SLB getting overextended here and up against the 200-day moving average and heavy resistance.

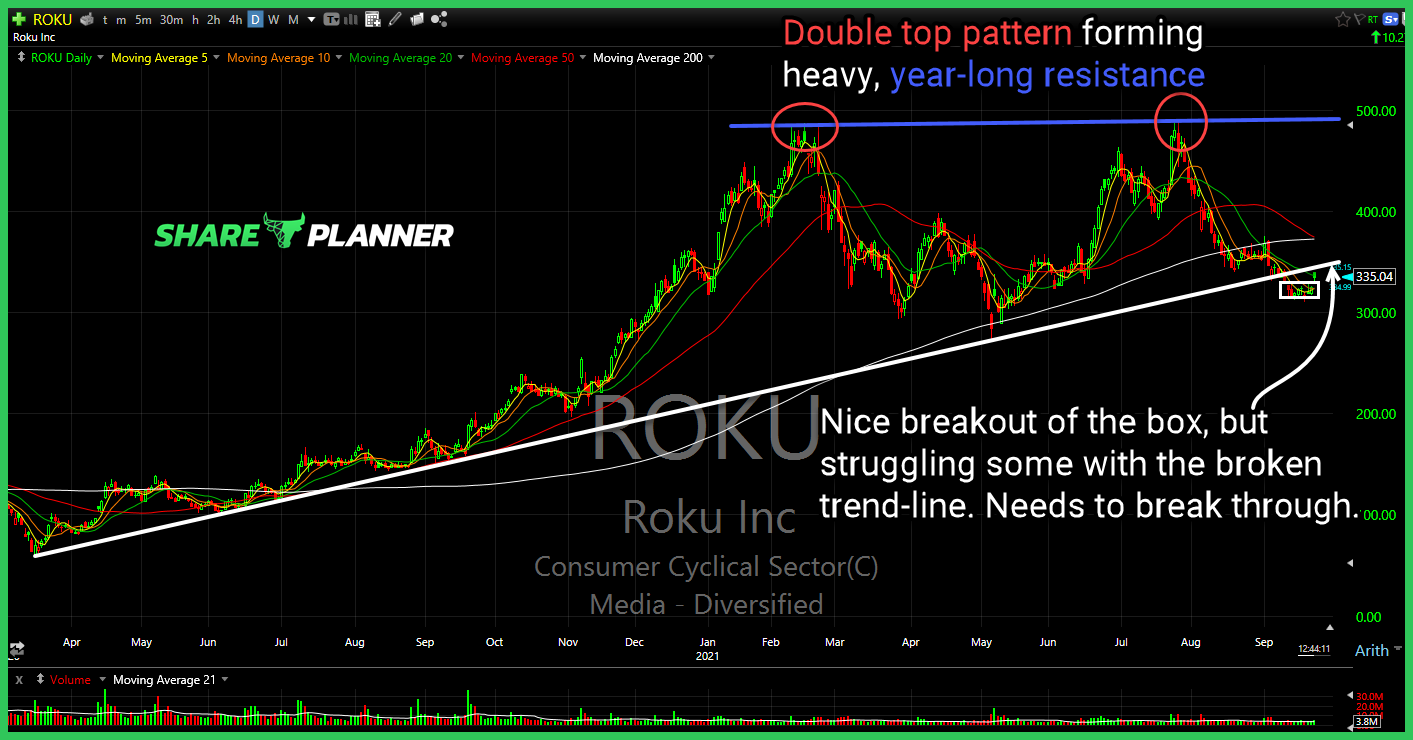

Three recent hits up against resistance on $JPM to be watchful of. If it pulls back, a break below $172 would confirm a bearish wedge. . ON $SLB: 1. Inverse cup and handle nearing confirmation. 2. If support hold it could result in a triple bottom, but support is going to need to hold, and

Watch $SLB as it pulls back. If energy continues the weakness today and in the days ahead, a bounce opportunity off of support could emerge. As $ROST pulls back watch for whether it can hold this rising trend-line and ultimately bounce higher. $SOFI working on a cup and handle pattern here. Broke out yesterday, but

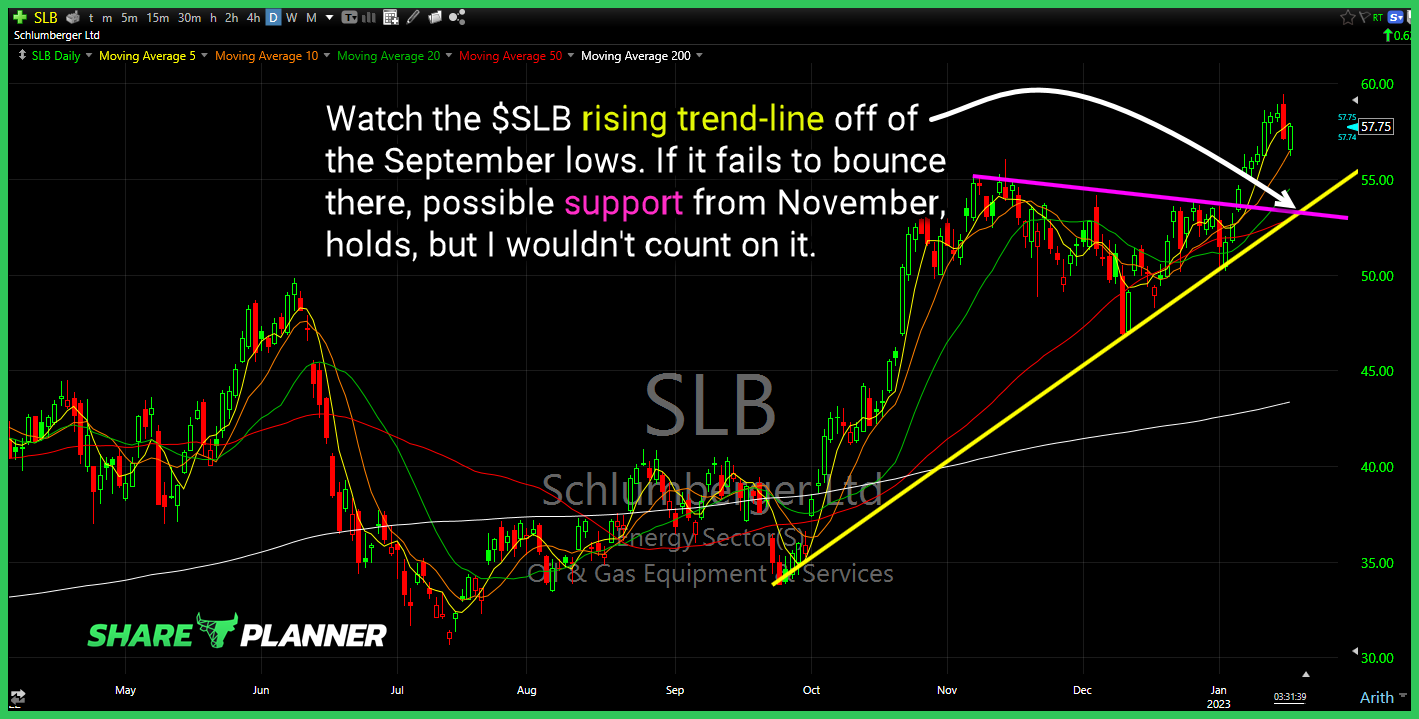

Watch the $SLB rising trend-line off of the September lows. If it fails to bounce there, possible support from November, holds, but I wouldn’t count on it.

$TH toying with major support on a descending triangle pattern. If Broken, could quickly see single digits.

Good bounce so far for Schlumberger (SLB), getting closer to testing resistance, but not quite there yet. Two significant levels of resistance overhead on Home Depot (HD) heading into earnings on the 17th. Twitter (TWTR) price below pre-Musk buyout offer. Spirit Airlines (SAVE) rallying hard today, but not dealing with some heavy short-term

$GME Nice hold of the March lows and possible double bottom though doubtful it will hold in the weeks and months ahead. Declining resistance will continue to be an obstacle for further price advancement.

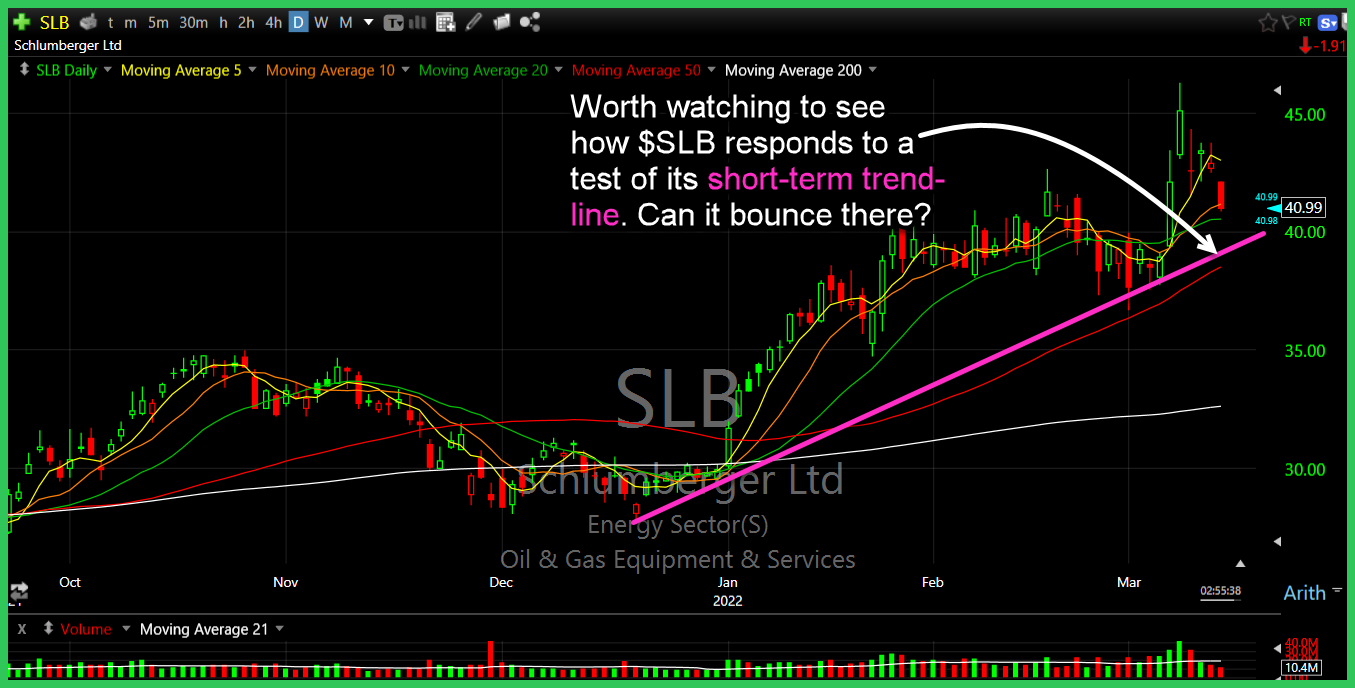

Worth watching to see how $SLB responds to a test of its short-term trend-line. Can it bounce there?

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

My Swing Trading Strategy I booked profits in Schlumberger (SLB) for +3.6% yesterday while also adding another position to the portfolio. I’ll look to add more today if this market can hold the morning rally and show a willingness to build upon it. Indicators Volatility Index (VIX) – Finished only 1% lower, but did manage to trade, intraday, below