Technical Outlook:

- Dow Jones Industrial snapped a 9-day winning streak. Last two times that has happened, it made it to 10-days. Not so yesterday.

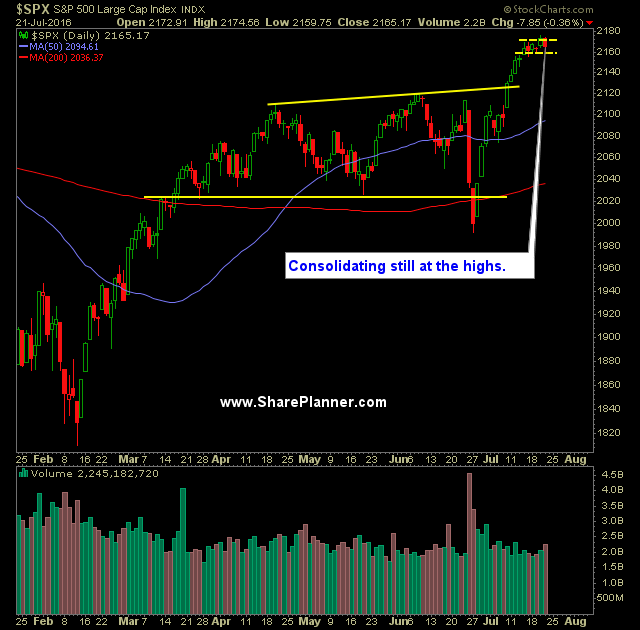

- SPX finished lower as well yesterday and below the 5-day moving average (by one point).

- Again though, the rampers showed up at 3:30pm to push the market off of the lows.

- Still the market isn’t showing any major willingness to sell this market off hard or fast.

- Volume on the sell-off has been extremely weak which is a good sign there isn’t a lot of enthusiasm to the sell-off.

- Watch 2155 on SPX – a break of this price level could lead to further selling today.

- So far the bulls have only been willing to work off overbought conditions through time and not through a pullback. Most clearly seen over the last two years that the market consolidated.

- Earnings season kicks into high gear next, particularly among the tech sector and will define the week as a whole.

- The trade to the upside can be categorized as the “pain trade” or “climbing the wall-of-worry” – that’s because this rally is hated by most traders. Heck,I don’t like it either, but I trade it because that is what the market is giving us right now.

- Shockingly, following the Brexit, just a little less than a month ago, SPX now has 2200 in its sights.

- The market trend-line is clearly starting to flatten out some. 30 point moves on SPX will be much more difficult to achieve.

- VIX saw a strong spike yesterday, rising 8% to just under key resistance at 13.

- Oil appears overdue for a bounce here.

- At this point, and with the election ahead, I’d expect the market to keep rallying higher. I don’t expect there to be a rate hike between now and the election. To do so would impact the market and thereby the election. I don’t think the Fed wants that, particularly since Trump has indicated that he would replace Yellen.

- Market is assuming that rate hikes are pretty much off the table for all of 2016.

My Trades:

- Closed out NFLX today at $86.15 for a 0.3% profit.

- Did not add any new swing-trades to the portfolio today.

- May add 1-2 new swing-trades to the portfolio today.

- Will consider hedging the portfolio as well with a short position.

- Currently 50% Long / 50% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.