Forget the notion that the markets might be calm this week

Or the idea that the markets might be engage in some friendly window dressing to close out the first half of the year. Because it has been anything but that. In fact, I would go on to say that it has been the most choppy and volatile week of the year – at least so far.

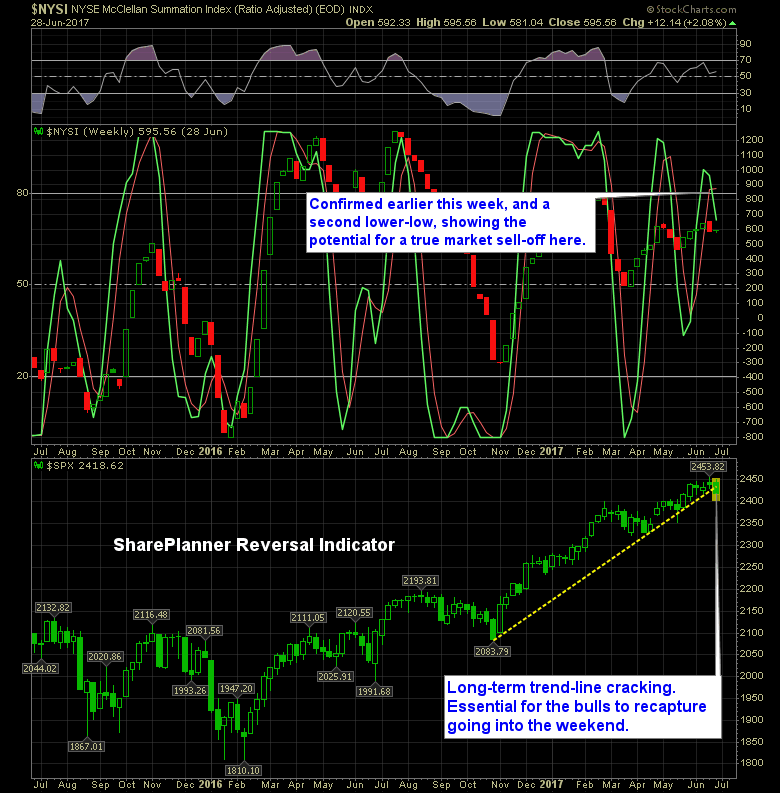

The S&P 500 is really showing signs for the first time of rolling over, and for me it would be welcomed with both arms wide open. More than anything, this market needs a 5-10% correction and the SharePlanner Reversal Indicator is showing as much with a bearish confirmation this week.

Previous bearish confirmations have simply resulted in corrections through time than price, but here you have lower-highs on the SPX chart which is a rarity, as well as the long-term trend-line shown on the weekly chart below, finally breaking.

This is the best chance that the bears have had post election to really dig their claws into this market. If they are wise, they won’t let this opportunity slip buy.

Here’s the SPRI:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.