My Swing Trading Strategy

I’m coming into today 100% in cash. Tried shorting the intraday bounce yesterday, but quickly realized that wasn’t going to work, while also booking profits in McDonalds (MCD) too. To say the least, I am quite suspicious of this market bounce, and highly doubt that the worst is behind us at this point.

Indicators

- Volatility Index (VIX) – A huge sell-off in the VIX indicator that saw its reading as high as 23.67, only to close the day at 19.49. Still very elevated, but people are already licking their chops about seeing this indicator fall even more in the days ahead.

- T2108 (% of stocks trading above their 40-day moving average): A 6.6% rally yesterday to take the indicator back up to 32%. Personally, I don’t think this is the bottom of the sell-off, and getting long here, when just yesterday we saw that the market could still sell off 60 handles on SPX within a blink of an eye, would suggest otherwise as well.

- Moving averages (SPX): SPX looks to reclaim 5-day moving average at the open here.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Interestingly, it was Staples that led the market rally yesterday, followed by Real Estate. That doesn’t mean nothing else rallied, but they essentially beat the next closest sector’s returns, Technology, by a 2:1 margin. A lot of sectors are showing the potential for a short-term bottom, as the bulls have managed to hold the lows from Monday, however, this is more than likely just a dead cat bounce.

My Market Sentiment

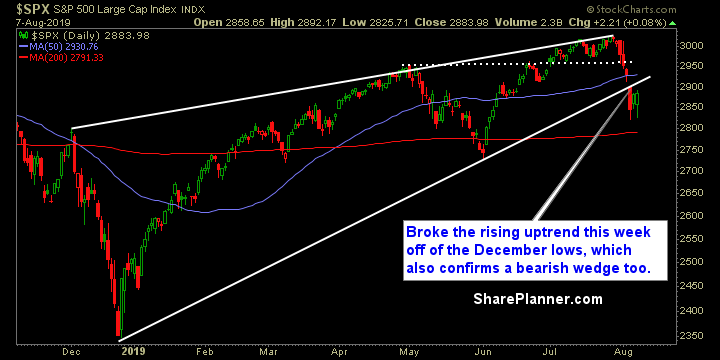

Bearish wedge pattern formed on the longer-term chart of SPX. Rally off the December lows have been broken. With that said, the market became very stretched following Monday’s sell-off, and as a result, there has been somewhat of a reflexive bounce that has followed, and will try to continue into today. Despite the last three days of trading strength, little to no improvement has emerged on the chart.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% cash.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.