Alphabet (GOOGL) pullback to the bull flag breakout today. Will need to hold this or risk this being a failed breakout. Advanced Micro Devices (AMD) pulling back to its rising trend-line off the January lows, after failing to break out of the bull flag this morning. With today's fade off the highs of

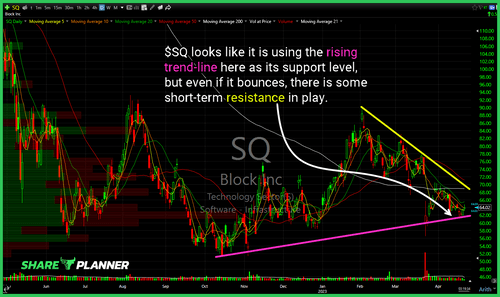

$SQ looks like it is using the rising trend-line here as its support level, but even if it bounces, there is some short-term resistance in play.

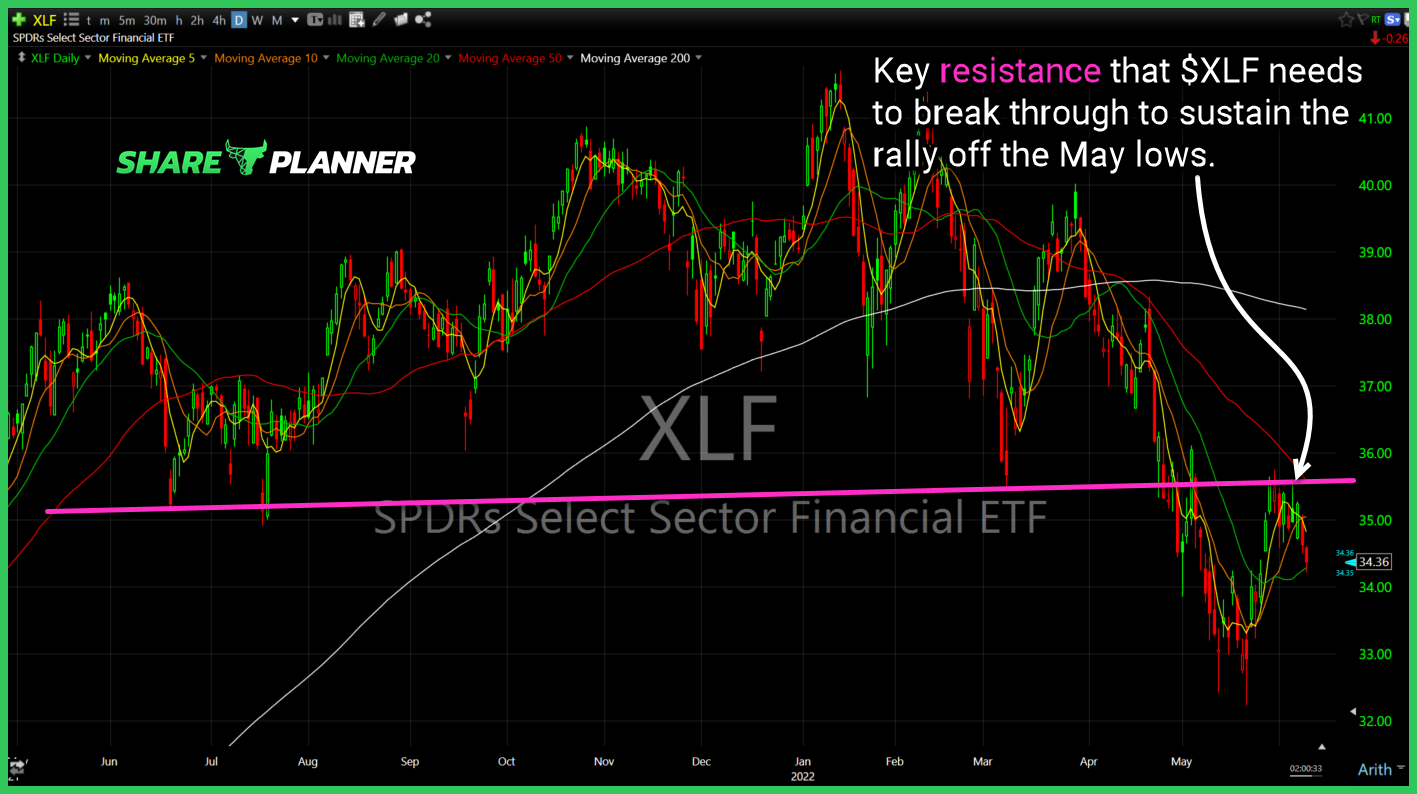

$XLF needs to make another run towards resistance and break that resistance, if the bounce off the May lows is going to stick.

$NVDA This is a major support area that I’ll be paying close attention to in the coming weeks, if it starts to test.

$CLF nearing a bull flag breakout.

$V breaking through declining resistance.

$POWW running on above average volume. Very promising move in the early stages. Careful though, earnings after the bell.

$BLNK approaching major resistance on the daily chart. Plus earnings coming up, makes this a dangerous play at this point in time.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it “cleaning out of the notebook” per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of