Is it time to reverse for the market or will we keep trucking higher?

I came into today knowing that the bulls had to hold the 20-day moving average. That has been a level of support for them of late, and if they blew through it, that things could certainly get dicey.

I covered my one short position in Intel (INTC) yesterday for a 2.1% profit and still have a nice profit in my TLT position too. The bulls held the 20-day moving average today and as a result I added a couple of new positions to the portfolio – both of which are performing nicely.

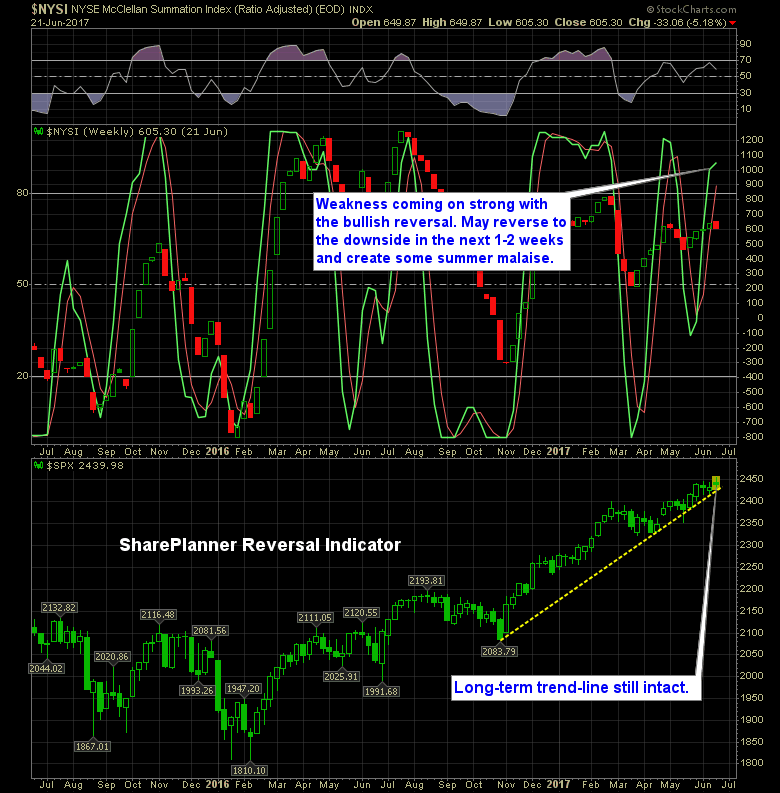

But then when you look at the SharePlanner Reversal Indicator, there are some problems there that could come into play soon. For one, we are nearing extremes, but the bulls also seem to be slowing down some and running out of steam with the SPRI starting to curve and flatten out its slope some. If this continues, then we could easily see a bearish reversal in the next 2-3 weeks. But often the case with bearish reversals, it doesn’t mean that we get a massive sell-off, rather we get a choppy market that trades sideways until the market can work off overbought conditions.

Here’s the SharePlanner Reversal Indicator:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Ryan gives his best secrets and tips to shorting stocks and what he focuses on, what he trades, and how he trades them, as well as the must-knows about shorting stocks that no one else will tell you.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.