Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Averaging through hurricane-related fluctuations, job gains have been solid, and the unemployment rate declined further. Household spending has been expanding at a moderate rate,

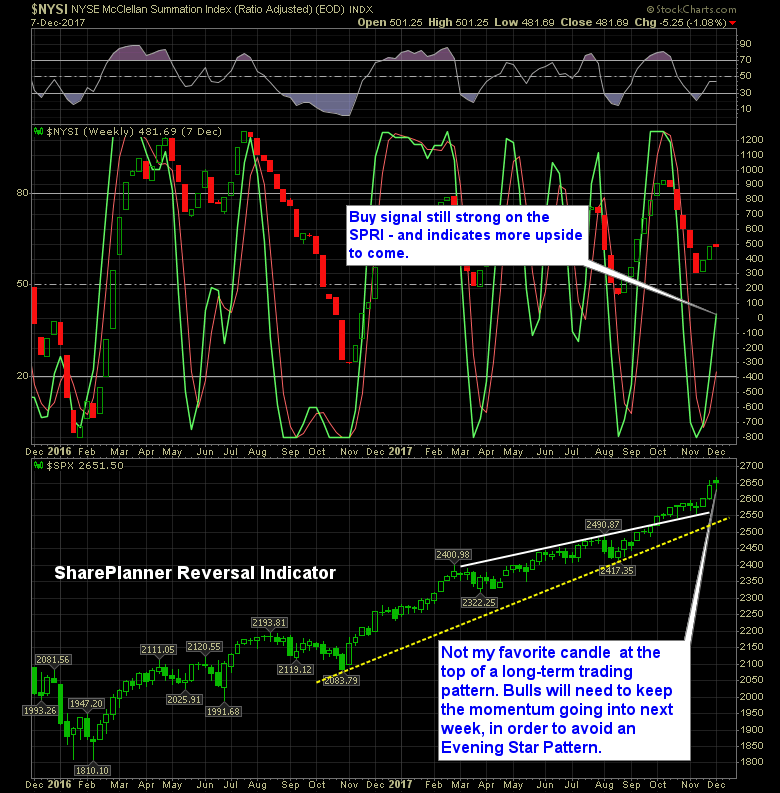

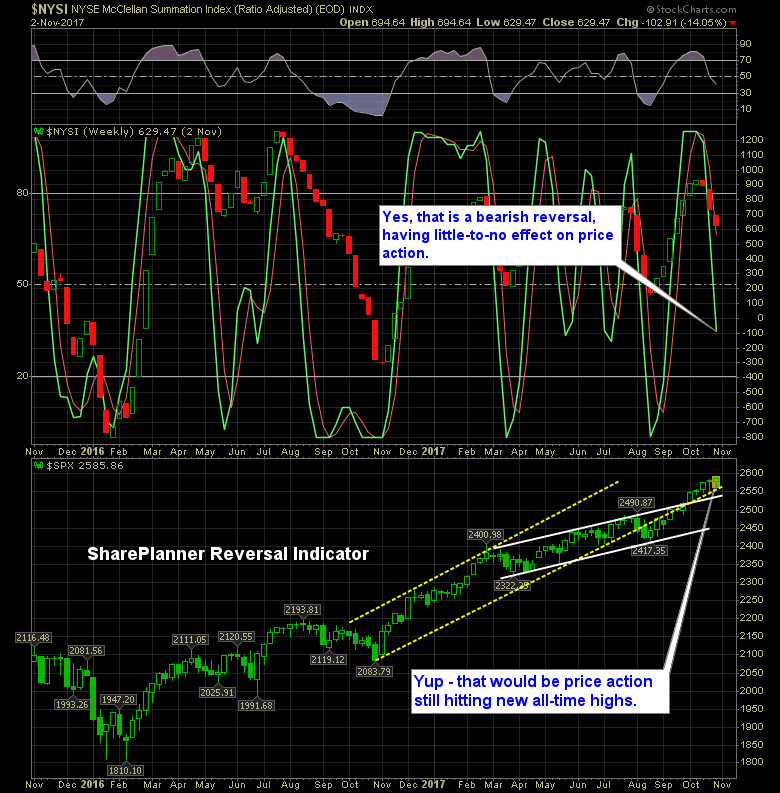

The bullish signal on the SharePlanner Reversal Indicator that came together a few weeks ago, remains in tact.

Check it out – for those wondering just how “bubble-y” the Bitcoin and crypto currency phenomenon has become, look no further than the Nasdaq Dot-Com price action in the late 90’s. Same thinking, same hoping, ultimately, it’ll be the same result.

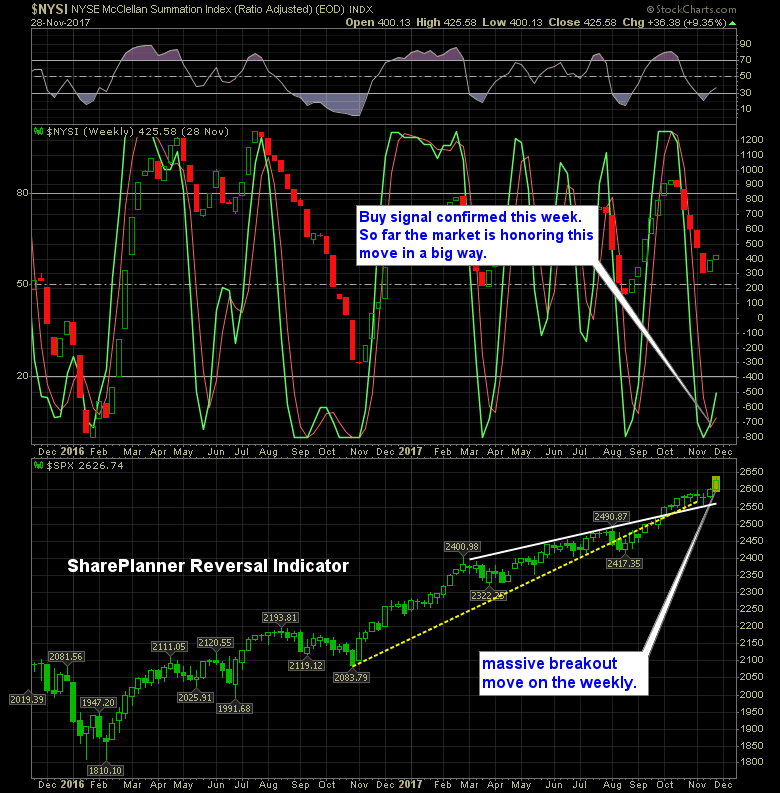

Last week, during the shortened trading week, the SharePlanner Reversal Indicator gave us a buy signal. So far this week, the market is honoring that move. In particular, yesterday, when the market made a 1% move to the upside out of nowhere.

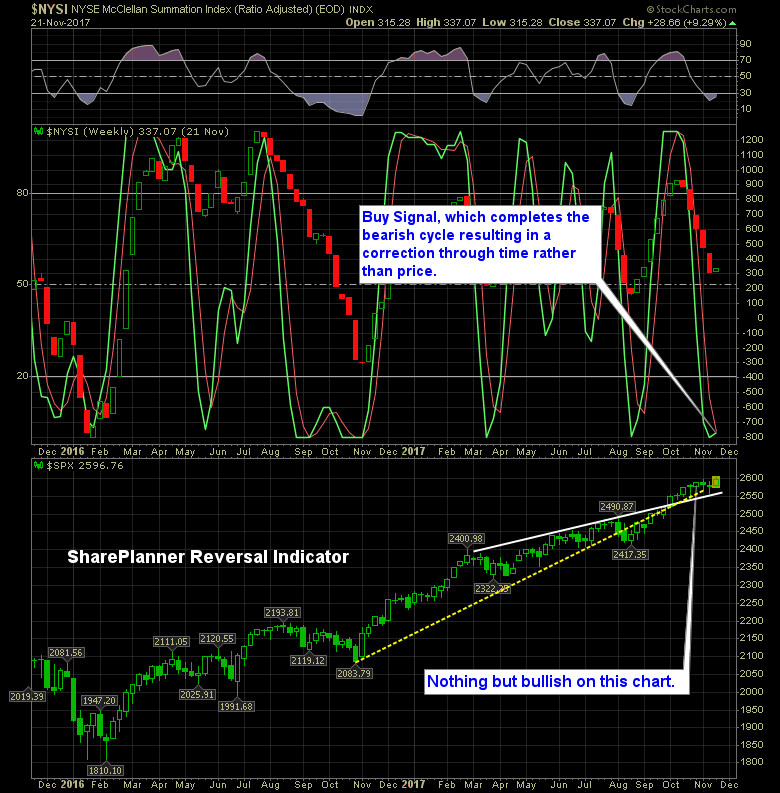

Alright, it might sound humorous in saying this, but the SharePlanner Reversal Indicator just flashed a bullish reversal signal. But hasn’t the market been in bull mode all year long?

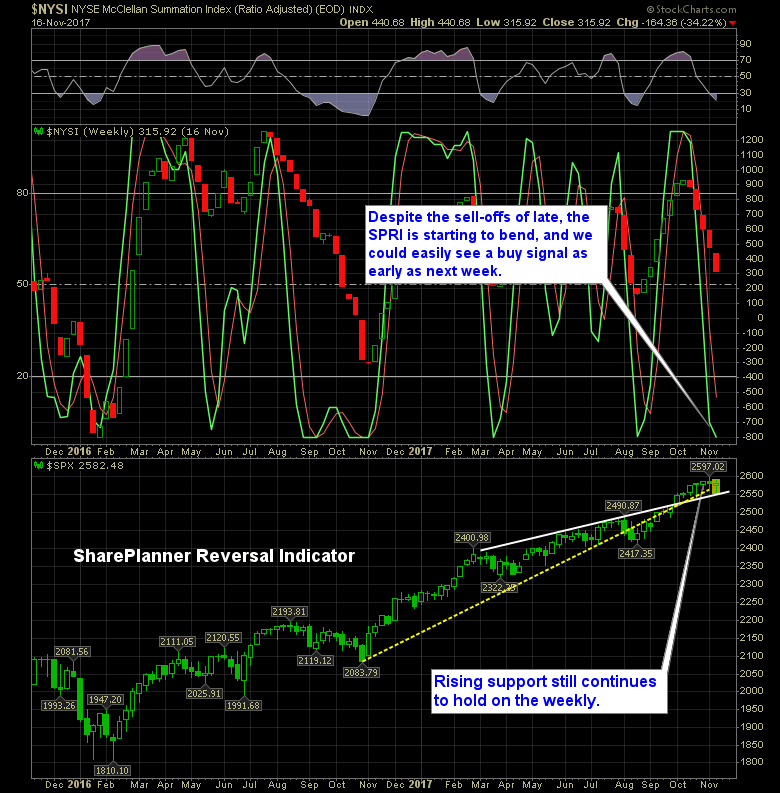

For much of November, the stock market has been one big ‘Snooze Fest’. Stocks have been correcting, even if it hasn’t been clearly visible on the indices.

T2108 has been one of my favorite indicators for judging the current health of the market. For about a month and a half, stocks have been slipping under the surface. You can see that in the Russell, in particular, which has been in a steady decline that has matched the time frame of T2108’s decline.

The sell-off looks really good at first, when it breaks the 5-day and 10-day moving averages. Then it takes out the 20-day moving average and it looks like this time is a bit different.

Never before has a bearish indicator meant so little to the market. Considering how relentless this market has been on trading higher, the SharePlanner Reversal Indicator has done fairly well, relative to other indicators. Two out of the last four bearish signals on the indicator, has spurred on a small amount of selling thereafter. Nothing

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate despite hurricane-related disruptions. Although the hurricanes caused a drop in payroll employment in September, the unemployment rate declined further. Household spending has been expanding