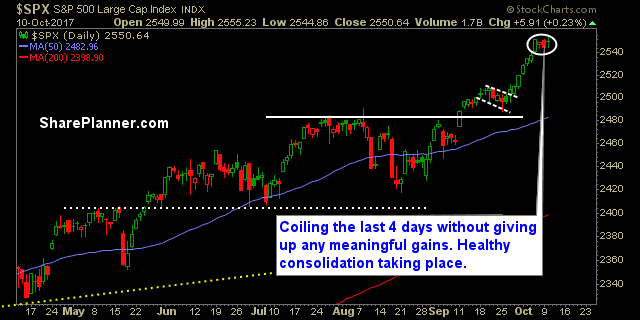

My Swing Trading Approach I trimmed my long exposure quite a bit yesterday. Booked a lot of profits. I added two new positions as well. If the market wants to break out of recent consolidation then I will likely add new positions again today. Indicators

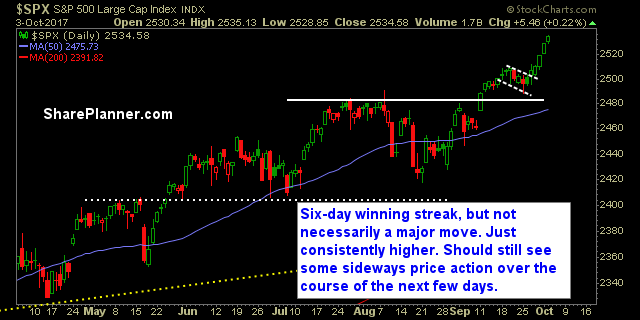

My Swing Trading Approach Don’t take profits for granted. It’s convenient to ignore risk management on the trades, but you have to keep raising those stops. I will also look to add 1-2 new long positions today. Indicators

My Swing Trading Approach I plan to continue raising the stop-loss on my current positions, while open to adding 1-2 new long positions to the portfolio. Indicators

My Swing Trading Approach Market looking at a rare gap down, potential for the dip buyers to swing in. I’ll sit on my hands until I can determine the direction the market wants to take. May even short the market today if the conditions are warrant it. Indicators

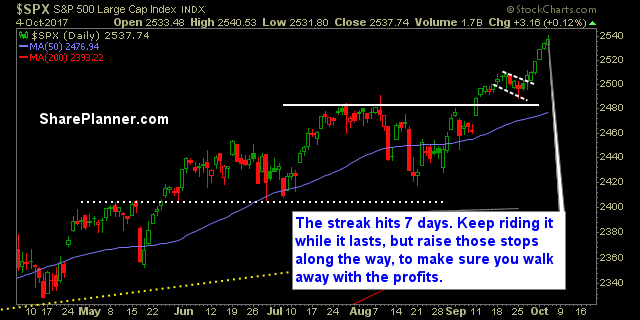

My Swing Trading Approach Seven days into this current win streak. Now isn’t the time to decide to get bullish on this market. Now is when you should be looking at how to manage the profits, and that is what I am doing here. Indicators

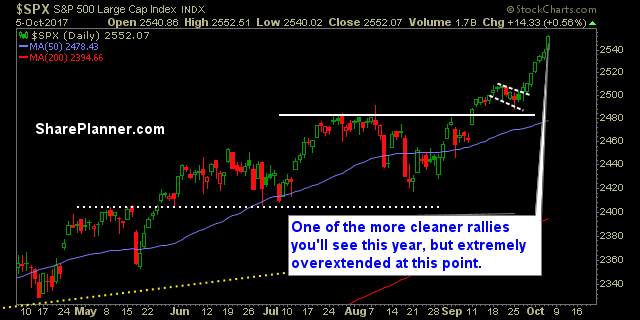

My Swing Trading Approach Concerned about significant additions to my portfolio at this juncture. The market is overheated, and prime for some selling. I won’t short anything until the time is right, but I am more interested in protecting profits by raising stops on existing positions. Indicators

My Swing Trading Approach Will look to add 1 to 2 new long positions to the portfolio if the market continues the buying spree. Keeping one eye on the exit though. Indicators

My Swing Trading Approach May add 1-2 new positions to the portfolio today, depending on the price action. Right now, unless the price action turns southward, I am not looking to add any new short positions. Indicators

My Swing Trading Approach Will look to increase my stops in current positions as well as lock in profits where needed. Likely to be careful about adding additional long exposure at current VIX levels. Indicators

For the first time since January, the S&P 500 and the rest of the indices are marching lock step witih stocks as a whole. Over 70% of stocks are trading above their 40-day moving average and that confirms that stocks are supporting this market move higher.