Seeing a sharp bounce at the extremes on the SharePlanner Reversal Indicator. That is a bit surprising to me, because with the market range-bound for the past two months and showing no signs of wanting to break it, I would have guessed it would have stayed at the extremes for 2-3 more weeks, barring a

The T2108 indicator provided by TC2000 is one of the best indicators for measuring the health of stocks, and in particular forecasting when a major market bounce off of oversold conditions or a major market sell-off following bubble-like market conditions will occur. This market reminds me so much of August 2015, that it isn’t

Some people haven’t quite shared the same sentiment about the current pattern developing on the S&P 500 (SPX) as me. Granted, it is tough to make out on the daily chart, but I’ve gone ahead and drilled down to the 30 minute chart to show you the head and shoulders pattern the market is

The SharePlanner Reversal Indicator is right near the extremes, but I’m not expecting an upside reversal anytime soon, and if the month of September is anything like what we just experienced in August, then I can assure you that it won’t move. The market has yet to move this month and is one of the

If you are looking for a trend on the daily or any clue as to the direction of this market, you won't find it by looking at the daily chart on the S&P 500 (SPX). In fact, you will have to drill down into the intradays, namely the hourly or half-hour chart to find what

I guess it has come to this: that the market can only move up or down when Janet Yellen gives it permission to. Whether it is a speech, minutes, FOMC statement, or one of her minions on the prowl, the market refuses to acknowledge anything else. Here we are with another week and the market

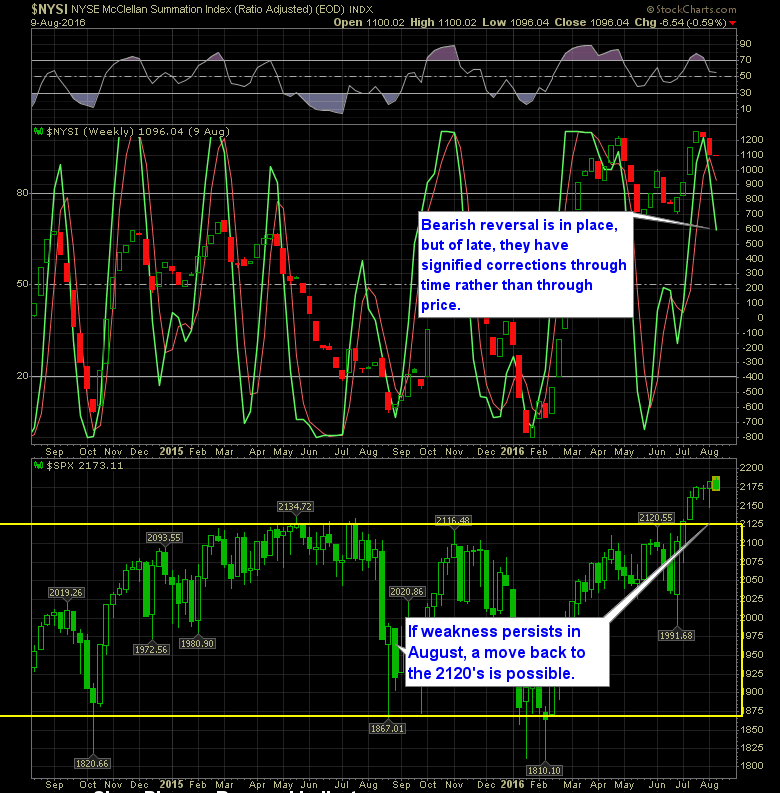

As with any bearishness over the years, it has to be taken with a grain of salt. If the market drops hard, then a hard bounce is right around the corner, and if the market sells off slowly but surely, the gains that could have been made by shorting it, will hardly be worth it.

The market is in a funk right now. Friday’s employment number gave a lot of traders hope that the market would make its way quickly to 2200, but that has not been the case, and is now on the verge of giving back all of last week’s gains. There are a number of moving averages

After a brief period of excitement in the market, when it sold off 1% yesterday, the S&P 500 (SPX) is back to its boring ways from the past few weeks and now trading in a very narrow, intraday range that is leaving traders with little to talk about. I personally want to see how this one shakes