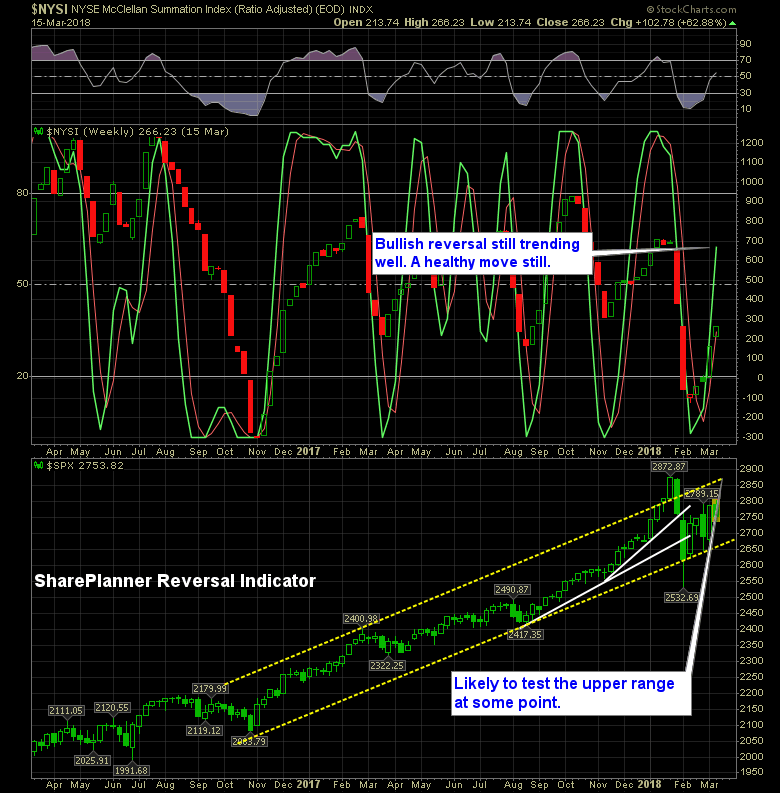

It has been a couple of weeks since we received the bullish reversal and it remains strong today. Price action this week has been less than desirable, to put it mildly, but that hasn’t affected the SharePlanner Reversal Indicator from trending bullish still.

Considering all the fireworks we have seen so far in 2018, this week here, has to be the most boring trading weeks so far. Fear not, the summer time is around the corner, and there will, no doubt be some mind numbing weeks there as well.

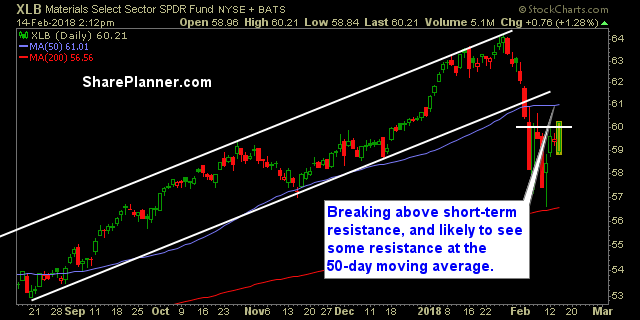

Today’s rally is strong, and finally pushed price through the 50-day moving average. When I saw the jobs number this morning, and how much it blew out the expectations, I very much expected when I turned my head back towards the monitors to see what the futures were doing in reaction to it, that they

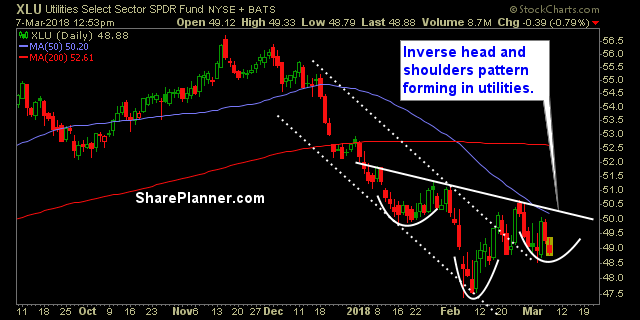

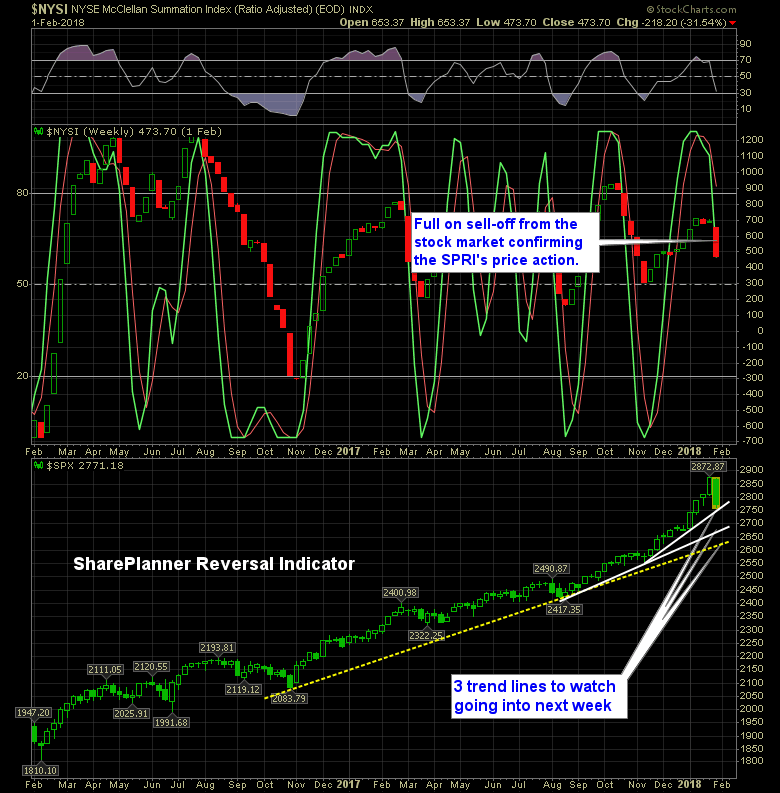

Stock Market is on shaky ground here. Direction is Uncertain. So lets take a deeper look at the sectors themselves. Which ones are most favorable and the ones that are not.

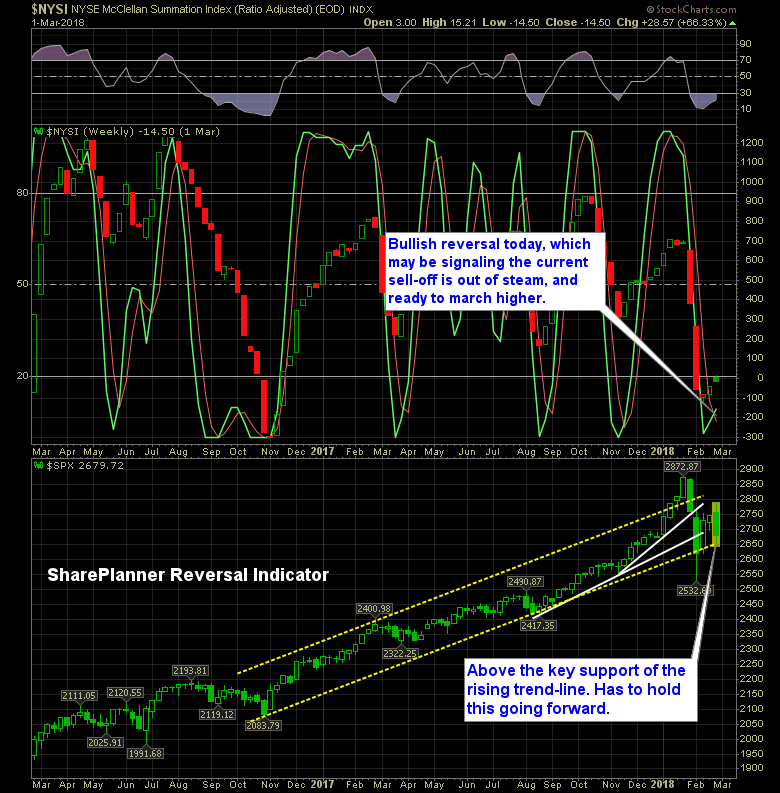

Bullish signal on the reversal indicator confirmed Last time we had a bullish reversal was back in mid-November when the market had been flat-lined for about a month. Once the signal took hold, the market rallied 300 points to the January highs, before the bearish signal finally took hold and gave us one of the

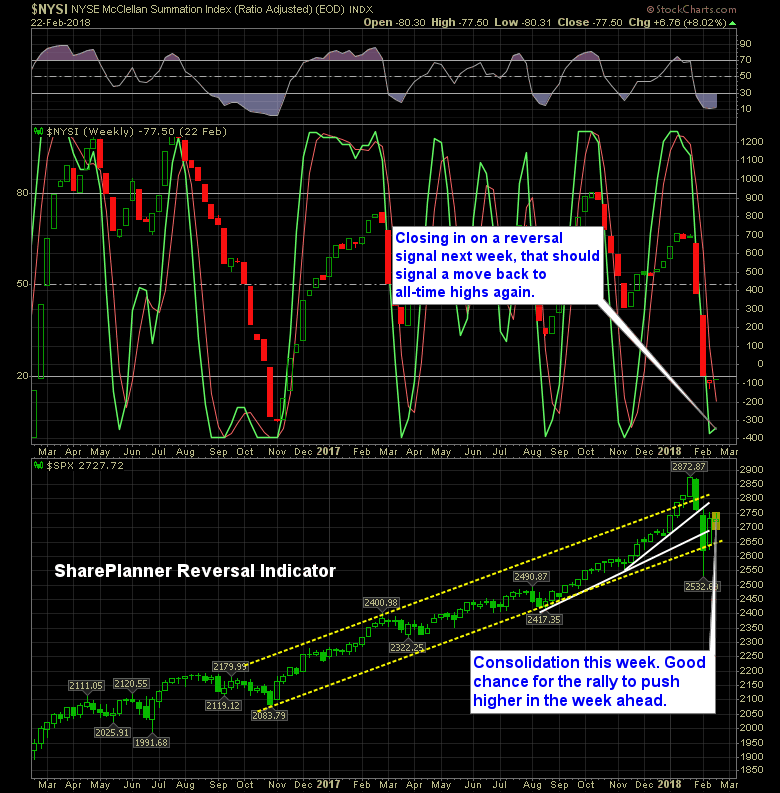

Price action is acting in a manner that suggests we are in “pause” mode before retesting the all-time highs once again. But first it needs to break that blasted 20-day moving average and hold it into the close. Something it has been unable to do for the past four trading sessions. The more it gets

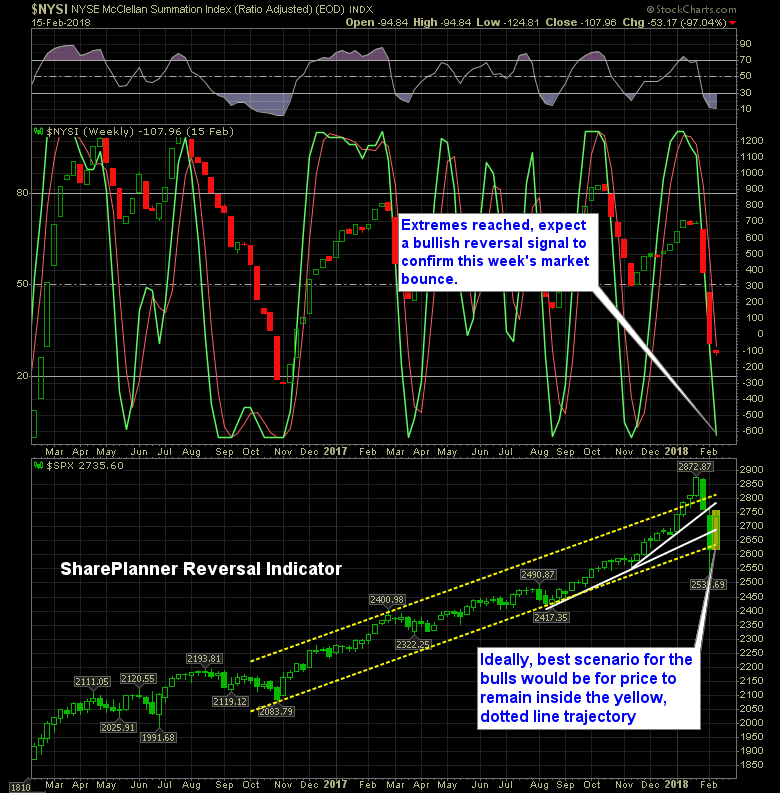

Last week’s sell-off hit extreme reading on the SharePlanner Reversal Indicator. Following the bounce off of the 200-day moving average on the S&P 500, it is no surprise, that we saw one of the best one-week rallies in years. However, with a three-day weekend ahead of us, next week represents another chapter in what has

Market’s have rebounded well since the sell-off that led to a test of SPX 200-day moving average. Following today’s CPI report in the pre-market, and the subsequent sell-off, I was ready for the market to begin its selling yet again, so I raised my stops to protect all profits.

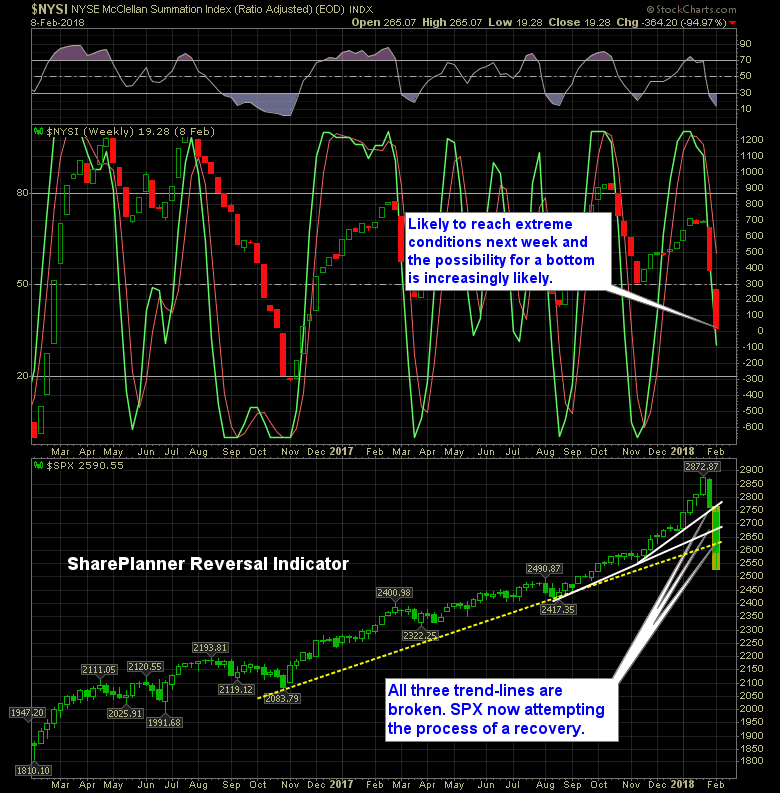

The market has officially tested the 200-day moving average and so far it is holding. It is the first time it has been tested since June of 2016 and when it did, an amazing bounce, immediately thereafter, unfolded.

Over the past couple of weeks, I’ve tried to remain some what cautious about getting overly long on this market. I stayed away from maxing out the portfolio and kept plenty of cash handy. And I am glad I did!