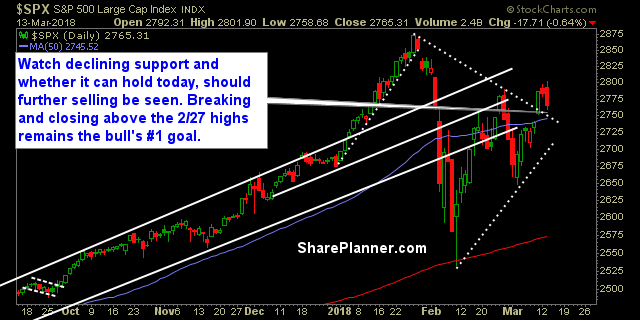

Once SPX crossed 2650, I decided to start closing out my long positions. Three out of four of which were profitable. I added Boeing (BA) this morning but I had to quickly bail on that one too (my only un-profitable positions).

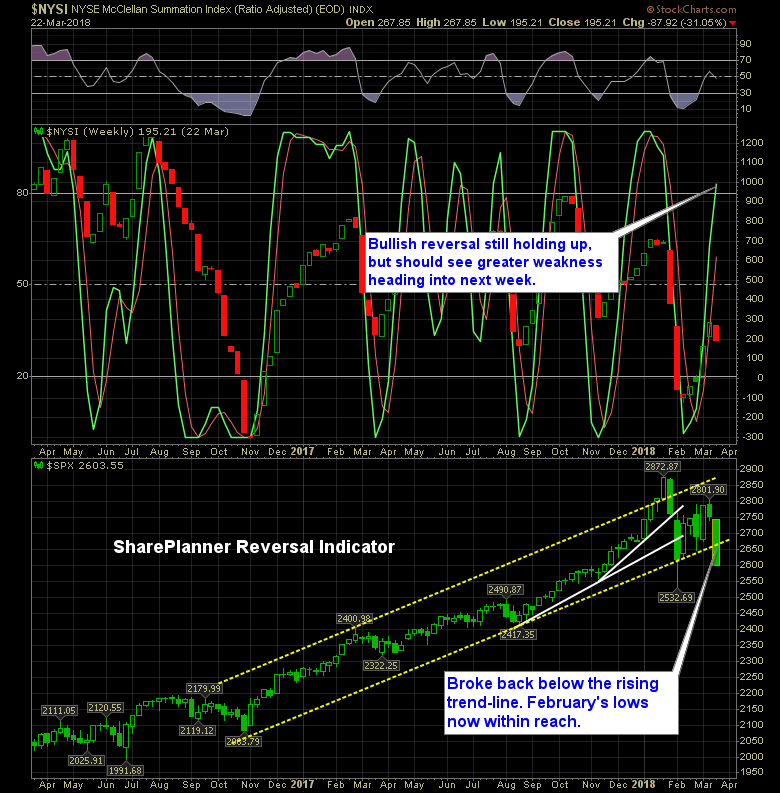

This has not been a good week for the bulls. They have fully lost control of the market. When I pulled up the SharePlanner Reversal Indicator, I fully expected it to show a bearish reversal in the works, but it is still riding strong to the upside. Of course, it hasn’t priced today’s action just

My Swing Trading Approach I am 100% cash at the moment, but will give the market some time this morning to determine the direction it wants to take. I will follow the trend of the market today and trade accordingly, while keeping my exposure small for now. Indicators

The bulls are faltering big time today and the market is seeing its biggest sell-off since February 8th. I traded one short position today, and made a rare day-trade out of it for a quick 1.7% profit. Ideally, I would have liked to of held the position overnight, but the volume is weak, and I’m

My Swing Trading Approach With weakness in the market this morning, I will be looking to manage risk to the long side, while possibly positioning myself to short the market, if necessary. Indicators

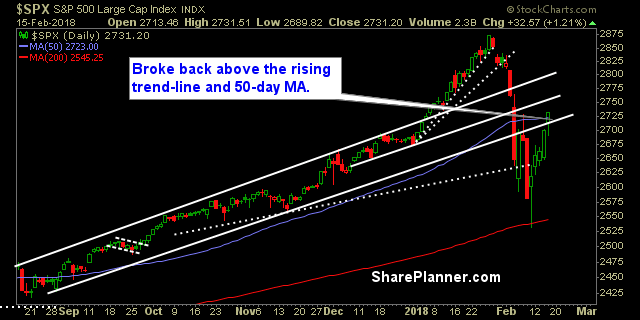

My Swing Trading Approach I will look to add 1-2 new positions today if the market strength can hold this morning. I booked profits in a number of positions yesterday, but will gladly ‘hop’ back into my positions today, should the market allow. Indicators

My Swing Trading Approach There is a solid possibility that I put a couple of short positions to work today. Plenty of trade setups to the downside are out there, and bears may be hitting the end of this dead cat bounce. If not, then I will look to continue playing the long side.

My Swing Trading Approach Three day weekend ahead of us, where I will likely take a more passive approach to trading today, while raising my stop losses on all the positions in my portfolio to protect profits. Indicators

My Swing Trading Approach Wait and see if the market wants to continue with the bounce off of the morning lows. If not, it will be a time to sit on my hands and watch. Indicators

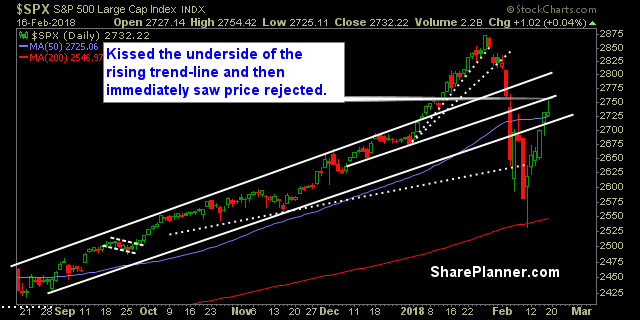

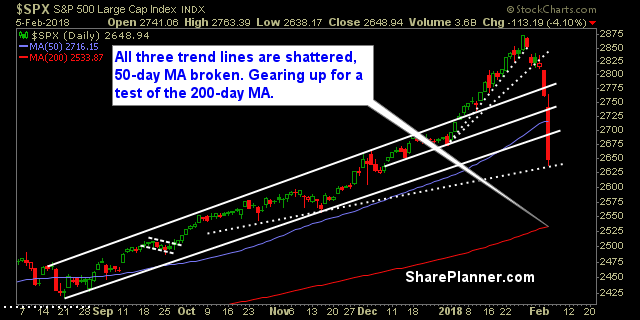

My Swing Trading Approach There will be a substantial bounce to play at some point in the future. I will sit on the sidelines until that time is unveiled. Indicators