I feel like, honestly, the expression “Going nowhere fast” is creeping into every one of my posts these days.

In reality, that is the state of the market. Market sells off hard and fast this morning, but by afternoon, it has managed to rally back to near break even. Prior to today, SPX had managed to close at 2399 in three out of the four trading sessions. In the end, the market just isn’t moving. And when it does it reverts back to where it came from – thus the reason for the stock market going nowhere fast.

So you have to be selective with what you are buying and selling. Move up those stops because when a stock does make a move, you wan to preserve those gains as much as possible.

Even if you get stopped out of a trade for a profit and then it bounces back and goes even higher on the day, that is okay, because when you have the market not giving you much to work with, you have to make sure that profits being salvaged is first and foremost on your list of risk objectives. With the sell-off this morning, AVGO sold off hard and fast and took me out for a 2.3% profit. It bounced back immediately afterwards and now it is a full percent higher.

Irritating? Of course!

But that is part of trading. Stops don’t mean that when they are triggered the stock is going to hell in a hand basket. Just that the trade is not adhering to your trade thesis, and has reached a point in the trade where risking any additional amount of existing profit on the trade is a foolish decision.

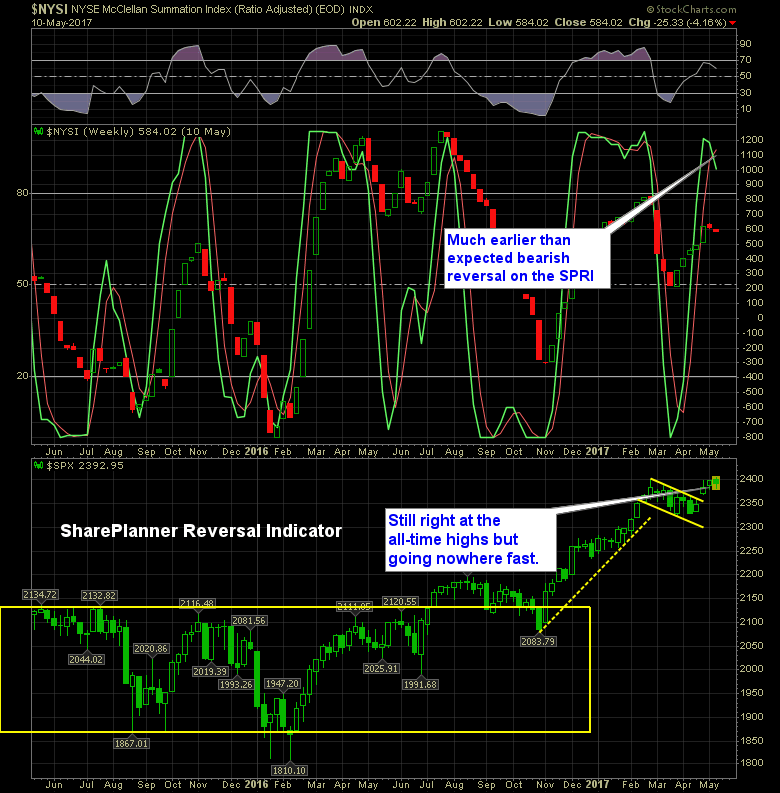

As for the SharePlanner Reversal Indicator below, you actually have a bearish reversal in place. Which quite honestly is very surprising to me. I didn’t think we’d see one for another one to two weeks. But not so here, because it is flashing that reversal loud and proud. However, I would caution against reading too much into it, because right now is the stage that it is most susceptible to a reversal back up to the extremes again. It has happened quite a bit over the last few years.

I think the most likely scenario that we are likely to see is a correction through time and not price.

Here’s the SPRI:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.