My Swing Trading Strategy

It was my third straight day without creating a new position. Why is that? Because, I wasn’t going to short the market when it was already down 100 points, and certainly didn’t find enough reason to buy the market yesterday. I’ve managed to profit off of the recent market selling with a position in SDS, and may try and reload here today.

Indicators

- Volatility Index (VIX) – An 18% decline yesterday, but still managed to hold the previous day’s lows, and the notorious 20 level as well. Expect volatility to resume today, especially as trade tensions increase.

- T2108 (% of stocks trading above their 40-day moving average): A 22% bounce yesterday that sent the indicator back up to 30%. Watch today’s weakness in the broader market and whether it is enough to break Monday’s lows on T2108 for whether we’re likely to see far lower price levels in equities.

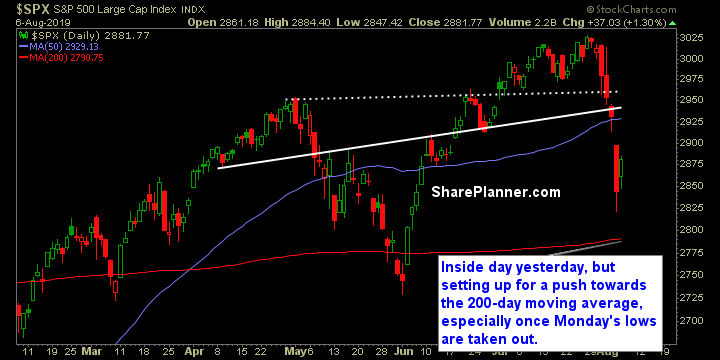

- Moving averages (SPX): Was not able to push back above any of the major moving averages. The 200-day moving averages lingers below, but will take a masive sell-off in order to test it today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Industrials were the big market winners yesterday followed by Financials and Healthcare. Interestingly enough, Technology was not among the market leaders yesterday, but was more middle of the pack. Energy, which I keep saying, was the market laggard. Stay away from them. Despite a broad-based rally yesterday, there isn’t any significant improvement on the charts that is worth being optimistic about going forward.

My Market Sentiment

Dead cat bounce yesterday, that looks sketchy all day long with breadth and tick readings. I didn’t buy it at all, and stayed on the sidelines completely. I had one long position that I have held on to since last week, but will look to increase the stop-loss today in order to preserve profits there. Hard selling in the pre-market this morning, look to make a test of the 200-day moving average more and more likely, as well as a possible retest of the May lows.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 long position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.