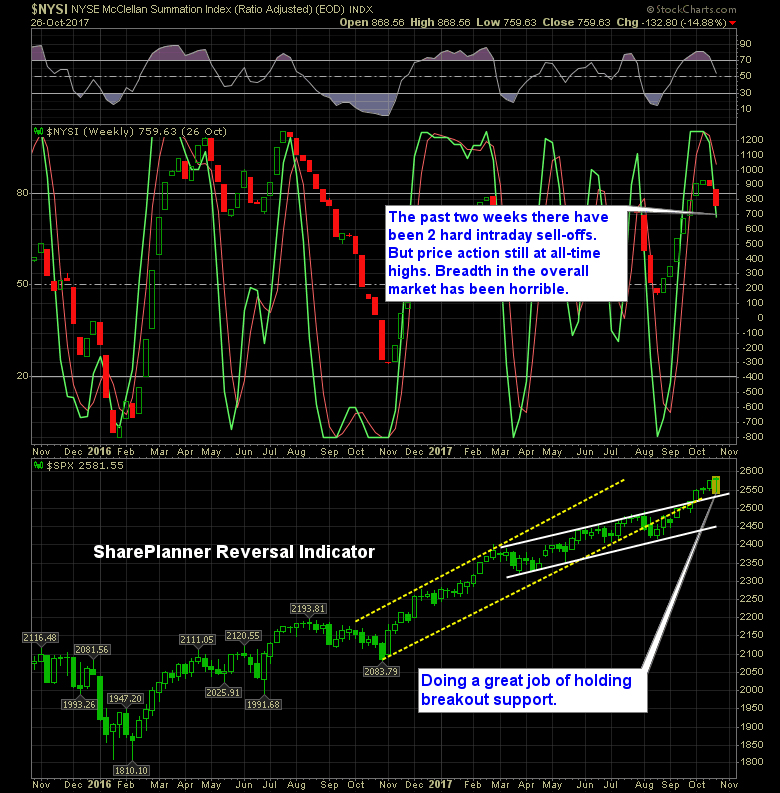

Stocks are back at all time high – or at least all the major indices are. Just today alone: S&P 500 (SPX): New all-time highs Nasdaq (COMPQ): Crushing New all-time highs Dow Jones Industrial Average (DJIA): Right at New all-time highs Russell 2000 (RUT): Bull flag at the all-time highs

All the indices are are trading at or near their all-time highs, and with Trump tweeting daily about how fabulous the stock market is on a daily basis, we should be enthusiastic about stocks across the board, right? Wrong!

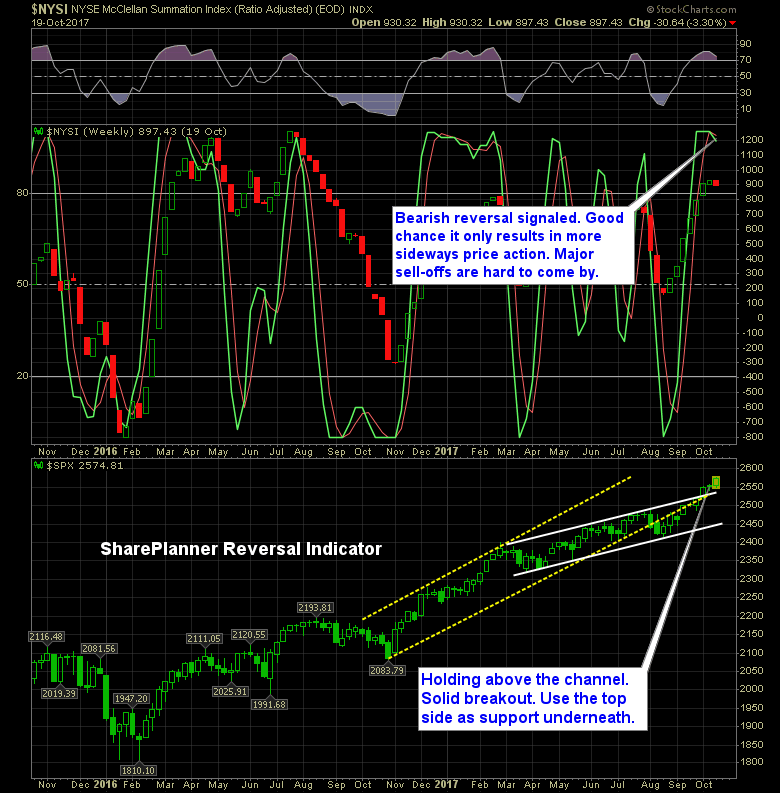

Bearish signal on the SharePlanner Reversal Indicator How much credibility should I put in this indicator?

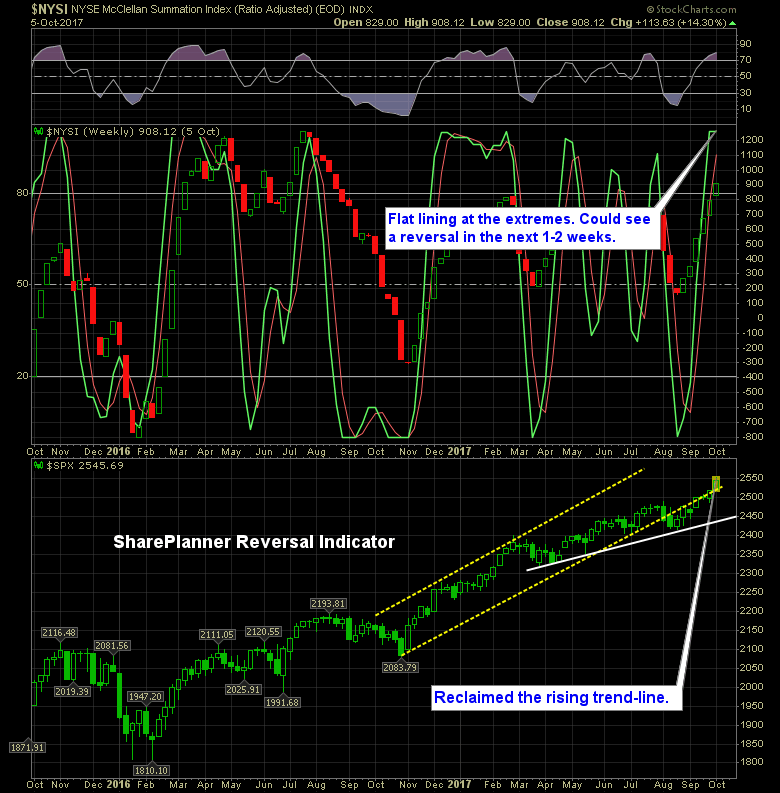

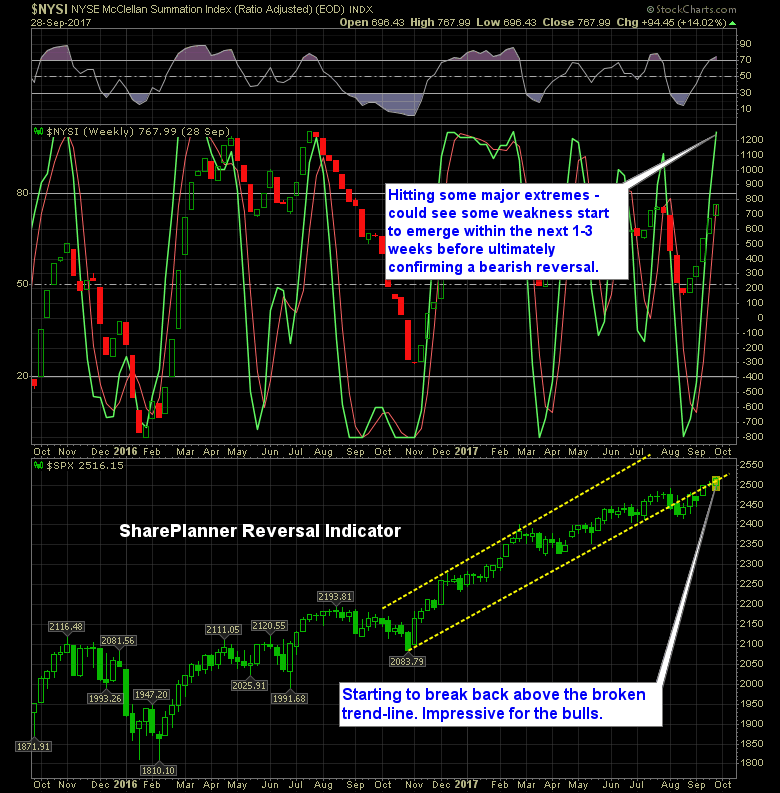

The bulls are sitting at extremes that haven’t been seen since March/April of 2016. As you can see in the chart below, this can persist for a while longer, but I’ll be surprised if we don’t start seeing some kind of bearish reversal on the indicator that leads to either 1) price consolidation over a

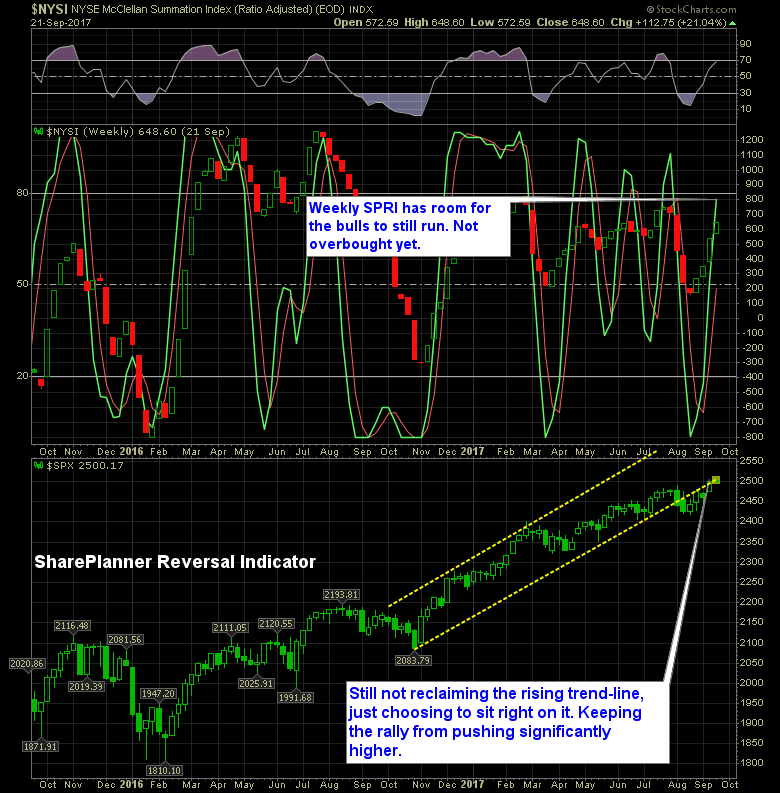

It has been a while since I’ve seen an extreme reading on the SharePlanner Reversal Indicator. In fact, the last one was back in February of this year.

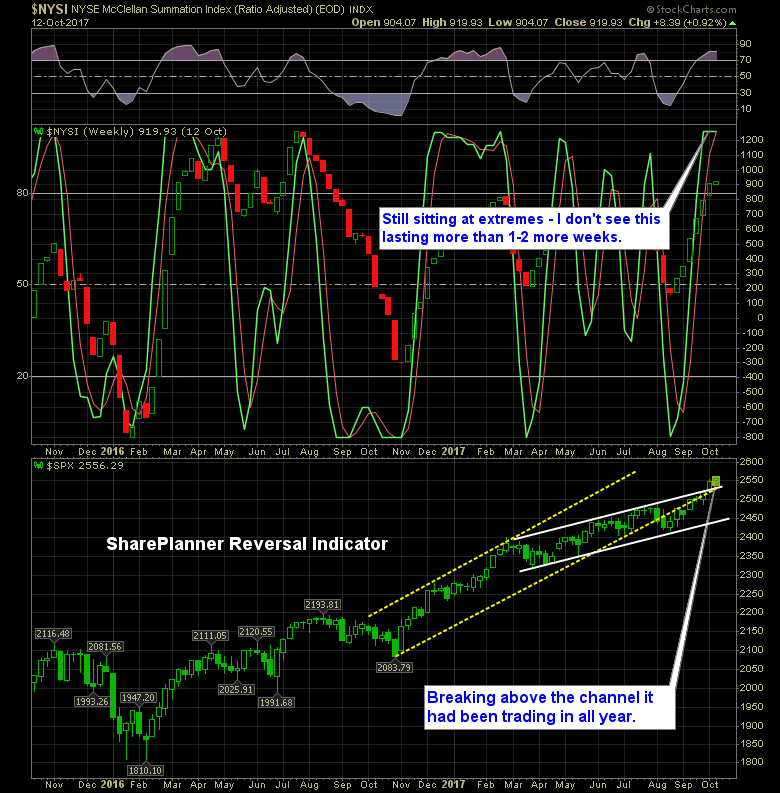

The SharePlanner Reversal Indicator is currently at some bullish extremes. It can stay there for 1-4 weeks, before ultimately setting up the bearish sell-signal for the downside.

For the first time since January, the S&P 500 and the rest of the indices are marching lock step witih stocks as a whole. Over 70% of stocks are trading above their 40-day moving average and that confirms that stocks are supporting this market move higher.

SharePlanner Reversal Indicator is looking solid still. My only hold up is the fact that it is struggling to push back through the broken trend line.

Information received since the Federal Open Market Committee met in July indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have remained solid in recent months, and the unemployment rate has stayed low. Household spending has been expanding at a moderate

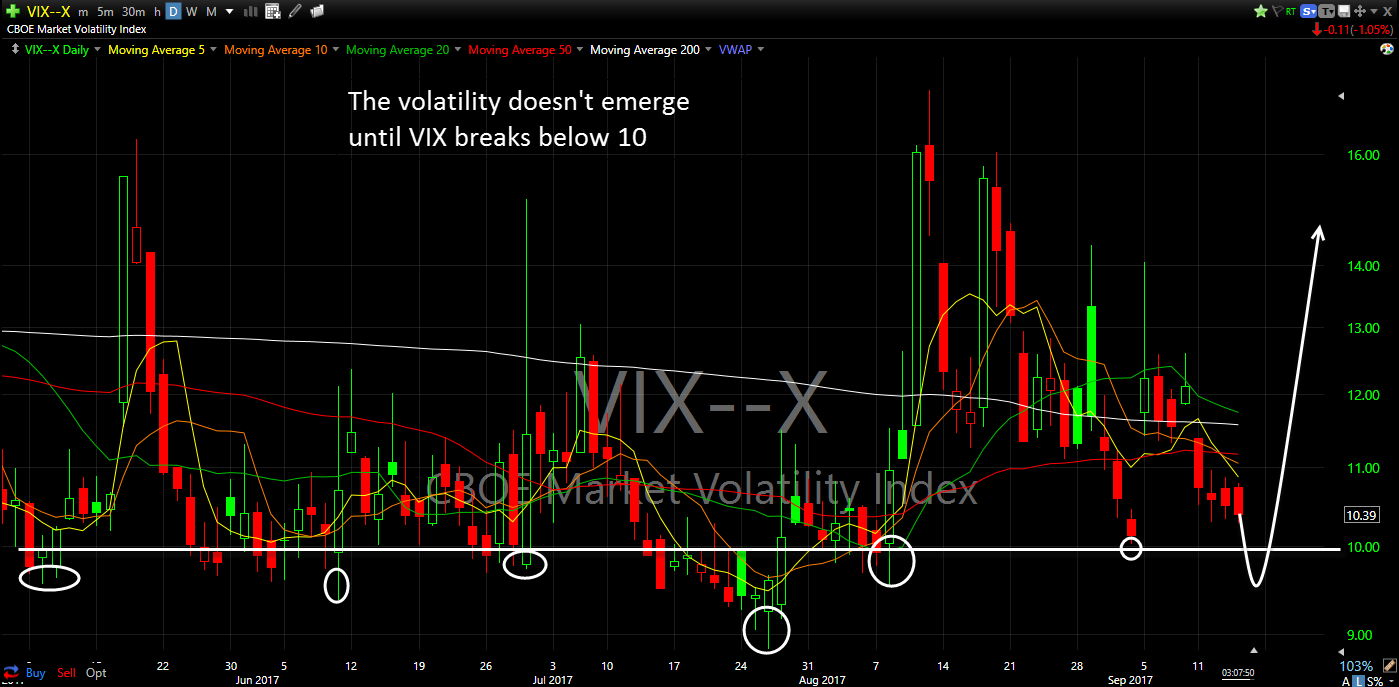

One interesting note that I’d like to put out there on the VIX right now and that is the tendency for stocks to stay relatively bullish until the VIX drops below 10.