The stock market has been crashing over the last three months. Do you buy when everyone is selling, or do you wait, or should you sell what you have. That is the question everyone is wrestling with, and I discuss my approach and what I am doing in this video.

In the eleven years I have been posting my weekly watch-list here on SharePlanner, this has been, by far, the smallest watch-list I have ever put together. This market has pretty much gotten the best of everything out there. And even the names on this list have been hit. They aren't a shining light of

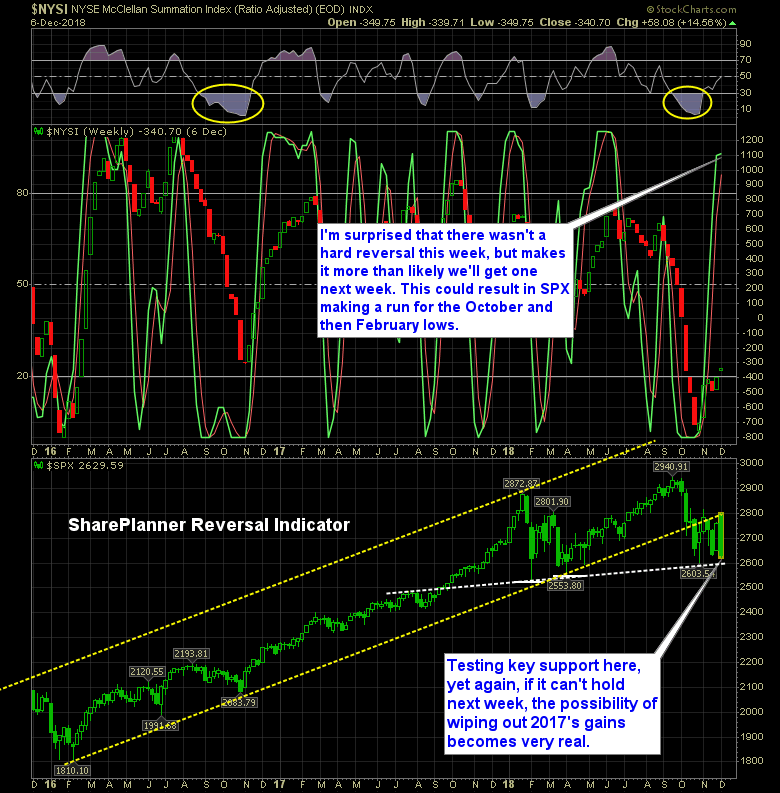

The Bears have held strong ever since Monday’s huge gap up. They have essentially pillaged investors of all their gains from November, and all of 2018, and we are only seven days in.

After two hard weeks of selling, the bulls are set to finish higher on the week, and thereby lifting the optimism of Wall Street heading into the weekend. I’m 100% cash now, and I plan to keep it that way heading into the weekend. For reasons unbeknownst to me, traders are optimistic and have fueled

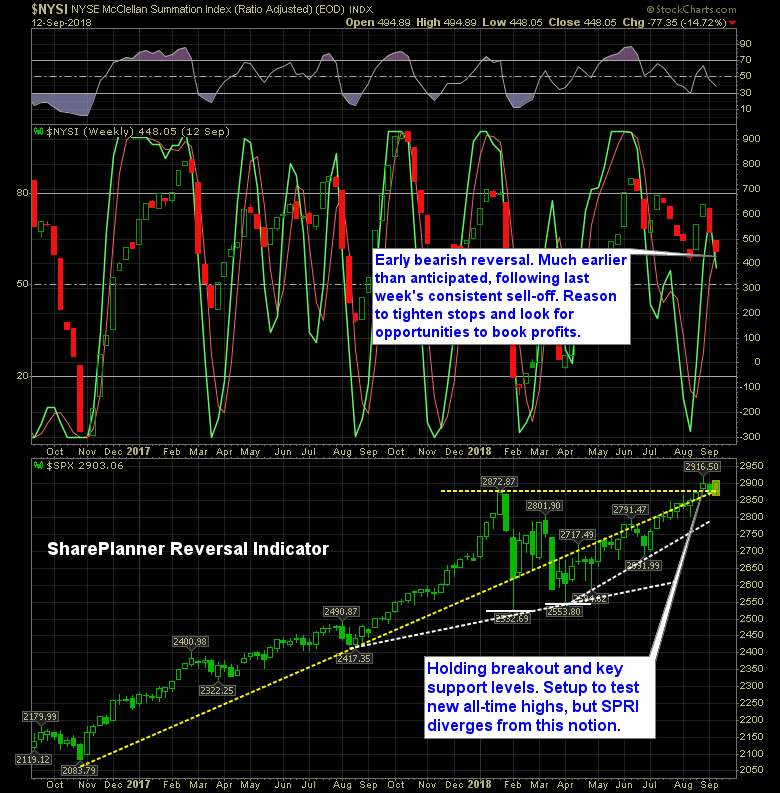

My Swing Trading Approach I held all my positions overnight, while adding one additional play to the portfolio. I will be raising my stops today, while also playing it cautious as today is the last day of the quarter. Indicators

My Swing Trading Approach I closed my swing-trades in JEC at $76.80 for a +3.8% profit and CRM at $158.60 for a +3.1% profit. I am open to adding another long position today should the market cooperate and allow for it. Yesterday’s sell-off creates some concern as to whether a rally can be sustained here.

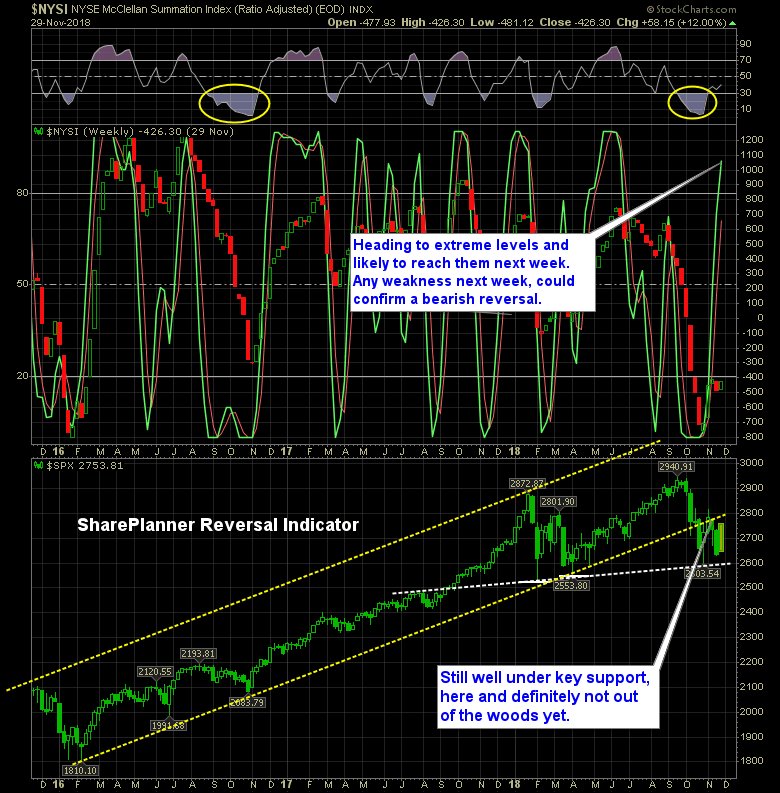

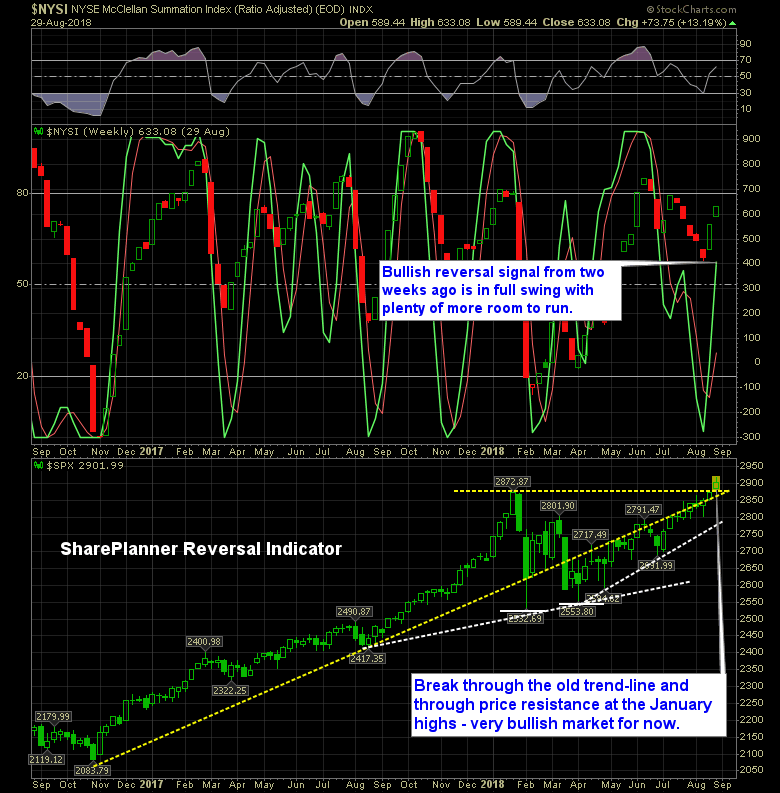

This week’s edition, if you want to call it that, of the SharePlanner Reversal Indicator has some unexpected bearishness. Obviously, last week had its share of bearishness but I never thought it would be enough to to trigger a bearish reversal in the market. But considering that breadth has not been all that great, I

The bulls should continue to push this market higher, despite the selling seen today. Sure the market is overheated and overbought, but it can stay that way for quite some time, before rationale minds start to take profits.

My Swing Trading Approach Should the early morning strength hold, I will look to add 1-2 new long setups to the portfolio this morning. Indicators