The overall market continues to frustrate traders with choppy, directionless price action. All three major index ETFs - SPY, QQQ, and IWM - remain range-bound, making it difficult to capture momentum or follow-through in either direction. In today’s video, I dive into each chart and examine: Where major support and resistance levels are forming How

After opening deep in the red, the market saw a sharp rebound across all major indices, with S&P 500 (SPY), Nasdaq 100 (QQQ), and Russell 2000 (IWM) all bouncing off the lows, though not recovering all the losses. We've seen a number of these huge sell-offs of late lead to massive rebounds in the days

Volatility Index (VIX) continues to get hammered at every turn by the shorts. Looking like 14's around the corner again.

VIX continues to spike this morning, rising 9.2% so far on the day and putting in a notable higher-low on the daily chart. A close near the highs of the day, could spell trouble for market bulls.

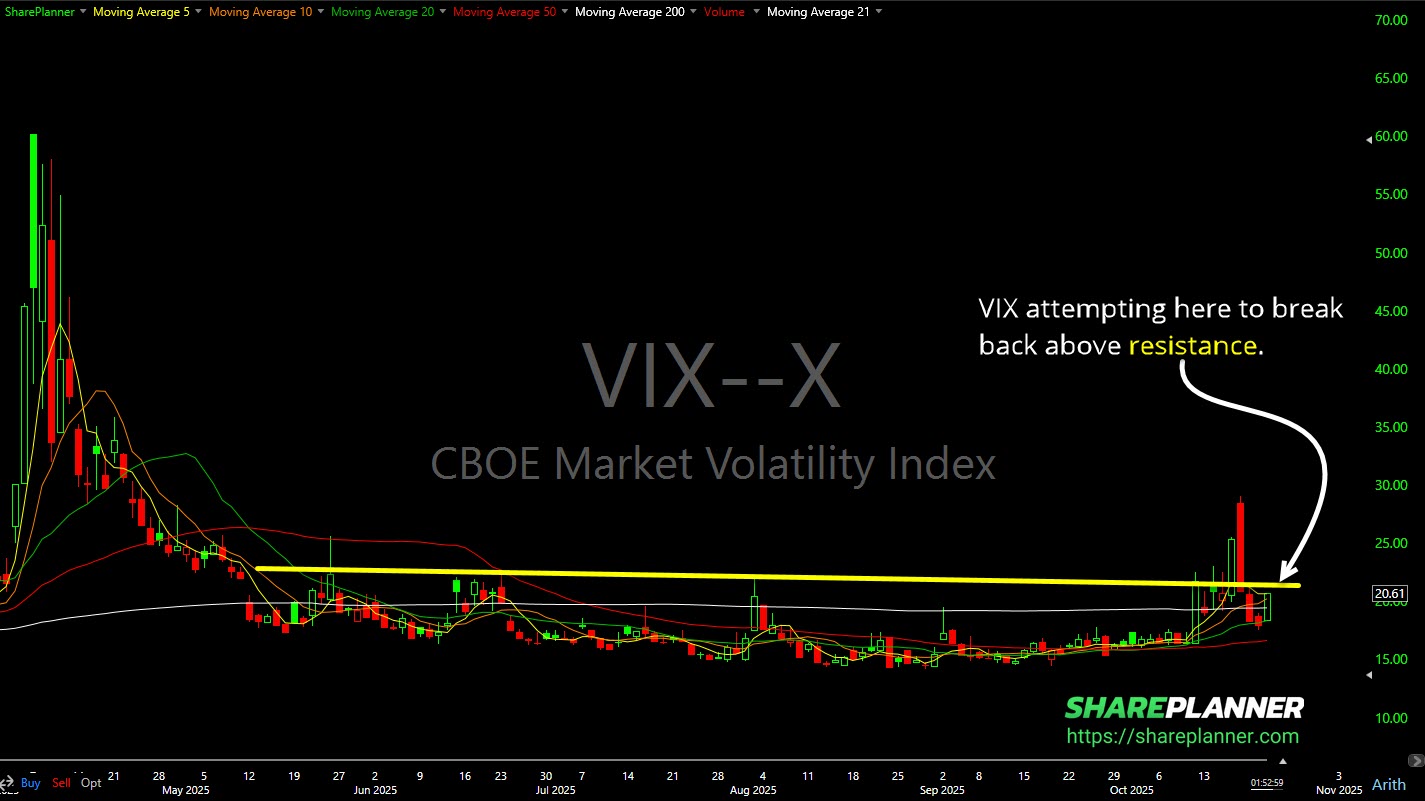

Volatility Index (VIX) attempting here to break back above resistance.

Looks like Volatility Index (VIX) is starting to make a move here in the way of a breakout.

While the market continues to push higher, the VIX has been somewhat abnormal in also rising for a fourth straight day, but still unable to break through the declining resistance.

Volatility Index (VIX) still rising over the last few days. Worth paying attention to here.

Nice pop in the pre-market but declining all morning long. Weekly Chart has it coming back down to support.

VIX not quite what we saw in 2020, and still not as high as the flash reading at last August. But it's closing readings are much worse than last August and still less than '20.