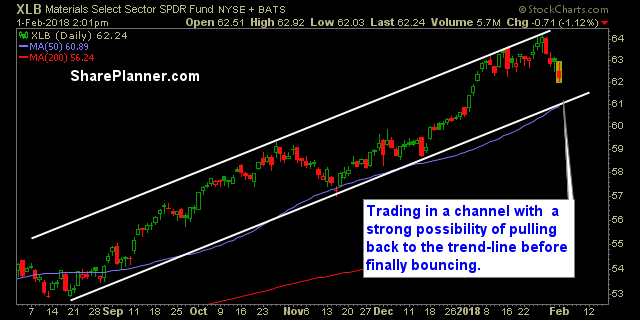

Beyond the technical analysis of the overall market, it is critically important to keep tabs on each sector, to know where the strength lies. For instance, had you invested in utilities over the past two months, you would be down royally, on your trade, while the rest of the market rallied. The same could be

Information received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Gains in employment, household spending, and business fixed investment have been solid, and the unemployment rate has stayed low. On a 12-month basis, both

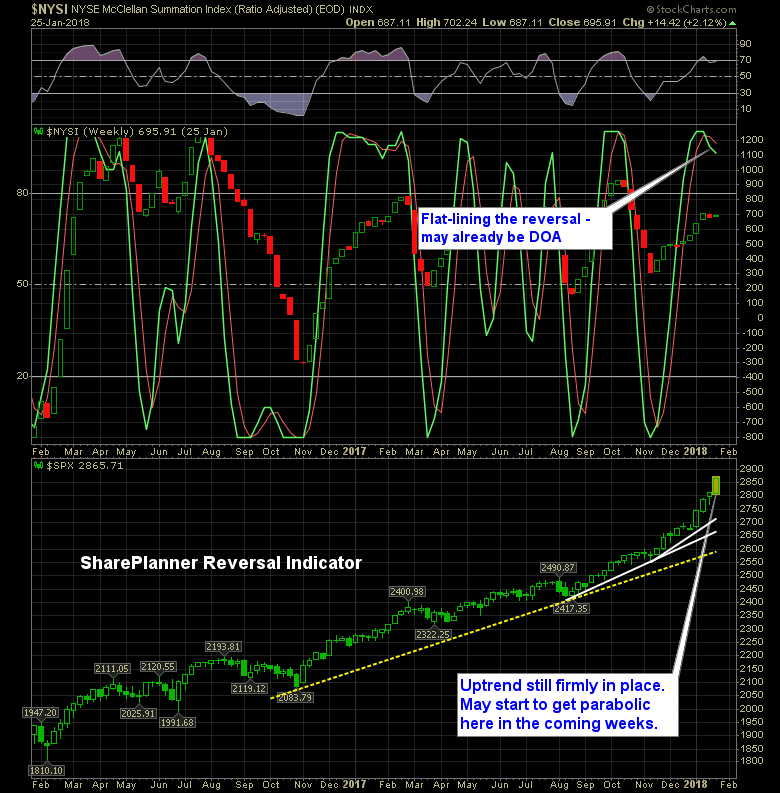

SharePlanner Reversal Indicator, following today’s rally is really going to be in some serious trouble. Up until today, there was some doubt developing, as the bulls continued to see their early morning profits slip into the red. But today, all is well in the market again, as it is now up 44% since Trump’s election.

New Bearish Reversal on the SharePlanner Reversal Indicator Last time we had one of these was in October, and it doesn’t take a genius to recall how the market it did then, as stormed higher the entire time. But if you got back to the July/August reversal last year, the market actually traded lower during

Bulls still maintain full control. Heck, I am pretty sure when you have rallied eight of the first nine trading days of the year (SPX), you are in pretty good standing on the technical side of the trade.

Corrections are 10% pull backs, Recessions are 20% sell-offs. So far the real estate sector has seen a decline of about 5%.

I’ve really been impressed by the start that we have seen here in 2018. Really an amazing start, and the best opening week that I can remember having to a new year, in a very, very long time. In fact it is the best opening week for the stock market since 2006.

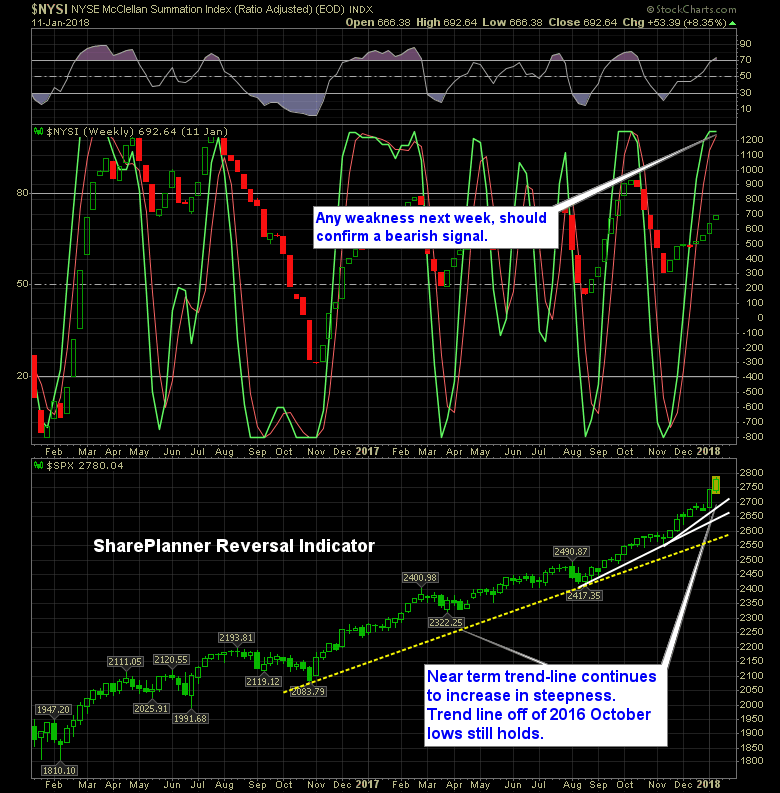

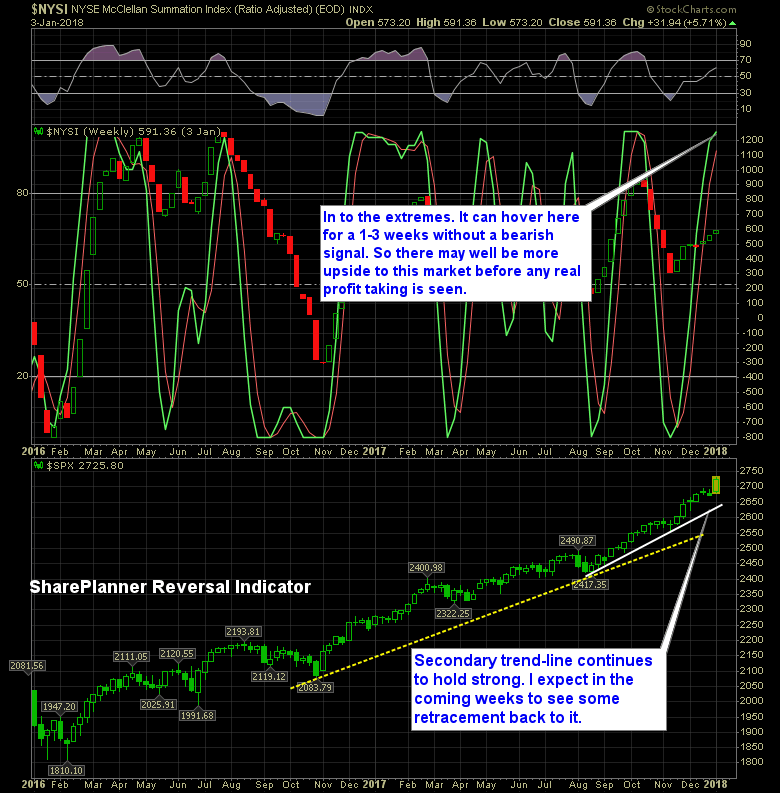

It’s Day 3 of 2018, and the market is still pumped about it’s prospects for finishing higher. The SharePlanner Reversal Indicator suggests that there is more upside to this market, though it does seem we are closer to a near-term top, than we are a bottom.

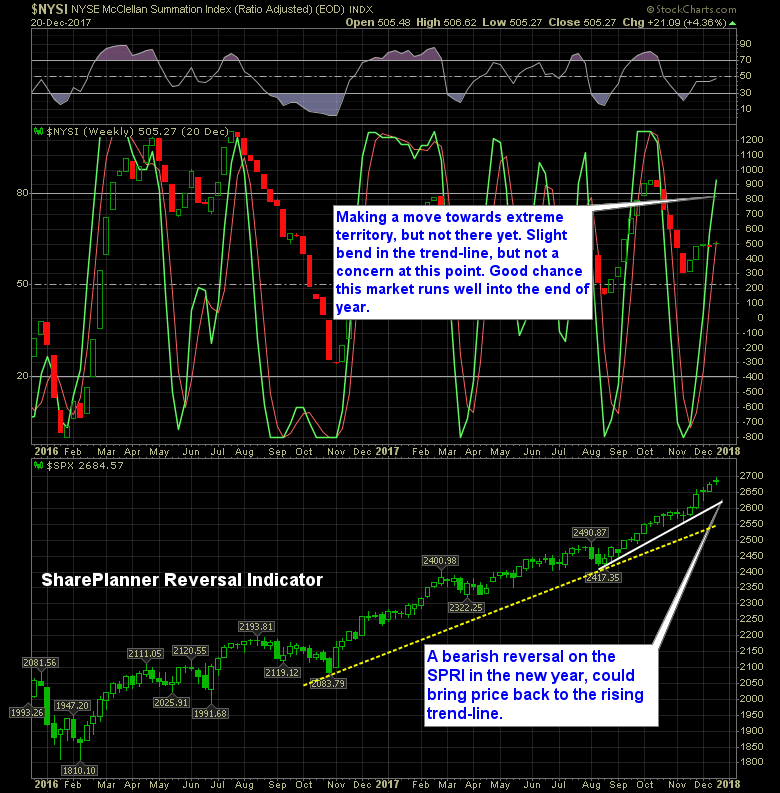

Based off of what the SharePlanner Reversal Indicator suggests, price action should be strong into the year-end.

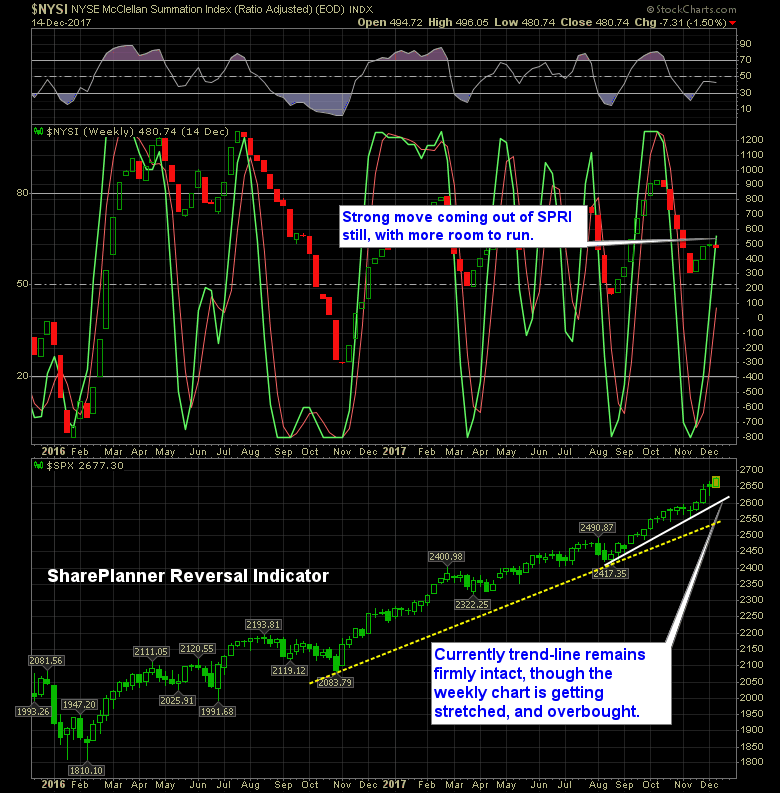

Big run today out of the market, but according to the SharePlanner Reversal Indicator, there is more opportunity still to the upside. Yesterday’s perpetual sell-off, had me a bit concerned, enough where I added one short position to the portfolio, but immediately closed it out this morning at the open, once it looked like the