My Swing Trading Strategy I’m coming into today 100% in cash. Tried shorting the intraday bounce yesterday, but quickly realized that wasn’t going to work, while also booking profits in McDonalds (MCD) too. To say the least, I am quite suspicious of this market bounce, and highly doubt that the worst is behind us at this

My Swing Trading Strategy It was my third straight day without creating a new position. Why is that? Because, I wasn’t going to short the market when it was already down 100 points, and certainly didn’t find enough reason to buy the market yesterday. I’ve managed to profit off of the recent market selling with

My Swing Trading Strategy I didn’t touch the market yesterday. I wasn’t overly crazy about shorting a market that gapping down over 40 handles on SPX. Though it would have been a profitable trade, the risk/reward wasn’t there. Today sets up for a potential gap and crap, so it is very much worth

My Swing Trading Strategy I sold my inverse ETF position in SDS on Friday for a +3.2% profit. While I’d like to still be in that position today, considering how weak the market was, selling it on Friday did make sense as the price action was well below the lower bollinger band and the S&P

My Swing Trading Strategy Yesterday was a real clown act by the market. I originally closed out my position in SDS for a 0.6% profit, only to have jump right back in the trade later in the day following the Trump Tweet. Right now, I have one staple play and one short position. Indicators Volatility

My Swing Trading Strategy My Long position SDS which provides a 2:1 inverse return of SPY did marvelously yesterday, and helped deflect some of the losses in the two positions I was stopped out of, due to Jerome Powell’s unbelievably and disastrous presser. Seriously, can we end these senseless press conferences already? It’s a dumpster fire every time.

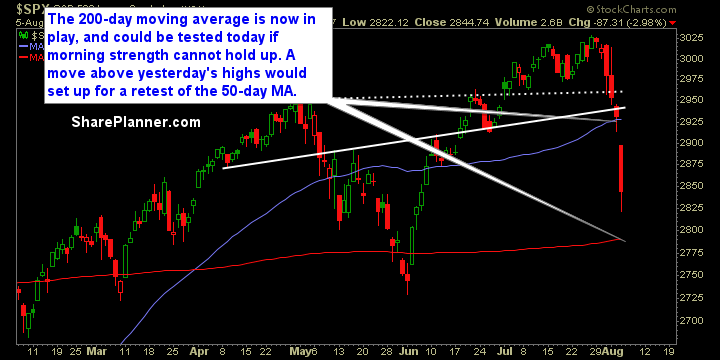

One day of price action has wiped out the last nine days of profits. There hasn’t been much action to speak of over those last nine trading sessions, which is why an actual sell-off is able to do such damage on the charts. However, I don’t see a lot of panic in the price action,

My Swing Trading Approach I sold Schlumberger (SLB) yesterday for a +1.1% profit. I’ll be looking to add another 1-2 new positions to the portfolio today, on top of the one I added yesterday. Indicators Volatility Index (VIX) – Popped about 10% yesterday but by the time the close rolled around, most of the gains

My Swing Trading Approach I closed out two positions yesterday: Netflix (NFLX) for a +1.5% profit and Square (SQ) for a +1.1% profit. Nothing all that exciting, but I was looking to curb some risk as the afternoon trading session was on shaky ground. May end up getting back in them in the

My Swing Trading Approach It was a second straight day for me, where I didn’t add any new positions to the portfolio. Dip buying still kickin’ strong, but the end of day antics of selling off is what causes the most havoc on most days. Either getting in early or buying right at the close