Technical Analysis: Christmas volume starting to kick in yeserday as the S&P 500 (SPX) barely moved and gave up most of its gains on the day. SPDRs S&P 500 (SPY) volume fell off dramatically yesterday, coming in below average and at the lowest level seen over the last 9 trading sessions. The CBOE Market Volatility Index (

Technical Outlook: S&P 500 (SPX) reversed Tuesday’s rally and closing at the same price level SPX closed Friday at. The volume on SPDRs S&P 500 (SPY) increased yesterday, when compared to the day prior, and more than double the daily average. The daily bands on the market continue to expand after exhibiting historical tightness, and

August is in the books, and did you know that the market was down for the first time since February. But Splash Zone traders were up yet again! Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial

Technical Outlook: S&P 500 (SPX) saw a massive reversal on Friday following an attempt at establishing new all-time trading highs. Despite the breadth and extent of the sell-off, the bears managed to rally SPX back close to break even on the day. SPX is down 3 straight days, but still has yet to manage to

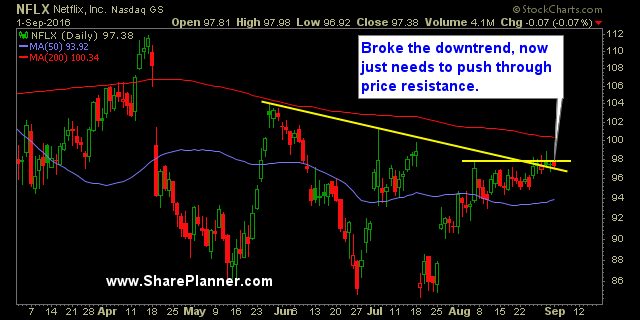

I almost got into Netflix (NFLX) yesterday but he market conditions weren’t right and resistance was still keeping it down. But today is a completely different story, and now NFLX is breaking out of resistance and beyond. Obviously getting an upgrade with a $145 price target doesn’t hurt matters, but from a technical

Technical Outlook: S&P 500 (SPX) again on Friday attempted to sell-off but low volume again plagued any attempt from the bears to make a meaningful move across the board. SPDRs S&P 500 (SPY) saw a drop in volume on Friday, which also came in well below average. SPX has seen consolidation over the last five trading

Technical Outlook: Dow Jones Industrial snapped a 9-day winning streak. Last two times that has happened, it made it to 10-days. Not so yesterday. SPX finished lower as well yesterday and below the 5-day moving average (by one point). Again though, the rampers showed up at 3:30pm to push the market off of the

I was stopped out of Disney (DIS) – other than that, I had a really good day of trading yesterday. And it came from some random bank that honestly, I know nothing about. But that has been the difficulty with trading DIS of late – and I’ve traded it about six times this year, and only two

Technical Outlook: SPX finished lower for the first time after five straight green days. Futures following Friday’s close sunk on the failed coup attempt in Turkey. All those losses were erased with the opening print on Sunday night. 5-day moving average still holding strong on the current market rally. At this point, the market could