T2108 has been one of my favorite indicators for judging the current health of the market. For about a month and a half, stocks have been slipping under the surface. You can see that in the Russell, in particular, which has been in a steady decline that has matched the time frame of T2108’s decline.

Give it a few hours, the market will bounce right back up! That’s the mentality of traders these days, and it is brutal from the standpoint of getting any real momentum to the downside. Today, just like we saw on October 25th, and again on November 2nd, 9th and today, we have the intraday sell-off

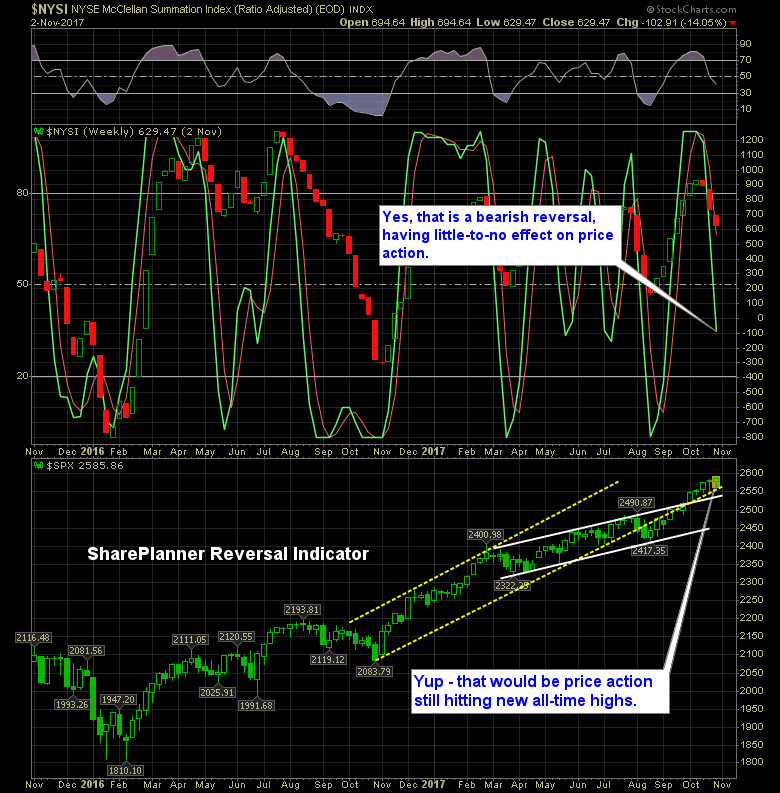

Never before has a bearish indicator meant so little to the market. Considering how relentless this market has been on trading higher, the SharePlanner Reversal Indicator has done fairly well, relative to other indicators. Two out of the last four bearish signals on the indicator, has spurred on a small amount of selling thereafter. Nothing

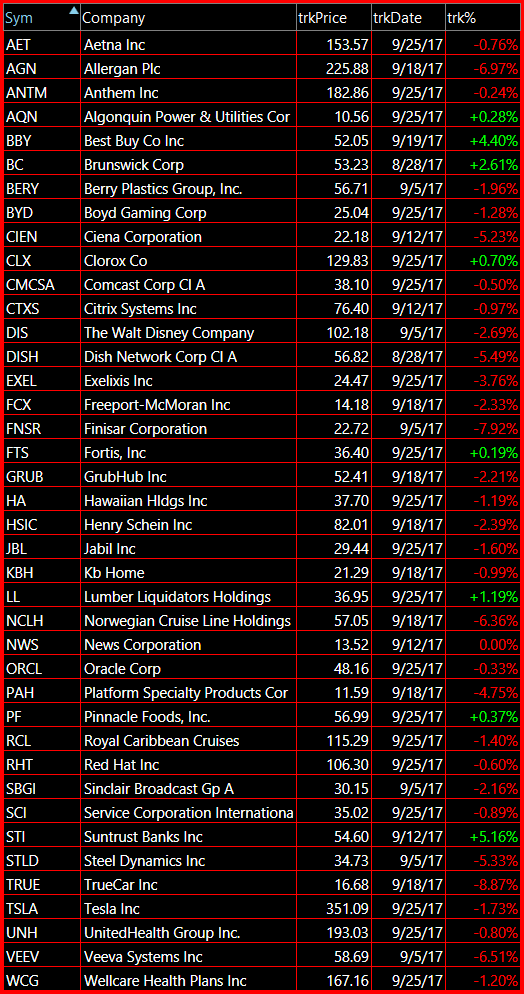

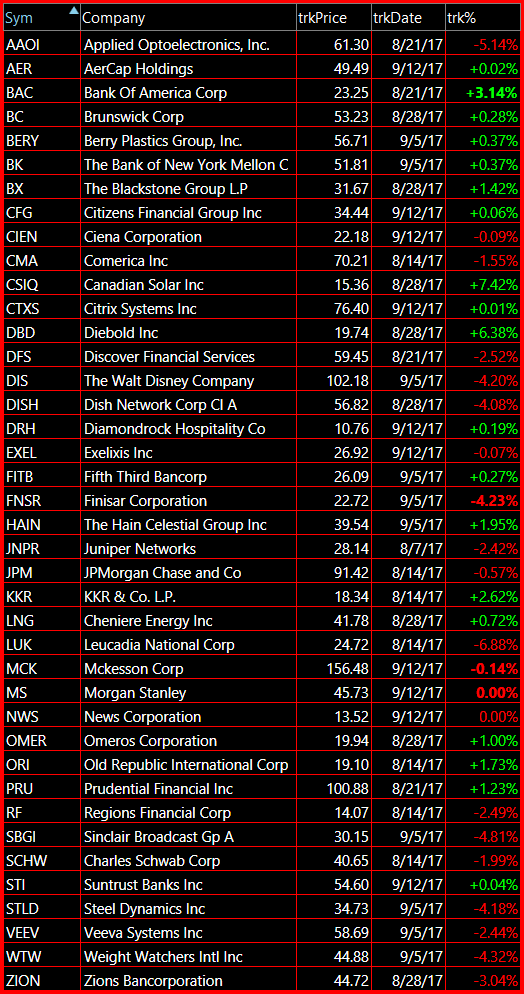

My Swing Trading Approach Raise the stops on existing long positions, and maintain the flexibility to get short as I have done over the past week of trading. Short setups are in play, if the weakness doesn’t immediately get bought up at the open. Indicators

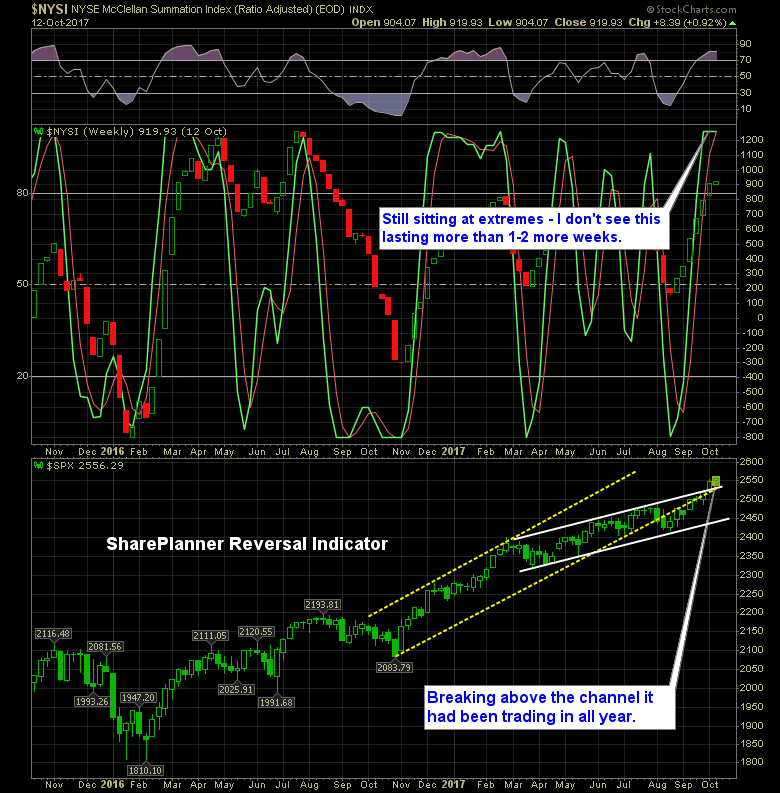

The bulls are sitting at extremes that haven’t been seen since March/April of 2016. As you can see in the chart below, this can persist for a while longer, but I’ll be surprised if we don’t start seeing some kind of bearish reversal on the indicator that leads to either 1) price consolidation over a

My Swing Trading Approach I plan to continue raising the stop-loss on my current positions, while open to adding 1-2 new long positions to the portfolio. Indicators

Sometimes I really question my sanity for keeping this watch-list. But usually when I get to thinking that way, is when I soon thereafter, become thankful that I do keep a running list of potential short setups. Right now though, the market and many of its participants, have no idea what a bear market is,

Not a lot to add here. The market still refuses to sell-off, so the long setups are the only way to go, for now. I even dabbled some yesterday to the short side with mix results. Right now, I just wait patiently for the market to give me the right opportunity to get short, and

There's no sign of that happening just yet, but we have seen our share of moves to new all-time highs, only to see stocks get crushed in the days that follow. So, even with the market doing well right now, you need a contingency plan, just in case things suddenly go sour again. Below you

The daily chart on the S&P 500 (SPX) is an absolute mess. There isn’t really much to like about it in terms of determining future market direction.