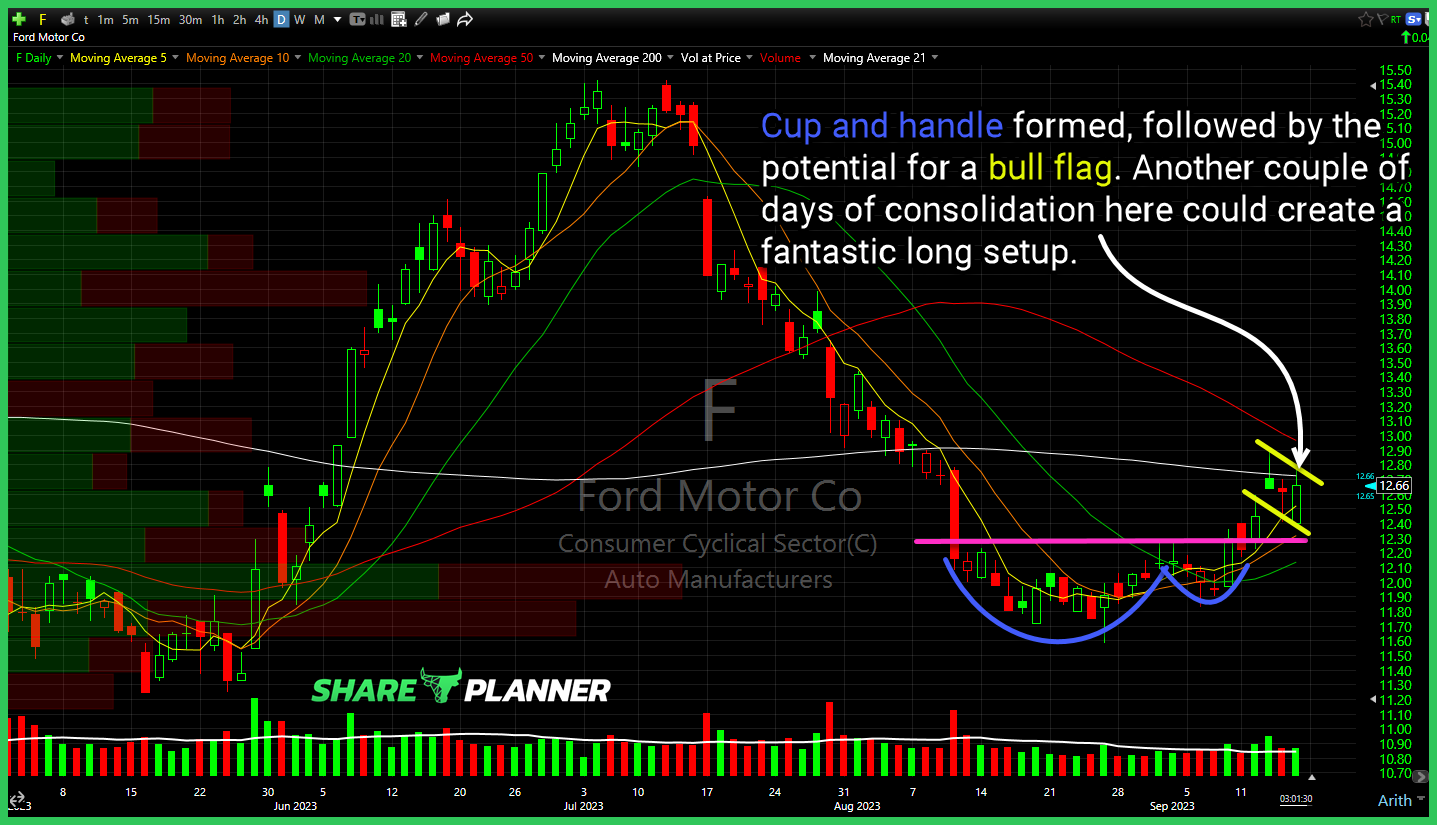

Ford Motor (F) Cup and handle formed, followed by the potential for a bull flag. Another couple of days of consolidation here could create a fantastic long setup. CBOE Market Volatility Index (VIX) hard bounce off price level support, now testing declining resistance. Advanced Micro Devices (AMD) breaking below its rising trend-line that goes back

Careful with Luminar Technologies (LAZR) despite the monster rally today that places price right at declining resistance. Adobe (ADBE) on watch for whether it attempts to bounce off of support. Semiconductors ETF (SMH) looking like it may try pulling back to its rising trend-line. AMC Entertainment (AMC) headed towards a test of major resistance. A

Adobe (ADBE) rising trend-line is broken, and now price falls back into the Nov/Dec chop area, where price could really get churned up. Russell 2000 (IWM) breaking below long-term support and a creating a lower-low in the short-term. Looking under the Robinhood (HOOD), it still hasn't broken out of the declining trend-line and threatens short-term

That massive sideways channel attempting to break with a push below support on ARK Innovation (ARKK) Rising channel in the short-term saw a huge break today for Netflix (NFLX). Adobe Systems (ADBE) nearing a triple top confirmation. Major breakdown of support here for Roblox (RBLX).

Roku (ROKU) declining channel remains firmly intact despite today's gains. Wait for a breakout of the channel before considering a long position. Despite solid gains for SoFi Technologies (SOFI) today, there is no clear direction going forward, until this sideways channel gets a breakout/down. Adobe Systems (ADBE) Reason 4,520,369 why I don't hold a stock

ARK Innovation (ARKK) testing major support. I don't have much faith in it holding. Berkshire Hathaway (BRKB) breaking major support today. Adobe (ADBE) nearing a test of its long-term trend-line. Advanced Micro Devices (AMD) support and resistance levels to be mindful of.

General Motors (GM) dealing with heavy resistance. Forge Global (FRGE) Condition yourself not to chase after these massive moves. Adobe Systems (ADBE) with a nice basing pattern. Bitcoin with a nice breakout of its base, but likely needs to pullback and retest before it can go much higher.

Adobe Systems (ADBE) hard selling, but a silver lining? Treasury Bond Fund (TLT) long-term trend-line worth watching. American Electric Power (AEP) working that bull flag pattern today. Archer Daniels Midland (ADM) has done great of late, but getting overextended. Best entries would be off of the rising trend-line.

Affirm (AFRM) breaking through the head and shoulders neckline today. Nvidia (NVDA) pullback to its trend-line, $230's becomes the next trend-line if it breaks. Otherwise, watch for a bounce. Snowflake (SNOW) breaking its rising trend-line. Adobe (ADBE) huge double top in place, yet tor confirm, but testing the major support level.

The FOMO is undeniable – it is best seen every day in the final minutes of trading. The buyers suddenly go into hyper-ventilating mode, and the bulls run the table, out of fear they will miss out on another gap higher. I really don’t know how long this can go on for, I trade off