Time corrections in price often lead to a quiet market

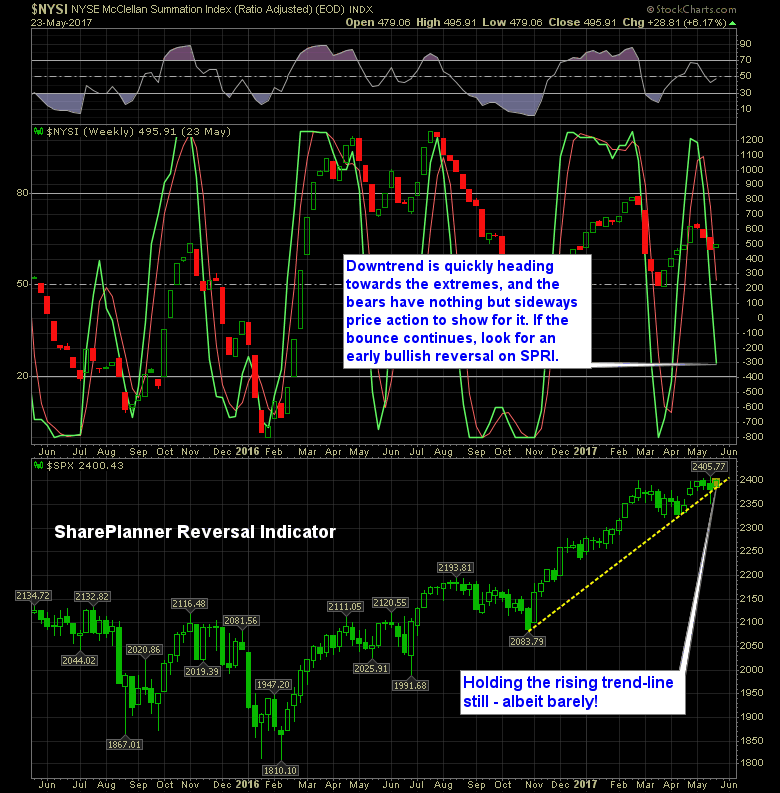

If you remember back to last week’s edition of the SharePlanner Reversal Indicator, I suggested that with the immediate bounce back the market was seeing, that it is likely we head right back up to the all-time highs and consolidate yet again in the price action. So far that seems to be the case as the bulls have us back into that month long box.

But when you look at the weekly chart of the SPRI below, you’ll see that it is holding that current trend-line rather well. It is barely holding on, but it is holding on nonetheless. And that is no doubt, important for stocks going forward.

There is also the case to say that this market isn’t necessarily boring, but actually extraordinarily resilient. I mean think about everything it has bounced back from: Brexit, unexpected Trump Election, ongoing terrorist attacks, Russia witch hunt, and even China being downgraded by Moody’s last night. And honestly, I haven’t even addressed probably half of the issues surrounding the economy.

Nonetheless, the market marches on.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.