My Swing Trading Strategy

I didn’t touch the market yesterday. I wasn’t overly crazy about shorting a market that gapping down over 40 handles on SPX. Though it would have been a profitable trade, the risk/reward wasn’t there. Today sets up for a potential gap and crap, so it is very much worth being mindful of that. Overnight futures have been all over the map and have traded with a 90 point range on the ES Mini. I may look to play the bounce today, but very conservatively.

Indicators

- Volatility Index (VIX) – VIX rocketed 40% higher yesterday, and registered its second highest close of the year (January 3rd was higher). I suspect that will peel back a few today as the index has become parabolic over the last six trading sessions. Also the index broke the May highs, which is very significant.

- T2108 (% of stocks trading above their 40-day moving average): A massive 40% drop in this indicator, sends it down to 25% which is the lowest since June 4th.

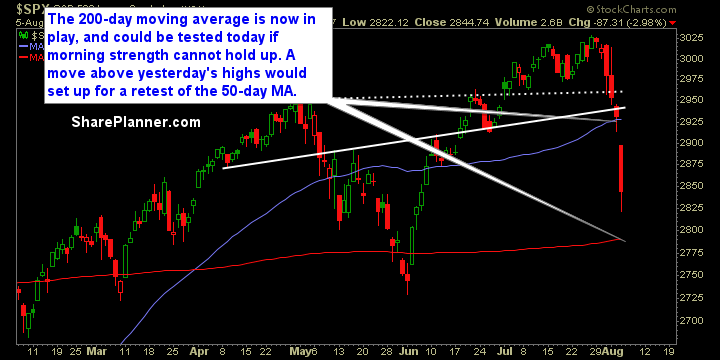

- Moving averages (SPX): Gapped below the 50-day moving average, and now sets up for a potential test of the 200-day moving average today, if the morning strength cannot hold.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Every last sector was down and down big. There was zero safety in the market yesterday, which is unusual, because you usually don’t see your more safe sectors get hit until much later into an extended sell-off. Technology was, not surprisingly, the worst sector yesterday, down 3.8%, while Materials, Telecom and Utilities were the strongest, down only 1.8%. The one sector, if you are looking to buy the dip, that I would avoid at all costs would be Energy, as that sector continues to exhibit problems that goes beyond the scope of the market’s current issues.

My Market Sentiment

Massive amounts of headline risk, tweet risk, and volatility. Overnight futures already have a 90 point range to them, and that is only likely to expand into today. Stop-losses have to be followed, and don’t over commit yourself in one direction or the other. Stay nimble, stay fast.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 long position.