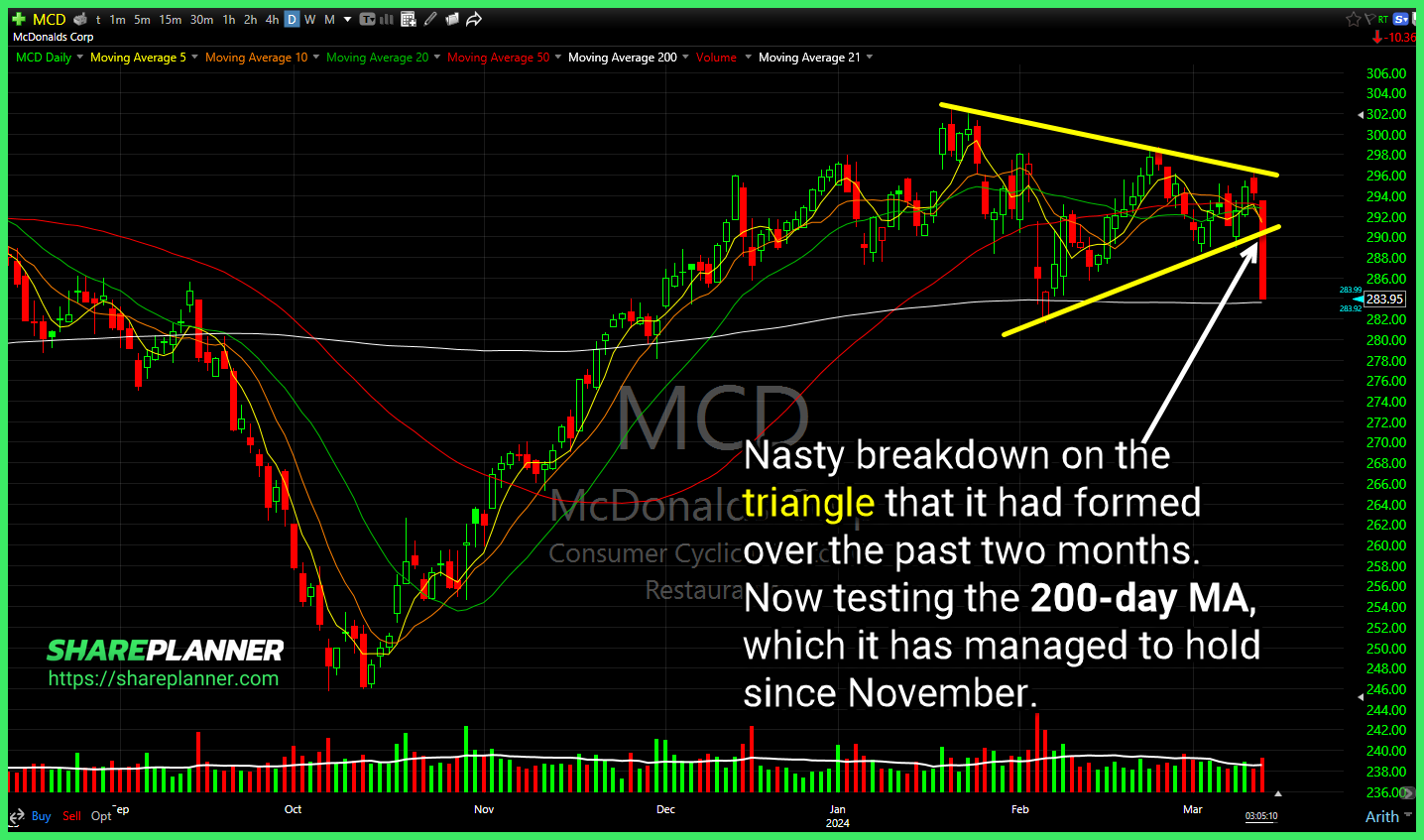

Nasty breakdown on McDonalds (MCD) with the triangle that it had formed over the past two months. Now testing the 200-day MA, which it has managed to hold since November. SoFi Technologies (SOFI) wedge break following a breach of the rising trend-line looks at a potential move back down to its lower channel band.

$MCD holding the breakout level above $299. Solid consolidation and potentially looking for another move higher. . $DIS not the best price action over the last two days, but could simply be consolidating here. Too early to know for sure, but certainly worth watching. Potential landing spot for $DHI at the 50% Fib retracement and

CrowdStrike (CRWD) sideways trading for the past 3 months, and forming a topping pattern on the verge of a breakdown here at support. Advanced Micro Devices (AMD) clinging to the trend-line, but getting very little bounce/separation so far. Discretionary/Retail is a key sector Discretionary Sector (XLY) to be watching here. Trying to hold that rising

Strong potential with Meta Platforms (META) and Alphabet (GOOGL) earnings out of the way, for a pullback to the rising trend-line on Communications Sector (XLC). Ideally, I'd like to see Healthcare Sector (XLV) spend a few more days inside of this bull flag before attempting to breakout. Worth watching this one. McDonalds (MCD)

3 straight days 10 year yield is holding breakout support. Looking for a move higher from here going forward. $TNX

$GLD struggling with upper channel band resistance. Potential for a pullback to the rising trend-line underneath.

Rising channel in place to trade from on $GMED. A break below would be bearish.

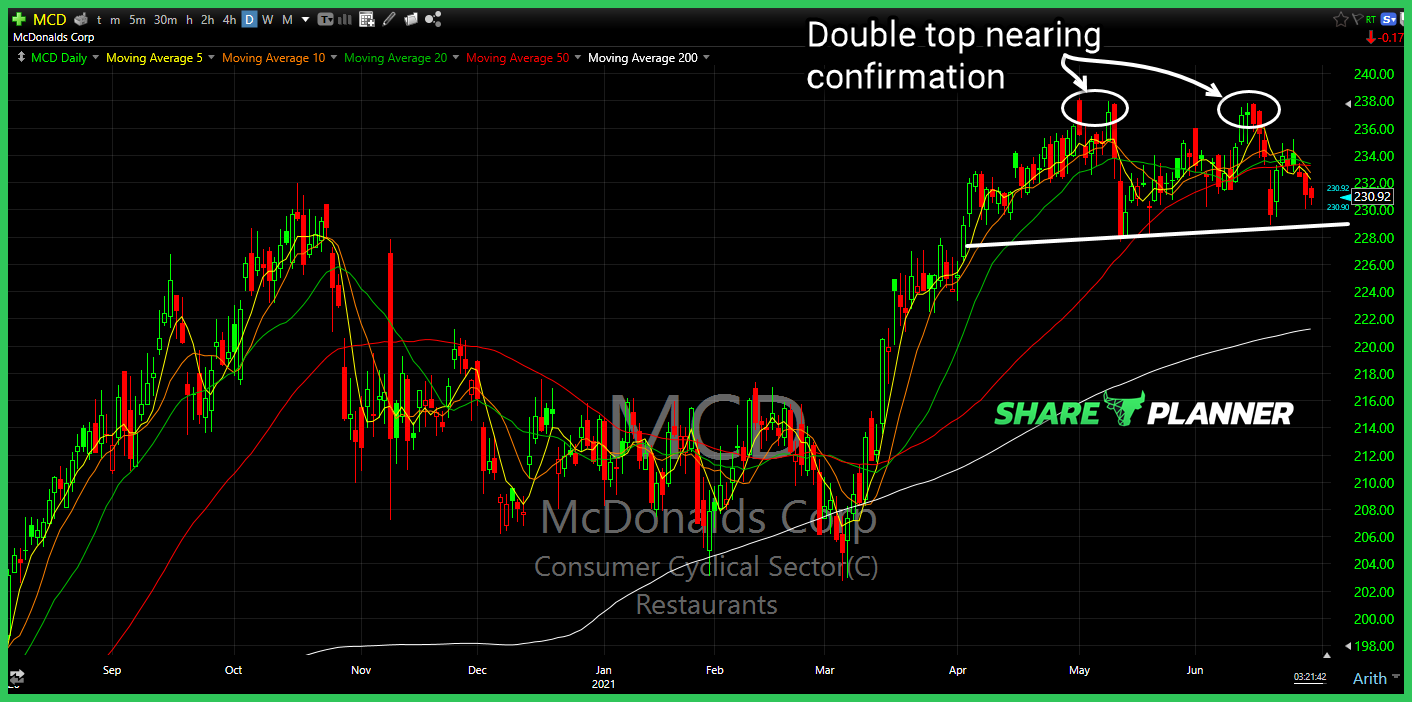

Intel (INTC) making a run towards its upper channel band. Amazon (AMZN) clawing its way back to hold a critical level of support today. Not every day you see McDonalds (MCD) go parabolic like this... Home Depot (HD) breaking out and confirming the double bottom.

As a new feature to SharePlanner, I’m going to roll out, the SharePlanner Notebook, where I essentially “clear out my notebook” of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

Swing Trade Approach: Busy day on Friday. I covered one of my short positions, Nutrien (NTR) at 44.39 for a 6.7% profit. Nice gain for a short position that I have held since November 26th at $47.60. But I didn’t stop there. I sadly closed out one of the more impressive trades of the year Visa (V), which