My Swing Trading Strategy

My Long position SDS which provides a 2:1 inverse return of SPY did marvelously yesterday, and helped deflect some of the losses in the two positions I was stopped out of, due to Jerome Powell’s unbelievably and disastrous presser. Seriously, can we end these senseless press conferences already? It’s a dumpster fire every time. I’m on the fence with this market here, not surprised if it rallies, or whether it may continue on yesterday’s decline. Today will be a pivotal day going forward.

Indicators

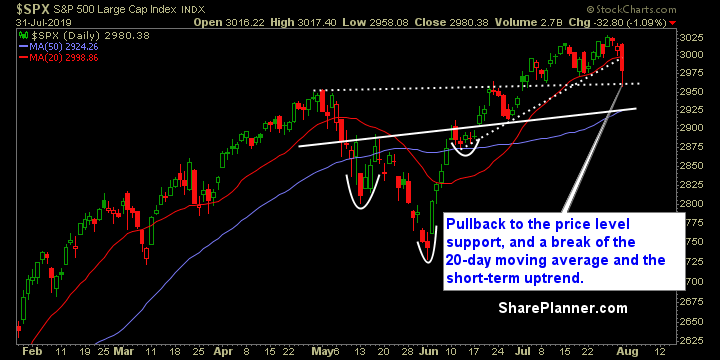

- Volatility Index (VIX) – Huge move to the upside (+15.6%) and follow through to the break the day prior, of the declining downtrend off of the May highs. Also broke through the previous July highs, and thereby establishing its first higher-high since early May. It is currently sitting at 16.12, the highest closing since June 26th.

- T2108 (% of stocks trading above their 40-day moving average): A 10.3% decline yesterday but still within the month long consolidation pattern. Currently sitting at 56%.

- Moving averages (SPX): In addition to the break of the 5-day moving average, the day prior, SPX is now trading below its 10-day and 20-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

All 11 sectors traded lower, with Materials leading the way. Utilities, Staples and Real Estate should be areas of safety for the market, should further weakness continue to filter in. Financials did not respond well to the rate cut yesterday, but performed relatively stronger than most of the other sectors, and its daily chart still shows it in consolidation for the month of July. Technology had one of the most impressive months in July, and should the market rally here, should be the focus of the buying.

My Market Sentiment

Huge sell-off yesterday, and first 1% SPX move for the market in almost two months. The volume was the 7th highest reading of the year, and if the bears are going to drive this market lower, it will need more volume like what was seen yesterday. That said, breakout support was tested yesterday, and while it broke intraday, managed to close well above it at the close.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 short position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, Ryan answers the questions of one listener ranging from his transition from paper trading to live trading, and swing trading to day trading. Also addressed is his approach to trading, specifically Fibonacci retracement levels and why Ryan prefers Pivot Points instead.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.