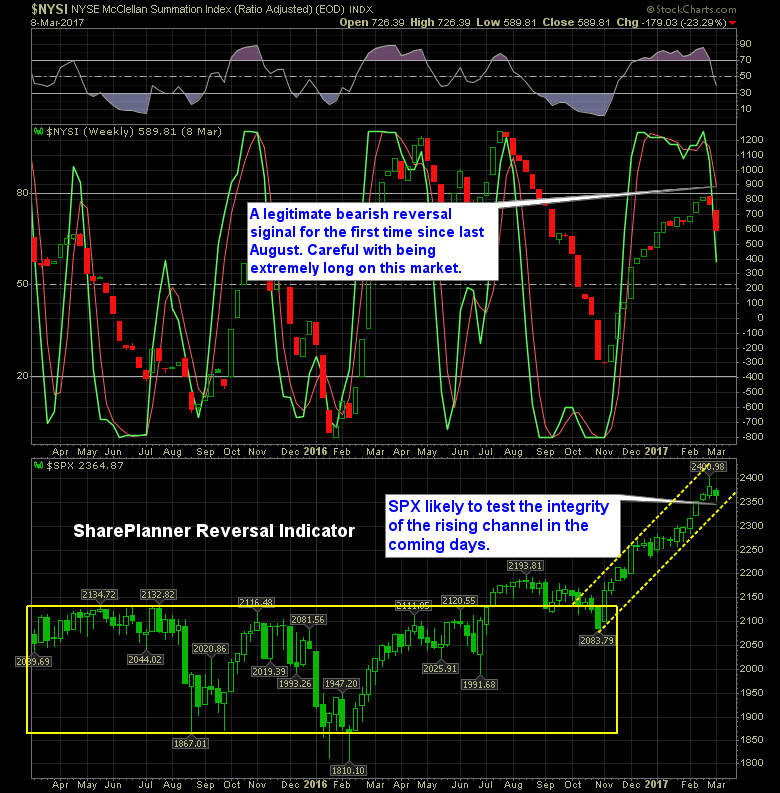

The SharePlanner Trend Reversal Indicator is flashing all sorts of bearishess And it is worth noting that there hasn't been a bearish reversal signal on the indicator since August of last year, which led to a 100-point reversal in the markets over the course a three month period. Obviously that came to an end when

It is always concerning to me when the T2108 Chart starts diverging from the market For those of you not familiar with the indicator, the T2108 chart measures the percentage of stocks that are trading above their 40-day moving average. Typically in a very healthy market where it is consistently making higher-highs and higher-lows, the

Snapchat Stock Value is through the roof and can’t be justified Snapchat (SNAP) IPO date was yesterday and it came out soaring. Everyone is looking for a reason to buy and if you haven’t bought (me included) you are the exception not the rule. I have received a lot of emails lately from people

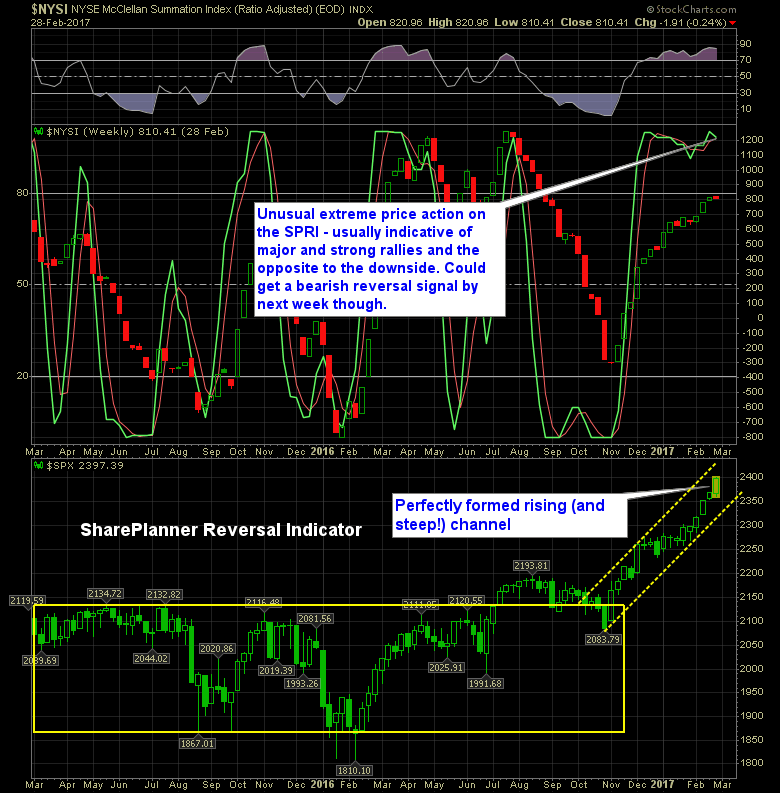

The market has held strong following the Trump election and as of yet my trend reversal indicator remains bullish. Obviously that can always change at any given time, so even in the most bullish of markets, you want to be managing your stops and curbing your risk exposure. Right now, the SharePlanner Trend Reversal Indicator

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been expanding at a moderate pace since mid-year. Job gains have been solid in recent months and the unemployment rate has declined. Household spending has been rising moderately but business

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and growth of economic activity has picked up from the modest pace seen in the first half of this year. Although the unemployment rate is little changed in recent months, job gains have been solid.

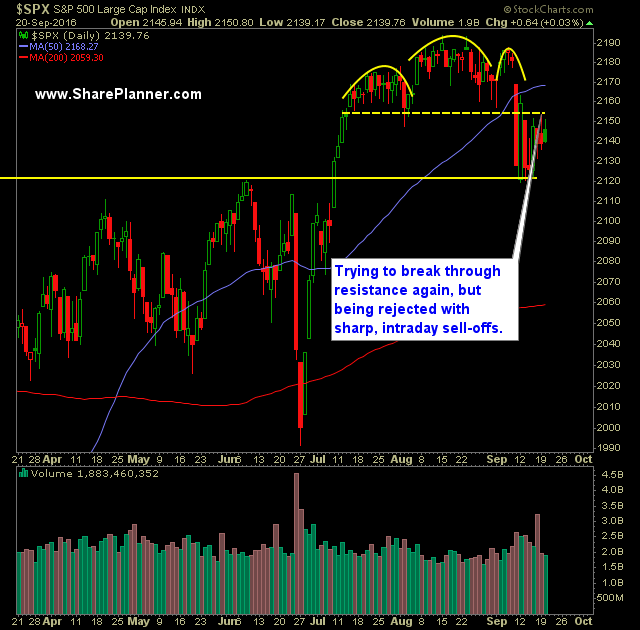

There are so many opposing forces fighting each other in the market that determining the ultimate direction it will take is almost futile in its undertaking. The Fed and BOJ refuses to let this market drop for even a half day. But you have real concerns with Deutsche Bank (DB) tinkering with utter collapse in

Information received since the Federal Open Market Committee met in July indicates that the labor market has continued to strengthen and growth of economic activity has picked up from the modest pace seen in the first half of this year. Although the unemployment rate is little changed in recent months, job gains have been solid,

The SharePlanner Reversal Indicator is sitting on extreme bearish levels, that at some point will lead to a bullish reversal or hold out at these levels for another 2-3 weeks. We did, with the sell-off from last week get a test of the 2120 level and the market has, up to this point, held that

Today’s market video doesn’t need any special analysis – it can be best described with the following video: